Strong wage growth should support the recovery of euro area inflation in the coming months.

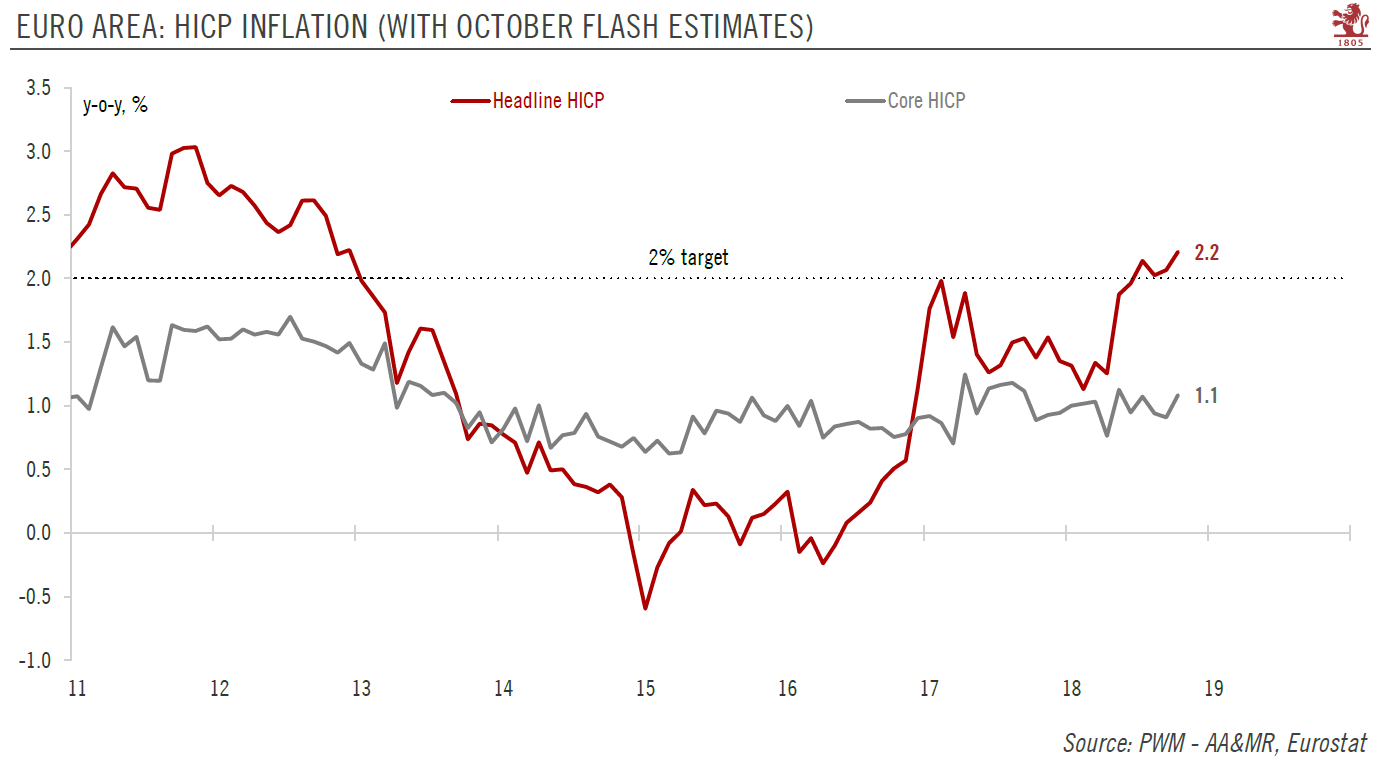

Euro area flash HICP rose from 2.1% year on year (y-o-y) in September to 2.2% in October, in line with expectations and the highest level since December 2012. Crucially, core inflation (HICP excluding energy, food, alcohol and tobacco) rebounded from 0.9% to 1.1% in October. Energy inflation rose to 10.6% y-o-y from 9.5% y-o-y in September. Food, alcohol and tobacco inflation eased, by 0.4 percentage points to 2.2%, primarily due to fresh food prices. Core inflation was mainly lifted by an increase in the price of services (1.5%, compared with 1.3% in September). The pick-up in services inflation was largely due to mechanical base effects in Germany (package holidays) and in Italy (education prices were cut in October 2017). Non-energy industrial goods inflation in the euro area also rose marginally (to 0.4% from 0.3%).

The details by country were mixed. HICP inflation was in line with expectations in Germany (2.4% y-o-y after 2.2% in September) and Spain (unchanged at 2.3% y-o-y), while it was slightly below expectations in Italy (1.7% y-o-y after 1.5% in September) and France (unchanged at 2.5% y-o-y).

Looking ahead, we expect euro area headline inflation to remain close to 2% for most of the rest of the year. Strong wage growth is likely to support a gradual recovery in core inflation to an average 1.0% in 2018 and 1.3% in 2019.

| At its Governing Council meeting this month, the ECB did not materially change its assessment of the economic conditions despite mounting risks to the outlook, including “somewhat weaker” data, business sentiment and tighter financial conditions. Crucially, the Governing Council continued to describe the risks to economic activity as “broadly balanced”. ECB considers recent softness in activity to be a mean-reversion from strong (export) growth last year and the result of idiosyncratic factors in some countries. But the central bank remained confident that inflation is on track to return to target. Draghi again highlighted rising nominal wages, including negotiated wages, as an important element in the central bank’s assessment of inflation prospects. In this regard, October’s inflation data should provide some relief to the ECB.

Overall, our baseline scenario for monetary policy remains unchanged. We expect net purchases under the asset purchase programme to cease by year’s end and we forecast a first 15bp hike in the ECB’s deposit rate in September 2019, followed by a 25bp hike in all policy rates in December 2019. Nevertheless, the risks to this scenario are growing. Recent data weakness (advanced estimates of Q3 GDP growth and October business surveys, for example) may mean that the ECB treads more cautiously than we expect when it comes to policy normalisation. Should growth momentum fall to such a degree that the inflation outlook declines materially, the ECB could adapt its forward guidance accordingly. Data releases ahead of the December ECB Governing Council meeting and staff macroeconomic projections will be key in determining whether we shift from our current baseline scenario to a more cautious one. |

Euro Area HICP Inflation, 2011 - 2018 |

Tags: Macroview,newsletter