The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners).

Ever since economic indicators have started to deteriorate this year and risks to global trade have accumulated, ECB rhetoric has been overwhelmingly consistent with the first option including a postponement of a QE decision to the 26 July meeting. This would have allowed the ECB to reassess the situation on the basis of additional data releases, including two PMI reports.

This week’s speech by the ECB’s chief economist, Peter Praet, was a game changer as far as the timing of the QE decision is concerned, but not its substance. Praet said that the ECB’s Governing Council (GC) will have to make an assessment “next week” on whether progress has been sufficient to warrant a gradual unwinding of net asset purchases. The view of the ECB’s chief economist, who presents the macroeconomic outlook to GC, carries significant weight, so the tapering debate will be held next week and an announcement is now likely immediately thereafter.

But, there will be a trick, in our view. Recent data on business activity have not been strong enough to rule out further disappointment on the growth outlook – a risk that the ECB would find difficult to respond to. We think a ‘flexible tapering’ announcement is more likely than an unconditional commitment to an end date for QE. The ECB could say that there will be “no further large expansion of asset purchases” (since inflation criteria have been met on a forward-looking basis) barring an unwarranted tightening of financial conditions. The modalities of QE tapering could be decided in July.

Moreover, a short QE tapering could be made conditional on investors not bringing forward the timing of the first rate hike to H1 2019. Mario Draghi could do so by referring to the forward Euribor rates underpinning the staff projections, or to current market expectations. A more dovish option would be for the ECB to commit to reassessing the situation by September.

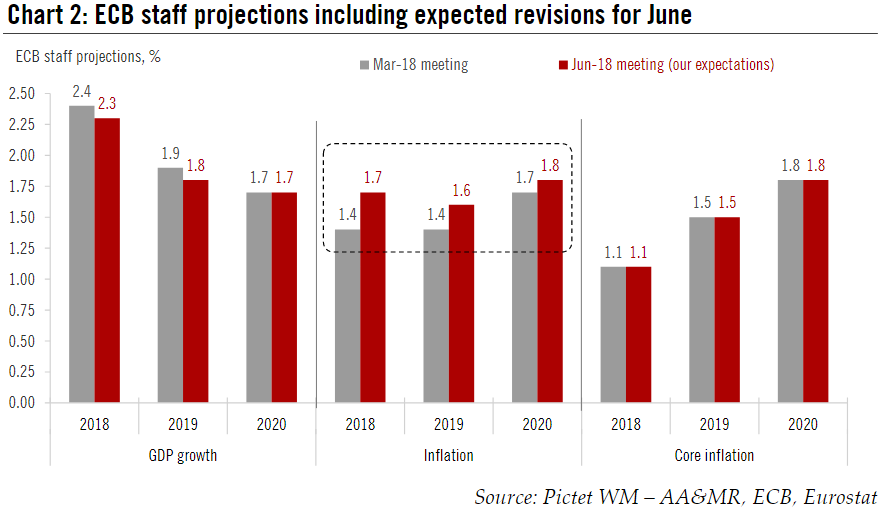

Either way, staff projections are expected to show headline inflation edging closer to the 2% target over the medium term, with upward revisions led by higher oil prices, a gradual adjustment to core inflation, and stronger wage growth. Small downward revisions to GDP growth are likely to be downplayed for now as the ECB looks through the clouds and the downside risks to global trade.

Why the rush?

The timing of Peter Praet’s comments did surprise us (and the market), if only because he has been erring on the cautious side for years, being at the heart of the ECB’s 3P strategy (“Patience, Persistence, Prudence”).

True, Praet said in recent speeches that upcoming activity data remained consistent with a “hawkish moderation” in the growth outlook, partly due to capacity constraints that could eventually generate more inflation. But he has also sounded concerned over developments in the US and China, among other risks, and our impression was that he was in favour of buying more time before a final decision was made on QE. So what happened?

