Fragmented politics and the risk of a financial crisis continue to hang over the country.

This weekend, the Five Star Movement and the League decided to pull the plug on their attempt to form a coalition government after the President of the Republic Sergio Mattarella vetoed the appointment of anti-euro professor Paolo Savona as minister of finance. Mattarella has granted ex-International Monetary Fund official, Carlo Cottarelli, a mandate to form a caretaker government. Should the caretaker government lose a confidence vote, elections could come in autumn.

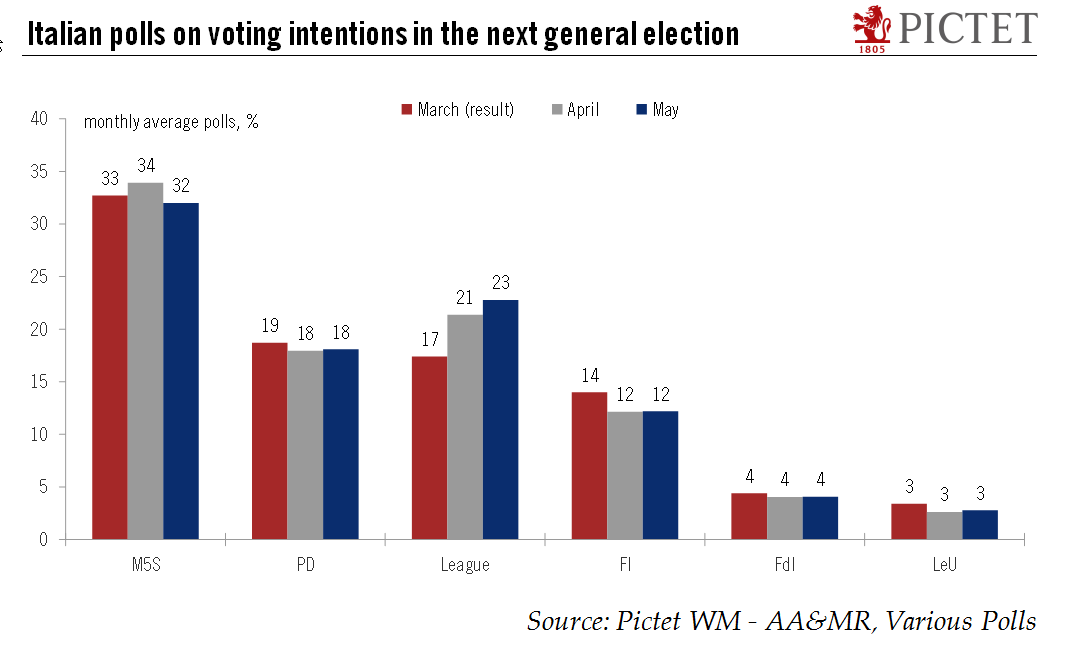

One critical question for investors will be whether the League, and to a lesser extent the M5S, manage to gain further support ahead of the next election. According to the latest polls, since the March 4 general election, the League has continued to gain support while support for the M5S is steady At this stage, it is difficult to say whether the League will decide to form an electoral alliance with Forza Italia (as in the March election) or with M5S, or whether it will run on its own. In any case, the League and the M5S together are polling at 55%, well ahead of other parties.

The obvious risk is that political fragmentation remains high, if not higher after new elections, with the same obstacles preventing the formation of a coalition government in the next election. Another concern for markets is that the next election could turn into a referendum on euro membership, even though most parties have now officially pledged to stay in the euro area. The immediate risk is not of a ‘In/Out’ referendum (hardly possible without a change in the Italian constitution), but of a de facto exit because of a severe financial crisis—for instance if the Italian Treasury started issuing some version of a parallel currency (IOUs).

The main (only) positive consequence we can see from recent developments is that eurosceptic political parties are forced to clarify their position once and for all. We see no reason to change our annual real GDP forecast of 1.4% for Italy in 2018. Although downside risks may have increased since the start of the year, this is true for the euro area as a whole and not specifically for Italy.

| Giuseppe Conte, the newly appointed prime minister, resigned this weekend after the President of the Republic, Sergio Mattarella, vetoed the appointment of a eurosceptic economist Paolo Savona as finance minister out of fear he would push Italy out of the euro. Under the Italian Constitution (Art. 92), the President of the Republic “appoints the President of the Council of Ministers and, on his proposal, the Ministers”. He has the right to reject the appointment of a cabinet member but that power has been rarely used before now.

