The environment will remain challenging for EM currencies next year.

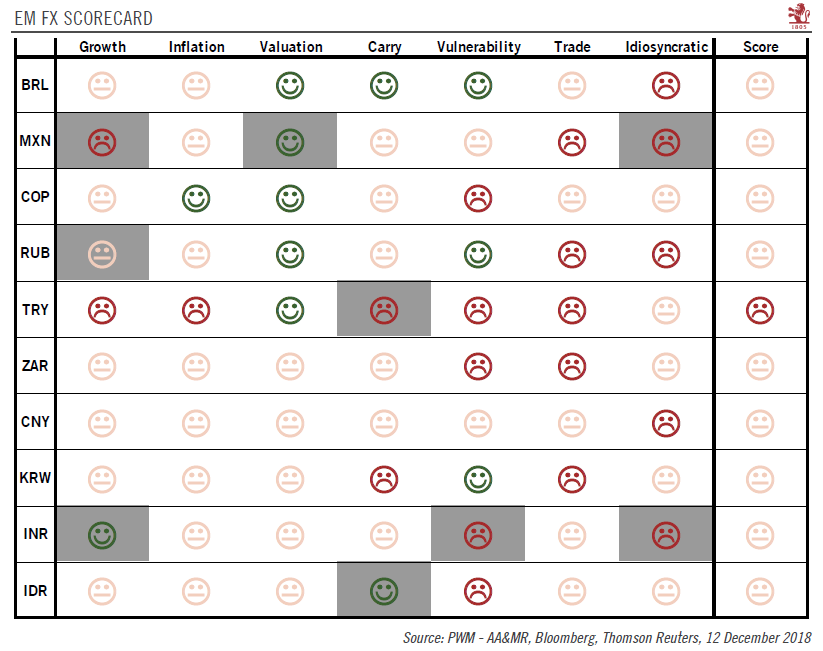

Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latest EM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the 10 it monitors on a 12-month horizon.

Being undervalued and offering decent real rates, while offering strong external buffers and low idiosyncratic risks increases the attractiveness of an EM currency. The Brazilian real comes close, but we anticipate that Brazil’s incoming president, Jair Bolsonaro, will find it difficult to enact meaningful economic reform. Given the challenging external environment investors may not prove very patient on this issue.

| Although weighed down by current account deficits, the Indian rupee and Indonesian rupiah have some attractive features too. But the surprise resignation of its governor is fuelling concerns about the Indian central bank’s independence ahead of the Indian general election next April/May.

Political uncertainties should remain an ongoing theme for Em currencies in 2019, notably for the Russian rouble and Mexican peso. Likely additional US sanctions against Russia argue for a cautious stance on the Russian currency despite elevated carry and the rouble’s strong external buffers. the Mexican peso will require some time before markets can discount uncertainties linked to the new economic policies of president López Obrador. We continue to have a cautious stance on EM currencies with weak external buffers. For example, while the Turkish lira crisis in August will likely help a short-term improvement in Turkey’s current account balance, the longer-term dynamics remain unfavourable. With a large current account deficit and inadequate FX reserves relative to short-term external debt, the outlook for the South African rand also looks poor. In sum, some improvements in the external environment in 2019 (a more dovish Fed, a weaker US dollar and limited upside on US rates) could prove supportive of EM currencies. But risks numerous remain. Market expectations for Fed rate hikes in 2019 now seem too dovish, political uncertainties (of which the US-China trade dispute is but one example) may persist for some time, and global growth could moderate. None of these factors favour outperformance by EM currencies. |

EM Scorecard table |

Tags: currencies,Emerging Markets,Macroview,newsletter,Uncategorized