It could be that for all our bullishness on the near-term inflation outlook, we underestimated the ECB’s confidence. The most recent releases for euro area core inflation and wage growth, which investors have overlooked, were in line, if not slightly stronger than what the ECB expected. It could be that the ECB wants to be done as soon as possible with QE, a deflation-fighting tool of the past that is getting closer to its political and technical limits. It could be that political developments in Italy have strengthened this argument, especially after this week’s communication spat over the reduction in the ECB’s BTP purchases. QE never was, and never will be, an appropriate answer to political uncertainly. It could be a combination of all of the above.

Does it really matter? Only to the extent that the timing of the QE decision reveals a change in the ECB’s reaction function. We doubt this is the case. Our scenario remains unchanged beyond the summer. We expect net asset purchases to end in December 2018 and the ECB’s deposit rate to be raised by 15bp in September 2019 (see “ECB: contingency plans”, 24 May 2018).

How to retain some degree of flexibility?

There are several moving parts in any recalibration of the ECB’s monetary stance. Whether the Governing Council commits to an end-date for its asset-purchase programme is a binary decision, but other elements are much more subjective and potentially open to interpretation, depending on the strength of the ECB’s commitment.

We suspect that the GC will be willing to avoid the two extremes of unconditional commitment to an end date for QE and no commitment at all. At a minimum, we expect the ECB to note that its criteria for a so-called Sustained Adjustment in the Path of Inflation (SAPI) have been met on a forward-looking basis, therefore ruling out a “further large expansion” of QE. A possible wording of the ECB’s statement could thus be that “the Governing Council intends to unwind net asset purchases, currently running at the monthly pace of €30 billion, over a short period of time after September 2018, with the aim of contributing to an appropriate monetary stance.” In that case, the actual end date would be decided in July, or in September at the latest.