In his speech following his decision, Mattarella mentioned that he “agreed to all the ministers picks except the finance minister” and that he “asked for a figure who would mean not risking an exit from the euro”. He added that the Five Start Movement (M5S) and the League refused to put forward any other candidates for the role of finance minister. Following Mattarella’s veto, M5S and the League decided to pull the plug on their plans to form a coalition government and the M5S said it was considering proposing impeachment of the President. Mattarella has granted ex-International Monetary Fund (IMF) official Carlo Cottarelli a mandate to form a caretaker government before fresh elections in December or at the beginning of next year. Should the caretaker government lose a confidence vote, elections could come earlier, possible in autumn. The earliest snap elections could be held is the first half of September. What next?The next step is for Mr Cottarelli to propose a list of ministers to the President. Presuming the list is accepted, the government would then ask for a confidence vote in Parliament. Failure to win the confidence vote would pave the way for early elections, possiblyin the autumn. As the y have a parliamentary majority, the League and the M5S could easily derail any attempt by Cottarelli to form a new government by voting together against his government. Indeed, both parties’ leaders have vowed to vote against a technocratic government. What do polls tell us if new elections were to be held?According to the latest polls, since the March 4 general election, the League has continued to gain support while support for the M5S is steady at around 32%. At this stage, it is difficult to say whether the League will decide to form an electoral alliance with Forza Italia (as in the March election) or with M5S, or whether it will run on its own. In any case, the League and the M5S together are polling at 55%, well ahead of other parties such as the centre-left Democratic Party and centre-right Forza Italia, which have lost some ground since the elections in March. It will be critical to watch how the most important political forces will run for next elections. |

Italian polls on voting intentions in the next general election |

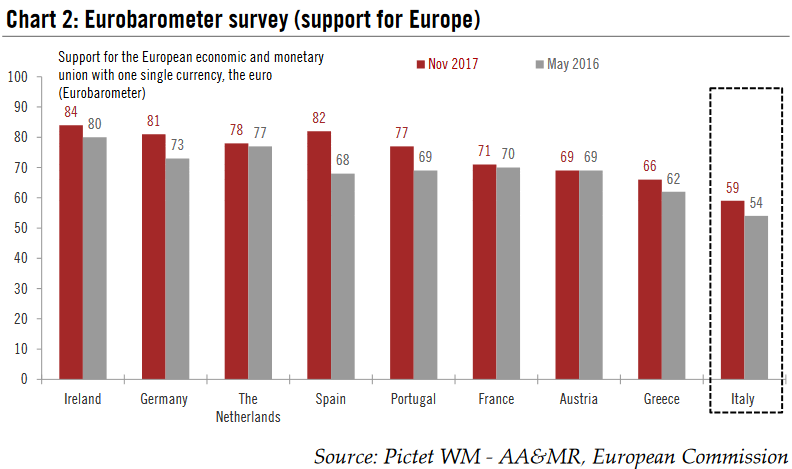

Possible scenarios: a binary outcome?One critical question for investors will be whether the League, and to a lesser extent the M5S, will manage to gain further support ahead of the next election. One possible explanation of the League’s insistence on the appointment of a eurosceptic finance minister is that their strategy was indeed to trigger new elections, with Salvini (League’s leader) seen as a likely winner in this scenario. Either way, the obvious risk is that political fragmentation remains high, if not higher, with the same obstacles preventing the formation of a coalition government in the next election. Another concern for markets is that the next election could turn into a referendum on euro membership, even though most parties have now officially pledged to stay in the euro area. The immediate risk from that perspective was not that a ‘In/Out’ referendum could be implemented (it would be hardly possible without a change in the constitution), but that an exit happened de facto in a severe financial crisis, for instance if the Italian Treasury started issuing some version of a parallel currency (IOUs). The main (only) positive consequence we could see from recent developments is that eurosceptic political parties are forced to clarify their position once and for all. The League, in particular, has been highlyambiguous about their intentions, to say the least. In the end, a majority of Italians are still in favour of euro membership (see Chart 2), according to the European Commission’s Eurobarometer survey, even though of course thinks might change ahead of the elections. Is there time to change the “ Rosatellum bis ” electoral law?Italian parliamentary elections took place in March under a new electoral law called Rosatellum bis. This is a combination of a first-past-the-post (37% of seats) and proportional representation system (61% of seats), with and the remaining 2% reserved for overseas constituencies. The legislation was agreed in late October 2017 and replaces the Italicum and Porcellum electoral laws. As with other electoral laws, the Rosatellum bis produced a hung parliament in March, and polls suggest it could happen again. Should parties ask to review the electoral law again to avoid such an outcome, new elections could be delayed beyond September. |

Eurobarometer survey (support for Europe) |

How does the impeachment procedure work?

The M5S said it was considering proposing impeachment of the President after his veto, invoking a constitutional clause (Art. 90) that says that “the President of the Republic is not responsible for the actions performed in the exercise of presidential duties, except in the case of high treason or violation of the Constitution”. In such case, the President of the Republic may be impeached through a majority approval of the two houses of Parliament in a joint session. In case of impeachment, sentence is passed by the Constitutional Court plus a jury of sixteen citizens chosen at random among anyone eligible to be a Senator. The last attempt to initiate a procedure of “impeachment” was in 2014 against the president at the time, Giorgio Napolitano. However this attempt failed at an early stage. No attempt at impeachment has ever succeeded.

Is Italy’s modest cyclical recovery at risk?

The Italian economy has been experiencing a modest cyclical recovery since the end of 2016. Leading indicators (for example, the latest PMI and Istat surveys) suggest that the recovery remains broadly on track. At this stage, we see no reason to change our annual real GDP forecast of 1.4% for Italy in 2018. Although downside risks have arguably increased since the start of the year, this is true for the whole region and not specifically for Italy.

Read full report here

Tags: Macroview,newslettersent