Stars in the Night SkyThe U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes. The short-term significance of the DJIA’s 8 percent decline since early-October is uncertain. For all we know, stocks could run up through the end of the year. Stranger things have happened. What is also uncertain is the nature of this purge: Is this another soft decline like that of mid-2015 to early-2016, when the DJIA fell 12 percent before quickly resuming its uptrend? Or is this the start of a brutal bear market – the kind that wipes out portfolios and blows up investment funds? |

Dow Jones Industrial Average |

| The stars in the night sky tell us this is the latter. For example, when peering out into the night sky even the most untrained eye can identify the three ominous stars that are lining up with mechanical precision.

These stars include a stock market top, followed by a monster corporate debt buildup, and a fading economy. In short, the stock market’s latest break is presaging a corporate credit crisis and global recession. The last time these three stars aligned in this sequence was roughly a decade ago. If you recall, that was when the DJIA crashed 50 percent coincident with a mega credit crisis and recession. We suspect that the disaster that’s approaching will be much larger, and much more destructive than the disaster of a decade ago. |

BofA/Merrill Lynch US high yield Master II Index yield this looks like a quite convincing breakout, impossible to tweet down. In other words, the corporate debt build-up is beginning to bite back – and rather bigly, if we may say so (ed note, in case you’re wondering: the little poems are from a Spectator competition in which people used phrases from actual tweets to put together Donald haikus and poems). [PT] - Click to enlarge |

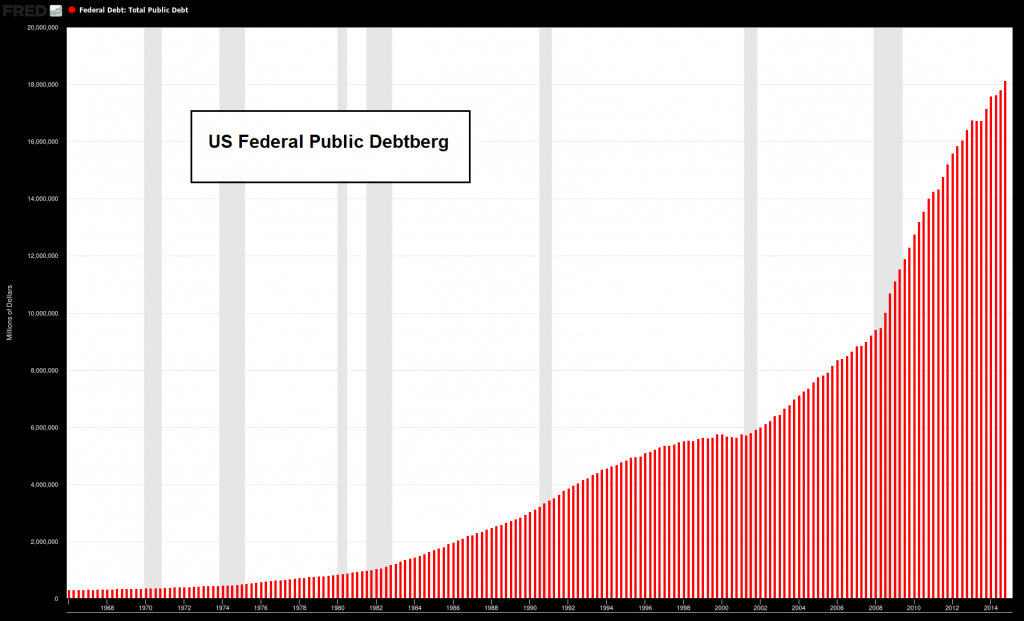

Bad HabitAstute readers will be quick to point out that government debt was not identified as one of the three ominous stars lining up in the night sky. This is not an oversight. Rather, it is an insight. Without question, government debt has burgeoned way beyond what even the most doom and gloom pessimists could have envisioned just a decade ago. In fact, November marked the widest one month budget deficit in U.S. history. Over a one month period – a month with just 30 days, not 31 – the U.S. government spent $411 billion while it only received $206 billion. By our rough back of the napkin calculation, the U.S. government spent nearly double what it took in. That difference, of course, was made up with debt. Roughly, $6.83 billion of new debt was added each and every day. At best, spending more than one makes, like smoking or swearing, is a bad habit. However, spending more than one makes with no intention to pay it back is a moral failing. What’s more, running up untenable levels of government debt with the implied intent of inflating it away at the expense of the citizenry is downright evil. Day after day, month after month, year after year, decade after decade, the U.S. government has racked up close to $22 trillion in debt. Throw in unfunded liabilities of social security, Medicare (Parts A, B, and D), federal debt held by the public, and federal employee and veteran benefits, and the U.S. government’s on the hook for over $115.8 trillion in debt – or nearly $1 million per taxpayer. How about that? Of course, as the population ages, and the ratio of workers to retirees balances, these debt figures will go vertical. As you can see, government debt is more than just an ominous star. It’s the essential star. Moreover, it is a dying star on the verge of collapse. Quite frankly, it may not have enough energy to backstop the financial system during the next downturn. Here’s why… |

