Since the beginning of the year, Bitcoin has seen its price cut in half and beyond. Other crypto assets have fallen even more. Although the king of the crypto world has rebelled from time to time over recent months, Bitcoin’s occasional price increases have always been met with follow-up downturns.

Since the beginning of the year, Bitcoin has seen its price cut in half and beyond. Other crypto assets have fallen even more. Although the king of the crypto world has rebelled from time to time over recent months, Bitcoin’s occasional price increases have always been met with follow-up downturns.

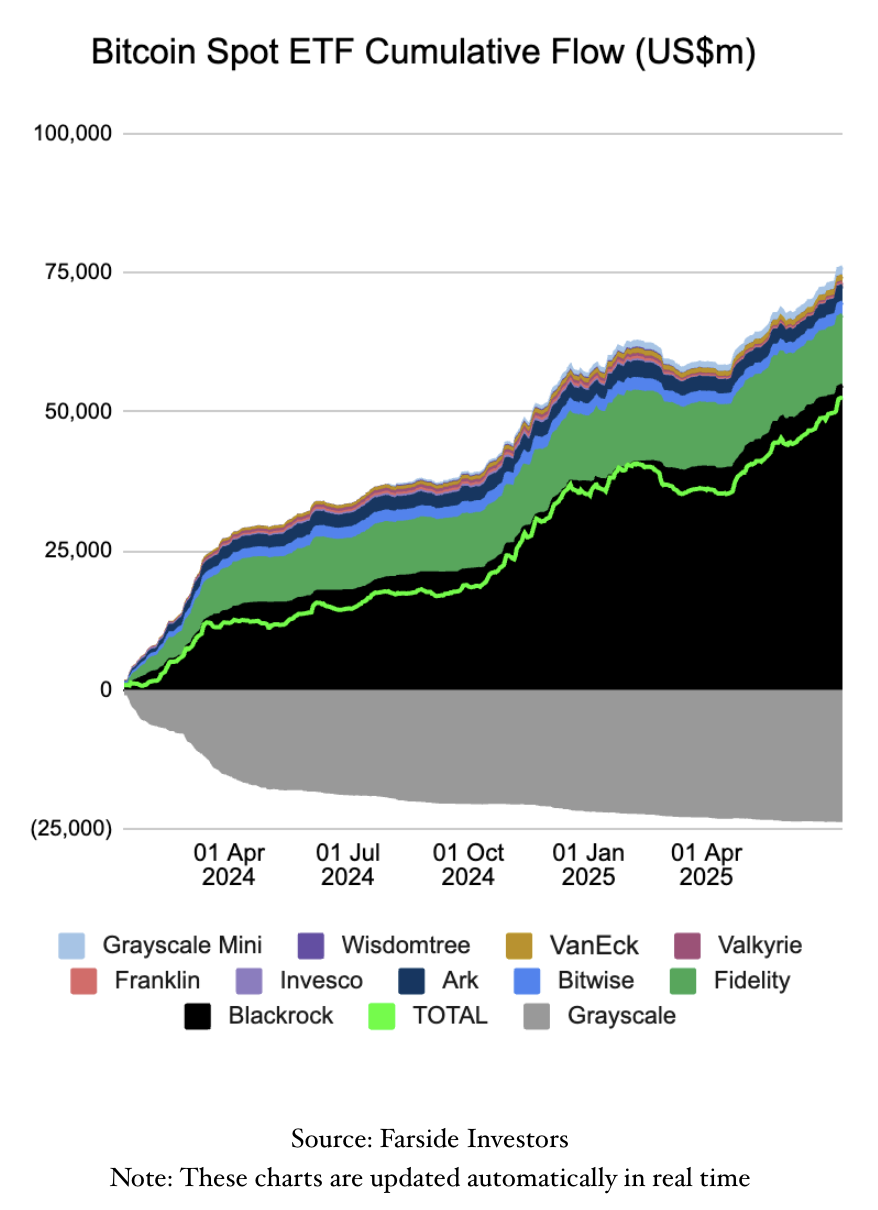

The crypto market is still mainly populated by private investors. Institutional investors, especially Wall Street, are not invested, apart from a few hedge funds. Reports like the one from BlackRock a few days ago might give an indication that general interest seems to be present, but concrete steps towards professional investment by institutional investors have hardly been taken.

The absence of Wall Street has long been praised by many crypto-enthusiasts as a wonderful stroke of luck, as this means that for once the simple but digitally savvy man from the street is ahead of the banks, asset managers and pension funds.

