Authored by Richard Murphy via Tax Research UK blog,

The FT has reported this morning that:

Debt at UK listed companies has soared to hit a record high of £390bn as companies have scrambled to maintain dividend payouts in response to shareholder demand despite weak profitability.

They added:

UK plc’s net debt has surpassed pre-crisis levels to reach £390.7bn in the 2017-18 financial year, according to analysis from Link Asset Services, which assessed balance sheet data from 440 UK listed companies.

So what, you might ask? Does it matter that companies are making sense of low-interest rates to raise money when I am saying that government could and should be doing the same thing?

Actually, yes it does. And that’s because of what the cash is being used for. Borrowing for investment makes sense. Borrowing to fund revenue investment (that is training, for example, which cannot go on the balance sheet but still adds value to the business) makes sense. But borrowing to pay a dividend when current profits and cash flow would not support it? No, that makes no sense at all.

| Unless, of course, you are CEO on a large share price linked bonus package and your aim is to manipulate the market price of the company. It is that manipulation that is going on here, I suggest. These loans are being used to artificially inflate share prices.

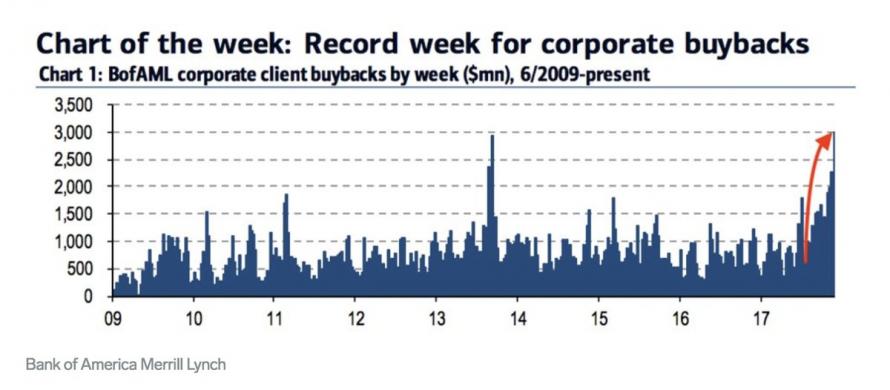

The problem is systemic. In the US the problem is share buybacks, which I read recently have exceeded $5 trillion in the last decade, meaning that US companies are now by far the biggest buyers of their own shares. That is, once again, market manipulation. And this manipulation does matter. People think their savings and pensions are safe because of rising share prices. They do not realise it is all a con-trick. And companies claim that their pension funds are better funded as a result of these share prices, and so they are meeting their obligations to their employees when that too is a con-trick. They may be insolvent when the truth is known, so serious is the fraud. |

Record Week for Corporate buybacks |

And sentiment is, wholly irrationally, but nonetheless definitely, based on the fact that if markets are high then all must be right in the world. After all, why else is the FTSE reported every hour on every news bulletin but to tell us the national financial mood?

And what is actually being reported is a fraud. The corporate world is not all right. It is out of ideas. And it is so bereft of ideas that it can’t even run outsourcing businesses, which were said to be the easiest thing in the world to get right.

And as fiasco after fiasco shows, the reports of well being in the form of the financial statements are themselves manipulated, or just blatantly cooked.

No one knows where the tipping point for any crisis will come from. I am not claiming I do. But the charade that current stock market valuations represent will be seen through some time soon. Those values are being maintained by Ponzi schemes. And such schemes always end in tears.

Full story here Are you the author? Previous post See more for Next postTags: newslettersent