Stock MarketsEM FX ended last week on a firm note, but weakness resumed Monday. Higher than expected Turkish inflation hurt the lira, which in turn dragged down BRL, ARS, ZAR, and RUB. We expect EM to remain under pressure this week when the US returns from holiday Tuesday. |

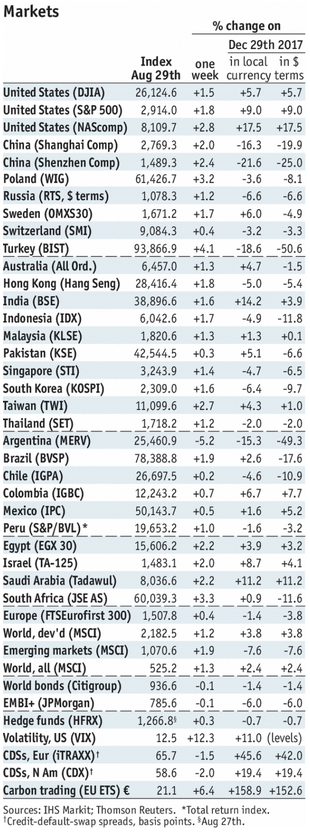

Stock Markets Emerging Markets, August 29 |

KoreaKorea reports August CPI Tuesday, which is expected to rise 1.4% y/y vs. 1.5% in July. If so, inflation would remain well below the 2% target. BOK just left rates steady at 1.5% on Friday. Next policy meeting is October 18, and no change is expected then. It reports July current account data Thursday. South AfricaSouth Africa reports Q2 GDP Tuesday, which is expected to grow 1.0% y/y (0.6% SAAR) vs. 0.8% (-2.2% SAAR) in Q1. Q2 current account data will be reported Thursday, and the deficit is expected at -3.2% y/y vs. -4.8% in Q1. Overall, weak growth, rising inflation, and wide external deficits are likely to keep the rand under pressure. BrazilBrazil reports July IP Tuesday, which is expected to rise 2.2% y/y vs. 3.5% in June. It then reports August IPCA inflation Thursday, which is expected to rise 4.29% y/y vs. 4.48% in July. Next COPOM meeting is September 19 and markets are split. Analysts see no change and CDI market is pricing in a 25 bp hike. We lean towards a hike. ChileChile central bank meets Tuesday and is expected to keep rates steady at 2.5%. Chile reported weaker than expected July retail sales Monday, which rose 0.1% y/y vs. 3.5% expected. August CPI and trade will be reported Friday, with inflation expected to remain steady at 2.7% y/y. If so, it would remain in the bottom half of the 2-4% target range. PhilippinesPhilippines reports August CPI Wednesday, which is expected to rise 5.9% y/y vs. 5.7% in July. If so, inflation would move further above the 2-4% target range. Next policy meeting is September 27, and another rate hike is likely then. MalaysiaMalaysia reports July trade Wednesday. Bank Negara also meets that day and is expected to keep rates steady at 3.25%. CPI rose only 0.9% y/ y in July. While the central bank does not have an explicit inflation target, low price pressures should allow it to remain on hold into 2019. Malaysia reports July IP and manufacturing sales Friday. It then reports July industrial and construction output and trade Thursday, with IP expected to rise 1.2% y/y vs. 1.5% in June. The economy remains robust and so the central bank is on track to hike rates again in Q4. Next policy meeting is September 26, which seems too soon for another hike. |

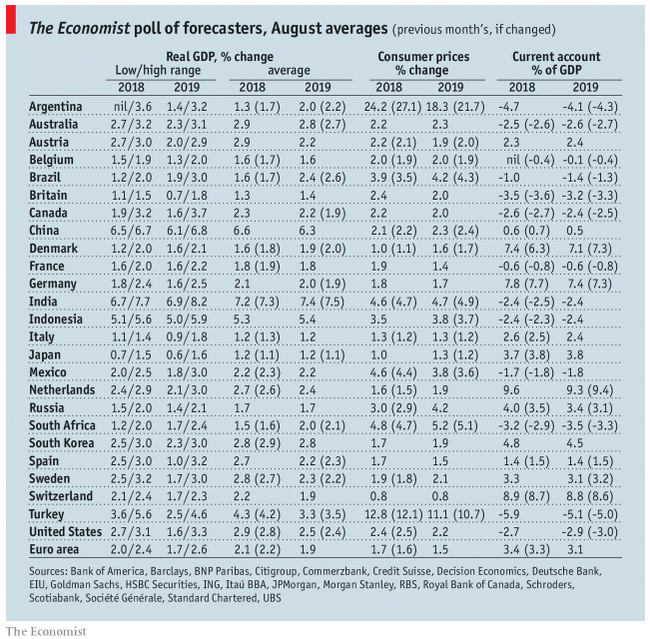

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2018 Source: economist.com - Click to enlarge |

Hungary

Hungary reports July retail sales Wednesday, which are expected to rise 6.9% y/y s. 6.4% in June. Central bank minutes will also be released later that day. It then reports July IP Thursday, which is expected to rise 8.0% y/y vs. 3.1% in June. July trade will be reported Friday. The economy remains robust and so the central bank needs to tilt less dovish. Next policy meeting is September 18.

Taiwan

Taiwan reports August CPI Wednesday, which is expected to rise 1.74% y/y vs. 1.75% in July. While the central bank does not have an explicit inflation target, low price pressures should allow it to remain on hold at its next quarterly meeting in September. August trade will be reported Friday. Exports are expected to rise 5.1% y/y and imports by 14.9% y/y.

Poland

National Bank of Poland meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 2.0% y/y in August, which is in the bottom half of the 1.5-3.5% target range. As such, we see no imminent tightening.

Colombia

Colombia reports August CPI Wednesday, which is expected to rise 3.10% y/y vs. 3.12% in July. If so, inflation would remain in the upper half of the 2-4% target range. Next policy meeting is September 28, and no change is expected then.

Mexico

Mexico reports August CPI Friday, which is expected to rise 4.85% y/y vs. 4.81% in July. Next policy meeting is October 4, and no change is expected then. However, much will depend on the peso.

Full story here Are you the author? Previous post See more for Next postTags: Brazil,Chile,Colombia,Emerging Markets,Hungary,Korea,Malaysia,Mexico,newsletter,Philippines,Poland,South Africa,Taiwan,win-thin