As time has gone by, however, the crypto market has become a nerve-racking hassle for many private investors. While the absence of institutional actors was initially glorified, now their continued absence seems to worry people. Therefore more and more of these people are longing for institutional investors to enter the scene. For months now it has been said that institutional investors are on the sidelines and are waiting for the right time to get their feet wet. Nasdaq-operated DX crypto trading exchange appeared to have already registered over 500,000 users before its market launch at the end of June. Recently, the latest Capgemini World Wealth Report also devoted a whole chapter to crypto assets. In the report, the authors stated that crypto and the blockchain are attracting great attention among very wealthy clients worldwide.

When are the floodgates about to open?

The fact that institutional investors have not yet touched crypto-assets seems to surprise some, given that the traditional investment world does not really offer any great yields as of late. The central bank interventions of recent years have inflated the prices of many assets immensely and reduced their yields. With Bitcoin and the crypto assets, a new asset class was born at this very time — but why was this not accepted as a promising investment opportunity by the profit-seeking financial world?

Until 2017, Bitcoin was ignored by the majority. It’s only obvious that no one on the institutional side thought about an investment. Today, however, crypto is known around the world and yet institutional investors still seem to keep their hands off it. The immatureness of the crypto market might be one decisive reason for this. To this day, there are still too few onramp options. Hardly any bank has neither a research nor trading desk for crypto assets. In addition, professional storage solutions by incumbents are barely available. This is quite an obstacle as nobody wants to store crypto assets worth several million dollars on an ordinary hard wallet.

Those actors within the crypto space, who have already built up a certain infrastructure are still too unknown and lack a track record. After all, when it comes to finance and investments, reputation and experience are essential for building trust. In view of the security and fraud risks that we hear about from time to time in connection with crypto, the reservation on the part of institutional investors is understandable. The fact that the overall legal situation has not yet been clarified further exacerbates the problem.

