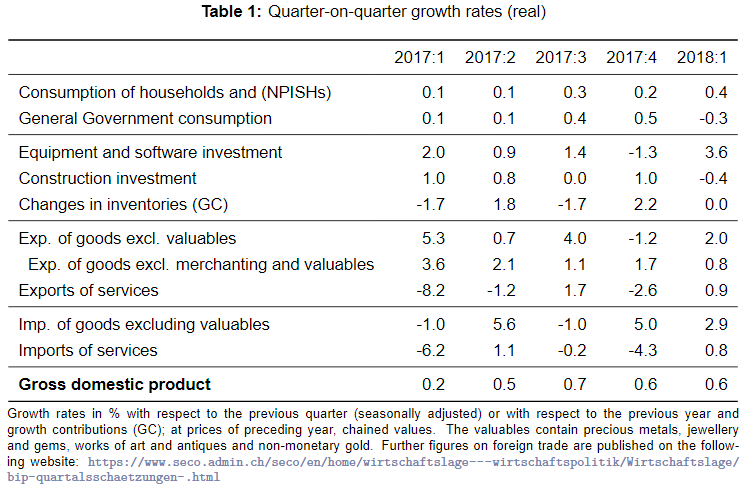

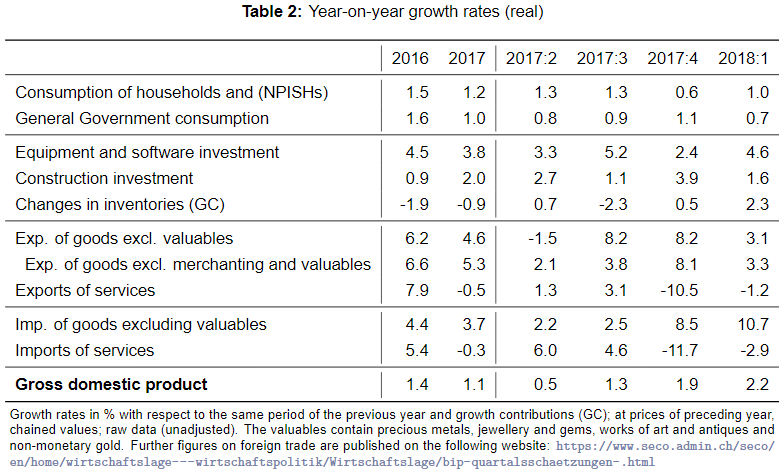

Switzerland’s real gross domestic product (GDP) grew by 0.6% in the 1st quarter of 2018.* Although growth lost some momentum in comparison to the second half of 2017, it was nevertheless broad-based across the various business sectors. The secondary sector expanded modestly, while growth in several service sectors accelerated, including in trade and business-related services. The entertainment industry recorded strong growth thanks to major international sporting events. On the expenditure side of GDP, growth was underpinned by consumption and investment in equipment, accompanied by a considerable increase in imports and a slightly negative growth contribution of foreign trade.

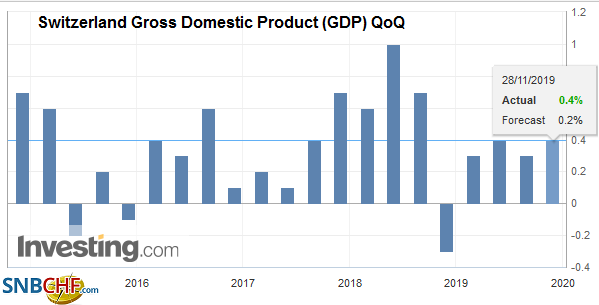

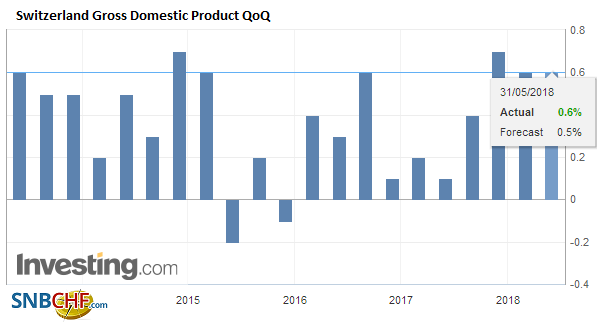

| Switzerland’s GDP grew by 0.6% in the 1st quarter of 2018, almost keeping up with the pace of the previous quarter. Compared to the second semester of 2017, GDP growth lost some momentum, it was nevertheless broad-based on the production side of GDP. |