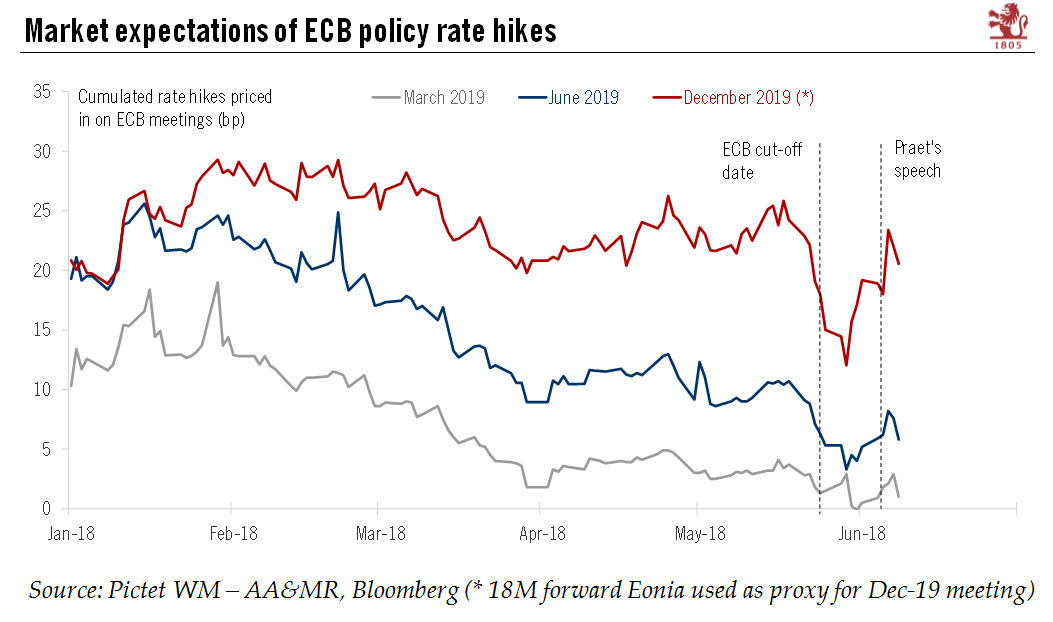

In the event that a fixed end date is communicated at the 14 June meeting then the ECB is likely to also announce some dovish sweeteners and/or to retain some degree of policy optionality, if only implicitly. Our favourite option sees the ECB linking its final decision to broad financial conditions, including market expectations of future rate hikes. The latter will be embedded in the staff projections via forward Euribor rates calculated over the two-week period ending on 22 May (our expectation for the cut-off date). Notwithstanding the recent re-pricing, market expectations have been broadly consistent with a first rate hike in Q3 2019, in line with our scenario, although we continue to expect a cumulated tightening of 40bp by the end of 2019, i.e. slightly more than priced in.

| By referring to forward rates, Mario Draghi could thus hint that the final tapering decision (including the size and length of the final extension) is conditional on market participants not bringing forward the timing of the first rate hike. Alternatively, he could explicitly endorse current market pricing of a delayed lift-off.

The option leaving maximum flexibility, with the ECB reassessing the situation over the next few months (‘full optionality’) , would probably not be agreed by the haws while complicating Draghi ’s task next week. Meanwhile, we expect no change to the ECB’s forward guidance on rates, with its statement reiterating that policy rates are expected “to remain at their present levels for an extended period of time, and well past the horizon of the net asset purchases”. The ECB is also likely to repeat that “an ample degree of monetary stimulus remains necessary” for inflation to rise towards the target over the medium term. We still believe that a strengthening of forward guidance on policy rates, or a maturity extension of QE reinvestments aimed at compressing the term premium could be part of the toolkit eventually, but such changes are more likely to come at a later stage, if at all. An announcement on quantitative easing is looking likely as early as next week. But the jury is out on what the central bank will actually say. |

ECB Policy Rate, Jan 2018 - June 2018(see more posts on ECB policy, ) |

Focus on headline inflationin the staff projectionsThe new staff projections will be important as usual, especially as the June exercise will be produced jointly by national central banks and ECB staff members. Among other things, it will be interesting to see to what extent the new Bundesbank projections for German GDP growth (lower), inflation and wage growth (higher) will feed into the euro area numbers. All in all, we expect the staff projections to be revised lower in terms of GDP growth, albeit not dramatically so, but higher in terms of headline inflation, with higher oil prices in euro terms translating into a 20bp net boost to HICP inflation over two years. Headline inflation that is rising towards 1.8% by 2020 would provide the GC with the necessary ammunition to make a tapering announcement, however flexible. We expect projections for core inflation to remain broadly unchanged: weaker economic growth in itself would put the 2020 core HICP median projection of 1.8% at risk, but any downward revision would complicate the ECB’s communication even more. |

ECB Staff Projections |

Peter Praet’s hawkish comments on inflation this week did not surprise us in terms of substance but did in terms of timing. The view of the (usually dovish) ECB chief economist carries significant weight, and therefore an announcement on QE is now likely at the 14 June meeting.

We expect the staff projections to be revised lower in terms of GDP growth, albeit not dramatically so, but higher in terms of headline inflation, thanks to oil. Headline inflation that is rising towards 1.8% by 2020 would provide the Governing Council with the necessary ammunition to make a tapering announcement.

However, it remains to be seen how far the ECB will go. We do not expect an iron-clad commitment to end QE in December but a ‘flexible tapering’ announcement based on a positive assessment of inflation criteria. We think the ECB is more likely to either introduce conditionality (based on rate hike expectations), or to retain some degree of optionality (by announcing that the modalities of tapering will be unveiled at a later stage).

Timing is not everything. Regardless of the June vs. July communication trade-off, our scenario remains unchanged beyond the summer. We expect net asset purchases to end in December 2018 and the ECB’s deposit rate to be raised by 15bp in September 2019.

Full story here Are you the author? Previous post See more for Next postTags: ECB policy,Macroview,newslettersent