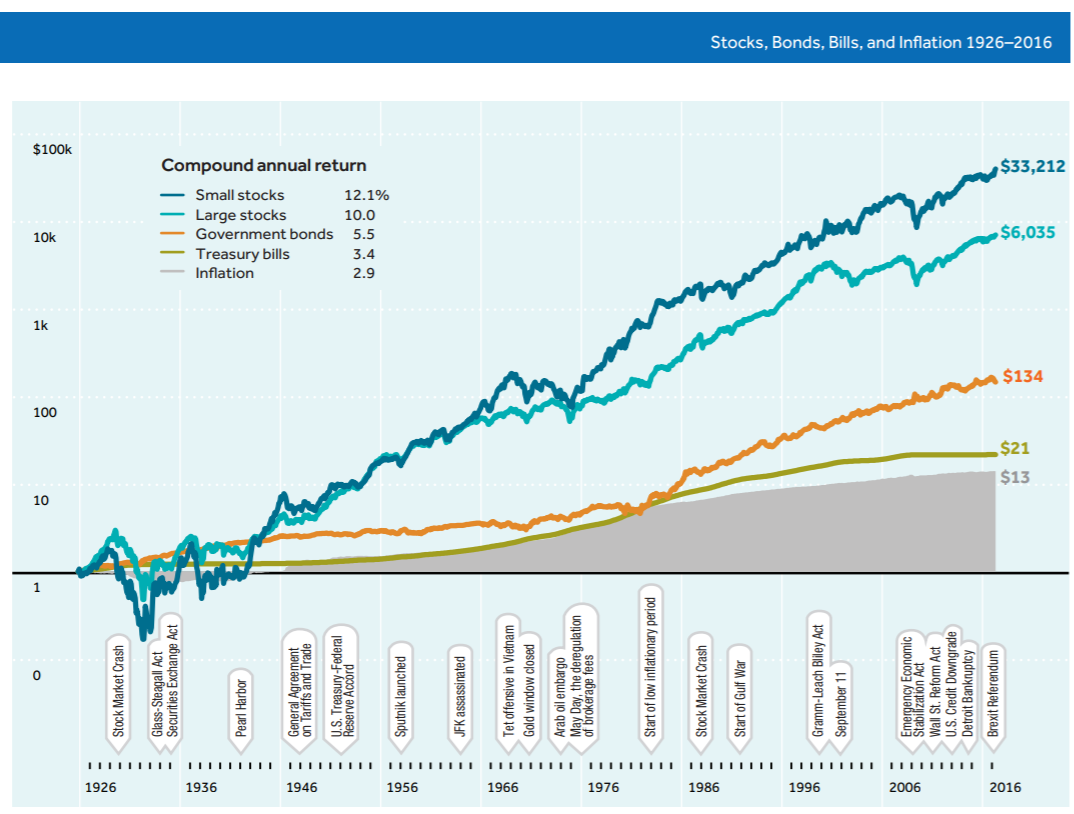

The continued high volatility of the crypto market also has a deterrent effect on institutional investors. Price fluctuations of up to twenty percent within a few hours are not uncommon for Bitcoin, while other crypto assets are even worse. When US stocks plummeted by only five percent in February of this year, Wall Street was already in a great uproar. Institutional investors simply cannot afford such price fluctuations. However, not only volatility is a thorn in their eyes, but also the unpredictability of the overall market. Precisely because the crypto market seems to follow its own rules, it is uncorrelated with traditional markets, which makes it even hard to read. A fact that makes this market rather unsuited for institutional players: What if for whatever reason a pension fund needs cash and is forced to sell its crypto assets? On a good day, the fund can sell the crypto asset for an astronomical profit. On a bad day, however, the fund loses a real ton of money belonging to thousands of pensioners.

As an argument against the current volatility it is often put forward: Once the market is mature and has a sufficiently high market depth, prices will also stabilize. It’s not obvious though if this is really true. And even if it were true, ultimately there is still the famous chicken and egg problem: if the crypto market is to be finally grown up and thus become a recognized, price-stable asset class, it needs the liquidity of institutional investors. However, they are currently reluctant to enter precisely because of the volatility.

No passive income

Bitcoin and most other crypto assets have another major disadvantage inherent in them: no indirect income can be generated with them. Generating a passive income is extremely important for institutional investors such as pension funds, investment funds and insurance companies. They all have to make regular payments. At the end of the day, their business model is to earn enough money on their investments to cover pensioners’, investors’ and insurance claims.

Whether dividends from equities or interest payments through bonds, traditional investment vehicles provide regular, indirect income that institutional investors can use to finance their expenses. Stocks and bonds do not have to be sold in order to yield a financial benefit. Bitcoin cannot provide such an important indirect source of income for institutional investors unless they participate in the bitcoin mining process.

Staking, an alternative consensus algorithm to Bitcoin’s proof-of-work algorithm, offers an opportunity to generate indirect income. Staking allows for a return on “staked” coins. Given this fact, institutional investors — if willing to invest at all — are expected to go for crypto assets that are of the proof-of-stake type. One possible reason why Ethereum, which plans to change from “Proof-of-Work” to “Proof-of-Stake”, seems to popular in the corporate world.

So the question is: So is it the unfavorable nature of bitcoin and other crypto assets that prevents institutional investors from investing? We can only speculate. However, such an assumption would not be entirely implausible, according to which crypto assets as a new asset class are not popular with institutional investors, precisely because they are no assets in an institutional investor’s point of view. That would be a bitter pill to swallow for the hopeful crypto community.

It also seems quite obvious that prices are part of the problem. In contrast to conventional assets, there has hardly been any agreement on uniform valuation model for crypto assets. Since bitcoin and other crypto protocols do not generate continuous cash flow, traditional valuation models such as the discounted cash flow method are of little use.

