Current AccountKey figures:Current Account: Up 85% against Q3/2017 to 14.6 bn. CHF

|

Current Account Switzerland Q3 2018(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

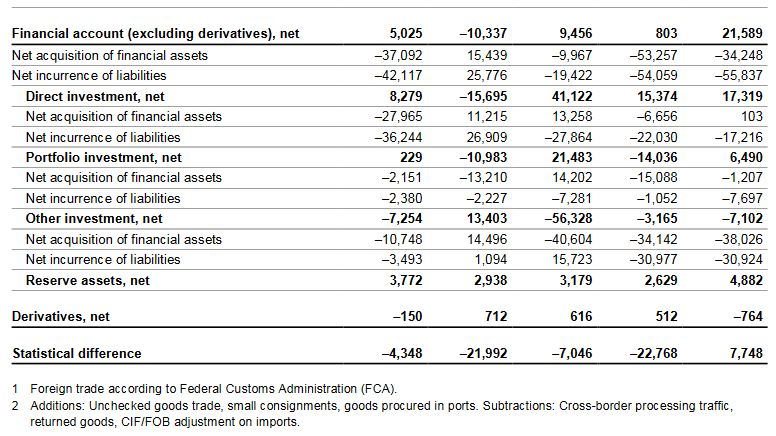

Financial accountNet acquisition of financial assetsThe assets side of the financial account registered a net reduction of CHF 34 billion (Q3 2017: net reduction of CHF 37 billion). This reduction was mainly due to other investment, which posted a net reduction of CHF 38 billion (Q3 2017: net reduction of CHF 11 billion). In particular, resident commercial banks reduced their claims abroad. Portfolio investment registered a net reduction of CHF 1 billion (Q3 2017: net reduction of CHF 2 billion). Resident investors sold both equity securities and short-term debt securities of non-resident issuers, but purchased long-term debt securities. Direct investment was affected by transactions in opposite directions. Resident companies withdrew funds in the form of equity capital fro m their non-resident subsidiaries in the context of the US tax reforms. At the same time, they granted intragroup loans and reinvested earnings abroad with the result that transactions balanced each other out overall (Q3 2017: net reduction of CHF 28 billion). Reserve assets registered a net acquisition of CHF 5 billion (Q3 2017: net acquisition of CHF 4 billion).

Net incurrence of liabilitiesOn the liabilities side, a net reduction of CHF 56 billion was recorded, to which all components contributed (Q3 2017: net reduction of CHF 42 billion). Other investment registered the strongest net reduction of CHF 31 billion (Q3 2017: net reduction of CHF 3 billion). As on the assets side this was largely due to commercial banks, with the latter reducing their liabilities towards non-resident banks and non-resident customers. Direct investment showed a net reduction of CHF 17 billion, primarily as a result of non-resident parent companies withdrawing equity capital from their resident subsidiaries (Q3 2017: net reduction of CHF 36 billion). These transactions took place in connection with the tax reforms in the US. The net reduction in portfolio investment came to CHF 8 billion (Q3 2017: net reduction of CHF 2 billion). Non-resident investors sold both shares and short-term debt securities of resident issuers.

Financial account balanceThe financial account balance came to CHF 21 billion (Q3 2017: CHF 5 billion). This figure is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrences of liabilities plus the balance from derivatives transactions. The financial account balance corresponds to the change in the net investment position resulting from cross-border investment.

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q3 2018 Source: snb.ch - Click to enlarge |

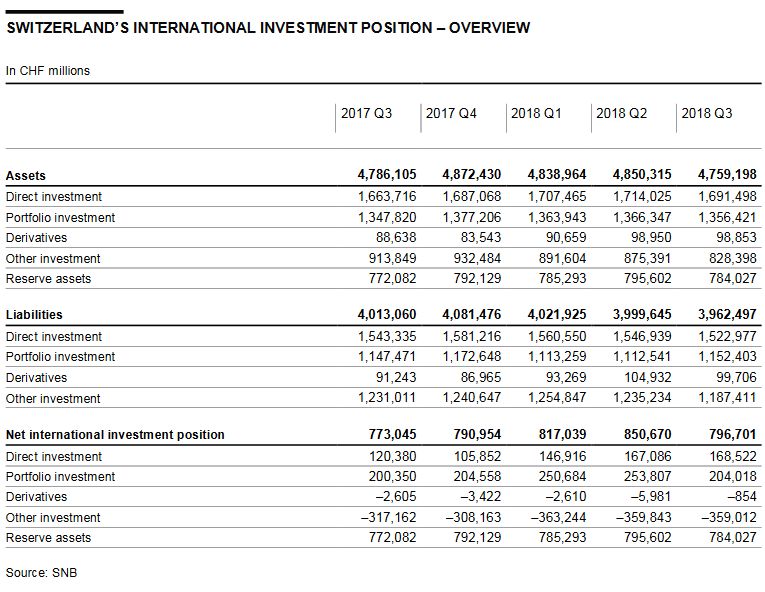

Switzerland’s International investment positionAssetsStocks of assets declined by a total of CHF 91 billion to CHF 4,759 billion compared with the second quarter of 2018. This decrease was due to the transactions reported in the financial account (net reduction of assets) as well as to valuation losses on US dollar and euro-denominated assets. Stocks of other investment declined by CHF 47 billion to CHF 828 billion. Direct investment stocks fell by CHF 23 billion to CHF 1,691 billion. Portfolio investment reduced by CHF 10 billion to CHF 1,356 billion, with valuation losses from exchange rate movements set against valuation gains from higher prices on foreign stock exchanges. Reserve assets were CHF 12 billion lower at CHF 748 billion. Stocks of derivatives remained unchanged at CHF 99 billion.

LiabilitiesStocks of liabilities contracted by CHF 37 billion to CHF 3,962 billion. This decrease was mainly attributable to the transactions recorded in the financial account (net reduction of liabilities). Since only a small proportion of stocks on the liabilities side are held in foreign currencies, valuation losses from exchange rate movements played a more minor role than on the assets side. Other investment fell by CHF 48 billion to CHF 1,187 billion. Stocks of direct investment decreased by CHF 24 billion to CHF 1,523 billion. Derivatives were down by CHF 5 billion to CHF 100 billion. An increase of CHF 40 billion to CHF 1,152 billion was recorded in portfolio investment, where valuation gains as a result of higher share prices on the Swiss stock exchange had a significant impact.

Net international investment positionGiven that stocks of assets (down CHF 91 billion) showed a more pronounced decline than stocks of liabilities (down CHF 37 billion), the net international investment position fell by CHF 54 billion to CHF 797 billion.

|

Switzerland International Investment Position(see more posts on Switzerland International Investment Position, ) Switzerland International Investment Position - Q3 2018 Source: snb.ch - Click to enlarge |

Tags: newsletter,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position