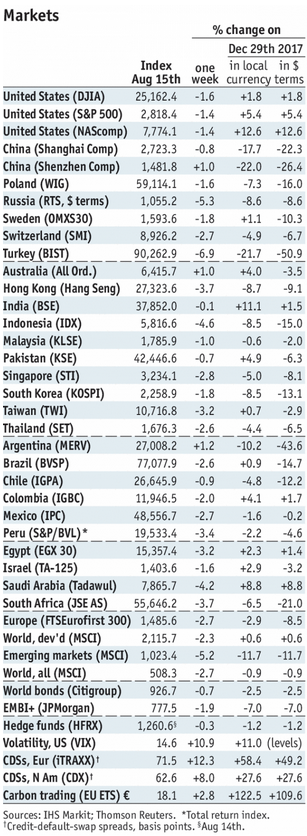

Stock MarketsEM FX stabilized last week as the situation in Turkey calmed somewhat. Reports Friday that the US and China are hoping to resolve the trade dispute also helped EM FX ahead of the weekend. However, TRY remains vulnerable as the US threatens more sanctions due to the pastor. Both S&P and Moody’s downgraded it ahead of the weekend and our own ratings model points to further downgrades ahead. Turkish markets are closed this week for holiday. |

Stock Markets Emerging Markets, August 15 |

ThailandThailand reports Q2 GDP Monday, which is expected to grow 4.4% y/y vs. 4.8% in Q1. CPI rose 1.5% y/y in July, which is still in the bottom half of the 1-4% target range. The Bank of Thailand has signaled that it is in no rush to hike rates. Next policy meeting is September 19, no change is expected then. PolandPoland reports July industrial and construction output and PPI Monday. July real retail sales will be reported Wednesday, which are expected to rise 7.4% y/y vs. 8.2% in June. Central bank minutes will be released Thursday. Despite rising price pressures, the central bank has maintained its ultra-dovish forward guidance of steady rates through 2019. Next policy meeting is September 5, no change is expected then. TaiwanTaiwan reports July export orders Monday, which are expected to rise 2.1% y/y vs. -0.1% in June. It also reports Q2 current account data that day. Exports and export orders have slowed in recent months. July IP will be reported Thursday, which is expected to rise 3.0% y/y vs. 0.4% in June. The central bank does not have an explicit inflation target, and so downside risks to growth should allow it to remain on hold at its next quarterly policy meeting in September. ChileChile reports Q2 GDP and current account data Monday. Growth is expected at 5.2% y/y vs. 4.2% in Q1. CPI rose 2.7% y/y in July, which is in the bottom half of the 2-4% target range. However, robust growth has led the bank to signal the likely start of the tightening cycle in Q4. Next policy meeting is September 4, no change is expected then. KoreaKorea reports trade data for the first 20 days of August Tuesday. Export growth has slowed in recent months. CPI rose 1.5% y/y in July, well below the 2% target. Policymakers are concerned about the growth outlook and low price pressures should allow the Bank of Korea to keep rates on hold for now. Next policy meeting is August 31, no change is expected then. |

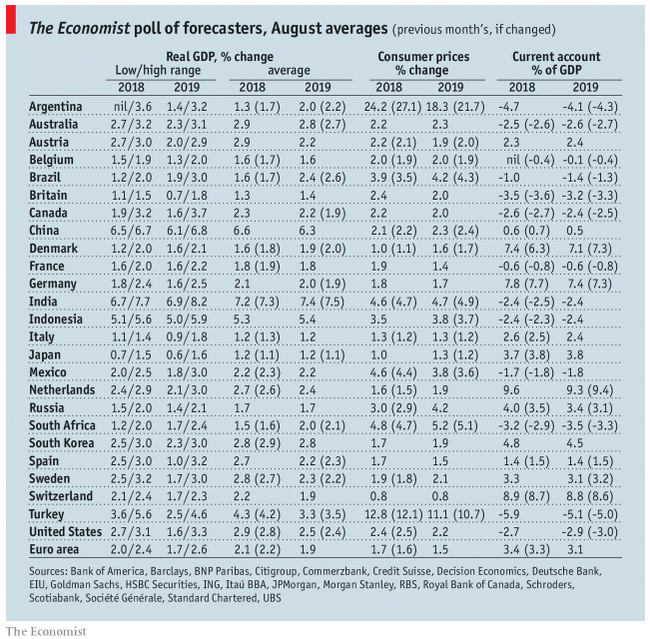

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, August 2018 Source: economist.com - Click to enlarge |

Hungary

National Bank of Hungary meets Tuesday and is expected to keep policy steady. CPI rose 3.4% y/y in July, the highest since January 2013 and in the top half of the 2-4% target range. Yet the bank has maintained its dovish stance. If the forint resumes weakening, we think the central bank will tilt more hawkish.

South Africa

South Africa reports July CPI Wednesday, which is expected to rise 5.1% y/y vs. 4.6% in June. If so, this would be the highest reading since September 2017 and moves closer to the top of the 3-6% target range. With rand weakness picking up, we see upside risks to inflation and so SARB will likely have to think about starting a tightening cycle. Next policy meeting is on September 20.

Singapore

Singapore reports July CPI Thursday, which is expected to remain steady at 0.6% y/y. While the MAS does not have an explicit inflation target, low price pressures should allow it to keep policy meeting at its semi-annual policy meeting in October. Singapore then reports July IP Friday, which is expected to rise 6.6% y/y vs. 7.4% in June.

Brazil

Brazil reports mid-August IPCA inflation Thursday, which is expected to rise 4.27% y/y vs. 4.53% in mid-July. The central bank views the recent rise of inflation as temporary, but we disagree, especially in light of renewed BRL weakness. COPOM will likely start a tightening cycle at the next policy meeting on September 19.

Mexico

Mexico reports mid-August CPI Thursday, which is expected to rise 4.76% y/y vs. 4.85% in mid-July. The central bank views the recent rise of inflation as temporary, but we disagree, especially in light of renewed MXN weakness. Banxico will likely resume its tightening cycle in the coming months. Next policy meeting is October 4. It reports Q2 current account data Friday.

Malaysia

Malaysia reports July CPI Friday, which is expected to rise 0.9% y/y vs. 0.8% in June. Q2 growth came in at a much slower than expected 4.5% y/y. While Bank Negara does not have an explicit inflation target, low price pressures should allow it to remain on hold well into 2019. Next policy meeting is September 5, no change is expected then.

Full story here Are you the author? Previous post See more for Next postTags: Brazil,Chile,Emerging Markets,Hungary,Korea,Malaysia,Mexico,newsletter,Poland,Singapore,South Africa,Taiwan,Thailand,win-thin