While the recent economic ‘soft patch’ has hurt all the main euro area economies, some have been more affected more than others. A divergence in fortunes can be seen across asset classes.

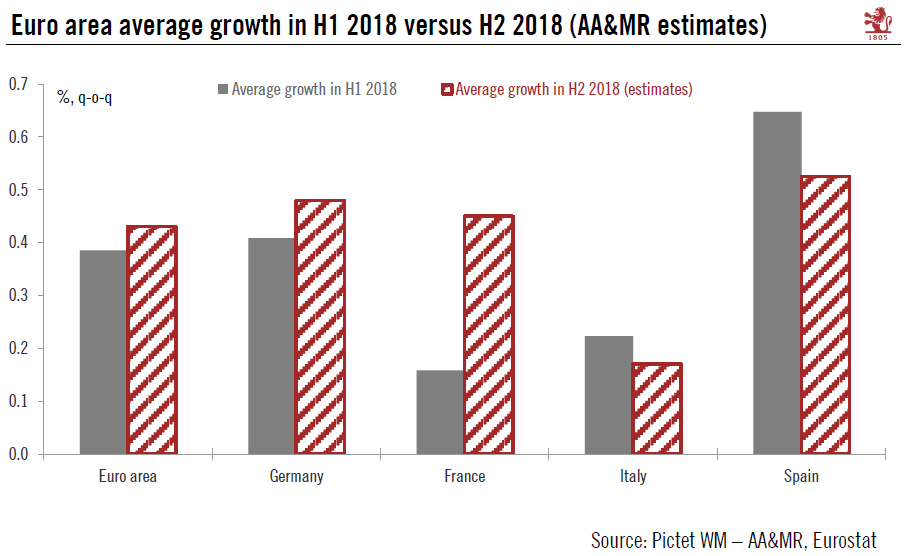

The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators show that Italy is the only of the four major euro area economies to face weaknesses both in export-led manufacturing and services, due domestic political uncertainties (including the upcoming state budget) as well as global trade tensions.

| We remain bearish on euro area peripheral bonds as Italian budget discussions could continue to stoke volatility. However, some relief could come from a commitment by the Italian government to stick to a 2% deficit target for 2019. This could bring relief to the riskiest parts of theeuro credit market as well as to Italian government bonds. But we will wait for more clarity on this point before turning more positive. We are currently bearish on core and peripheral euro area sovereign bonds. We are bearish on euro high yield, but neutral on euro investment grade credits (because of their lower exposure to Italy).

Italian political uncertainty has been a source of stress for euro area equity markets since May. They have also suffered disproportionately from global trade tensions. This is because quoted European companies are more exposed internationally than their US counterparts. For example, earnings growth in Germany started to slip when trade tensions escalated earlier this year. But as a counterpoint, an easing of trade tensions would be a positive factor for earnings growth in Europe in general and, by extension, for European equities. We are largely neutral equities at present, with a small tilt towards Scandinavian equities meaning that we favour Europe over the narrower euro area. We believe the euro is likely to appreciate against the US dollar and, to a lesser extent, against the Swiss franc over the coming six-to-12 months. While the uncertainty surrounding Italy and exposure to Turkey have hurt the euro of late, he two main fundamental drivers for recent euro weakness against the dollar are growth and interest rate differentials. We expect both to turn more in the euro’s favour in the coming months. |

Euro Area Average Growth |

Tags: euro area growth,Macroview,newsletter