US Federal Public Debtberg 1968-2014 |

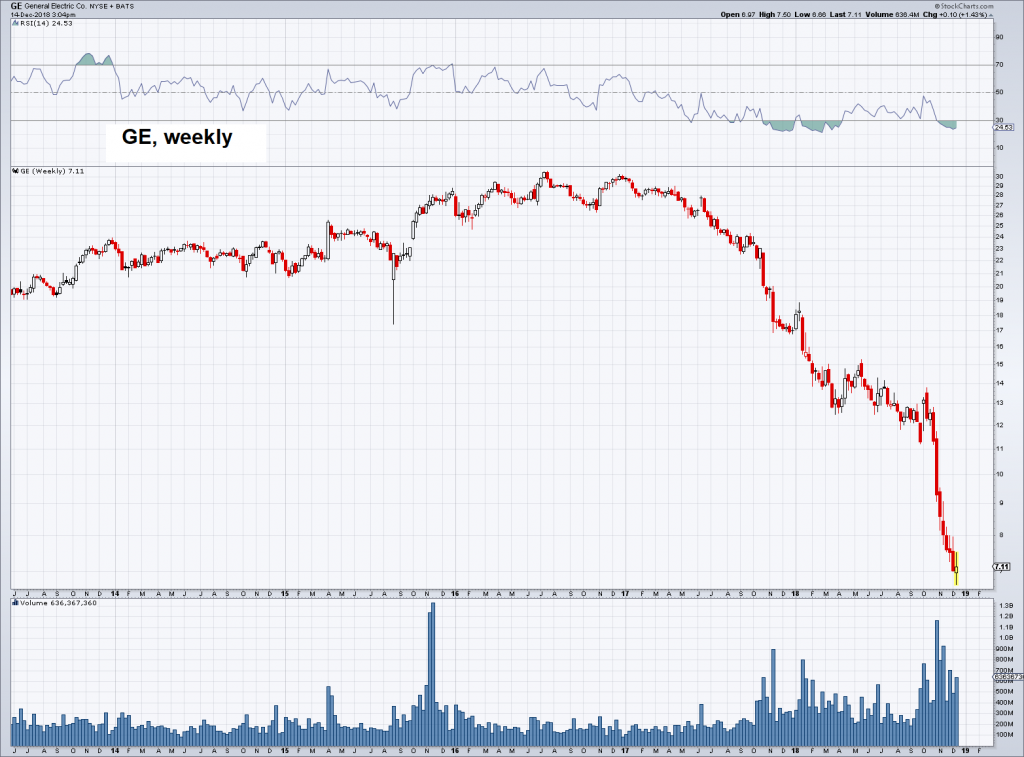

How Faux Capitalism Works in AmericaOur guess is that the real squawking from investors won’t begin until mid-2019. That’s about the time corporate America becomes acutely aware that pumping gobs of borrowed money into grossly overvalued stocks was an act of financial suicide. Just look to General Electric, IBM, and Citigroup for an early indication of the forthcoming catastrophe. For instance, over the last decade GE spent $46 billion buying back its shares. In 2016 and 2017 alone, at a time of mushrooming debt, GE pumped $24 billion into share buybacks. Over this time, the price of these shares dropped from about $30 to $16. And even with Thursday’s 7.3 percent boost, on word of a surprise JPMorgan upgrade, GE shares trade at $7.20. In other words, shares GE bought back during the early part of 2016 have lost 75 percent of their value. What to make of it? The 2008 financial crisis helped clarify how faux capitalism works in America. That when the big corporations and the big banks get in trouble, the people on top quickly absolve culpability while appropriating public funds from their friends at the Treasury for the purpose of private bailouts. This, in effect, socializes the losses across bottom rungs of society and concentrates profits across the top. |

General Electric 2014-2019 GE wasted $46 billion on buying back its shares – with nothing to show for it except a collapsing share price. This was an astonishing misallocation of capital – very likely the company will eventually have issue new shares to prop up its equity, at prices far below the prices it paid for buying them back. [PT] - Click to enlarge |

| No doubt, the aftermath of the great corporate stock buyback craze of 2009 to 2017 will be a text book example of faux capitalism in action. First, massive financial bailouts will be disseminated to crony banks and corporations with purpose and intent. Then, a colossal river of monetary liquidity from the Fed will be diverted into credit markets, and into direct stock purchases of government preferred corporations. |

The size and scope of these fiscal and monetary bailouts will utterly dwarf the TARP, ZIRP, and QE policies of the last crisis. Assuming this doesn’t blow up the Treasury’s balance sheet, or vaporize what’s left of the dollar’s value, a certain end effect will take shape. The middle class will be reduced to a notch or two above poverty, and wealth will be further concentrated into fewer and fewer hands.

We don’t like it. We don’t agree with it. But we can’t stop it. This is the world we live in. A world where justice has been debased and rectitude has been sullied.

Charts by: StockCharts, St. Louis Fed

Full story here Are you the author? Previous post See more for Next postTags: newsletter,On Economy,On Politics