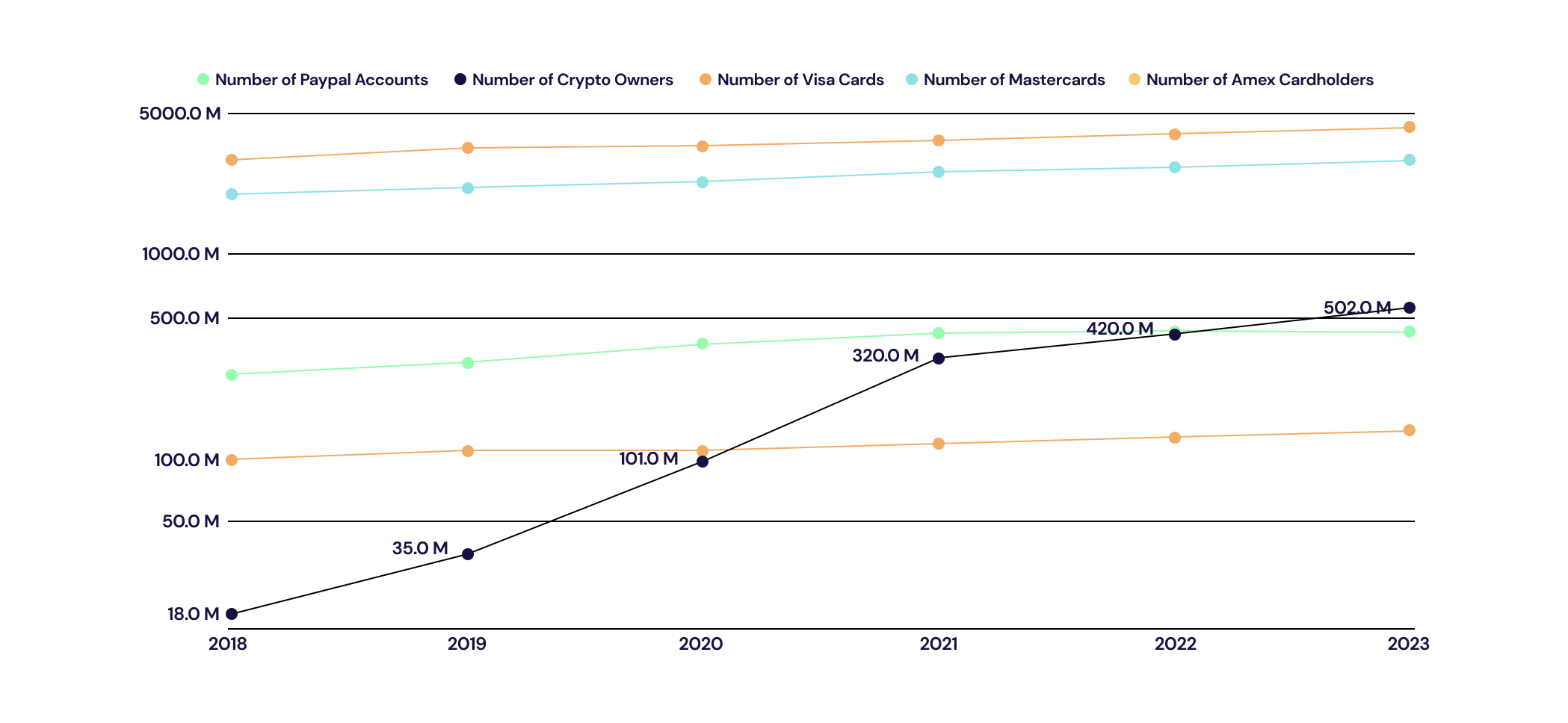

New methods are already being discussed. One approach is to evaluate a crypto asset’s potential for market penetration in order to achieve possible network effects. This is based on a rule of thumb of Metcalfe’s law that attempts to gauge the cost-benefit ratio of communication systems. The difficulty here: How is a market penetration potential to be meaningfully determined when it is hardly clear which market the protocols will one day serve? Another frequently chosen method of evaluation is based on an assessment of a crypto asset’s developer team. But such an approach is highly subjective. Very few investors know the respective developers personally. And since the crypto phenomenon is so young, very few blockchain developers do even have a meaningful track record.

What seems to be bound to happen, doesn’t have to happen

Therefore, are crypto-assets to be written off? We don’t know. But what we do know: Even though crypto-assets don’t seem to be suitable assets according to institutional investors’ standards, this does not necessarily mean that this must remain the case forever. After all many people are already predicting great future for the security token model.

But even for the bitcoin the signs are good. Because, as so often in life, it’s not just about “fill” or “kill” or “black” or “white. As a matter of fact, 98 percent of our society do not have any interest in dual market policies, antiques, classic cars, catastrophe bonds or microfinance. Yet these asset classes are ten, a hundred or even a thousand times Bitcoin’s market capitalization. Looking at the situation from the portfolio perspective also indicates: Bitcoin and other crypto assets show virtually no correlation to conventional asset classes, in some cases even slightly negative. Due to such (and other) unique characteristics, Bitcoin will have additional potential even without broad mainstream adoption. It is not necessary at all that Bitcoin will be the dominant currency in 2023 — the example of gold illustrates this in an impressive way. A stable niche with a few 100,000 investors is completely sufficient to push up Bitcoin’s price by quite a bit.

Even if the majority of institutional investors were to stay away from Bitcoin, this would have one decisive advantage: The correlation to other asset classes dominated by institutional investors would remain reasonably low. Should the Bitcoin blockchain proof to be unhackable and indestructible over several decades, this, in combination with a persistent non-correlation, might encourage many a reasonable private investor to no longer ignore Bitcoin when it comes to portfolio decisions.

Are you the author? Previous post See more for Next postTags: Bitcoin,cryptocurrency,newslettersent