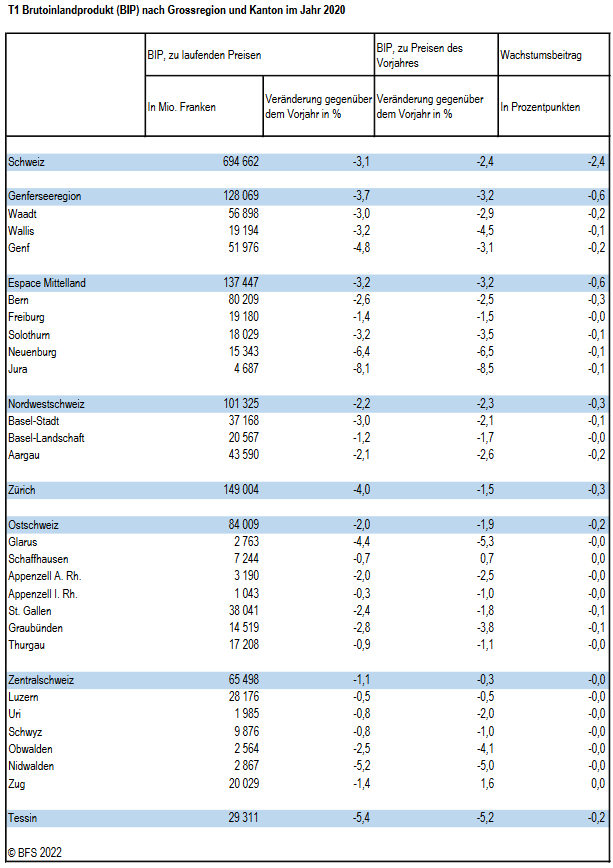

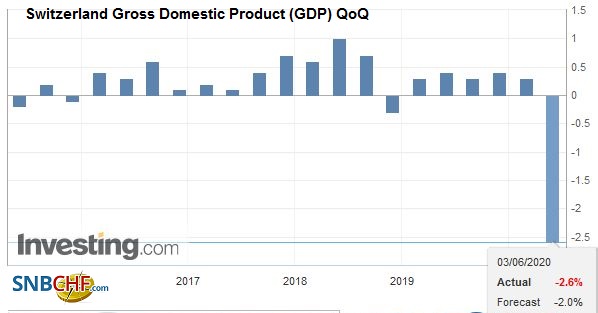

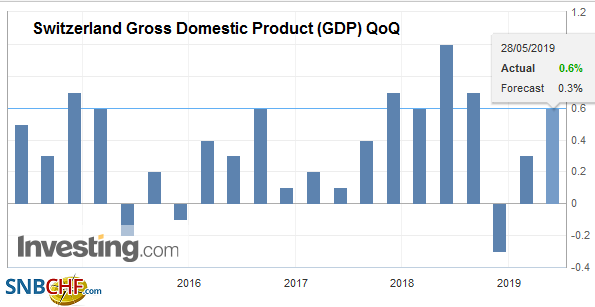

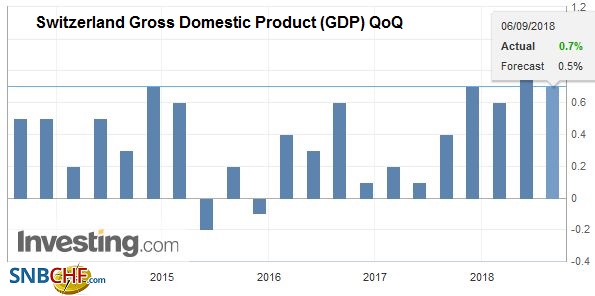

Switzerland Gross Domestic Product (GDP) QoQ, Q1 2018(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| On the expenditure side of GDP, growth was underpinned by final domestic demand in the 1st quarter. |

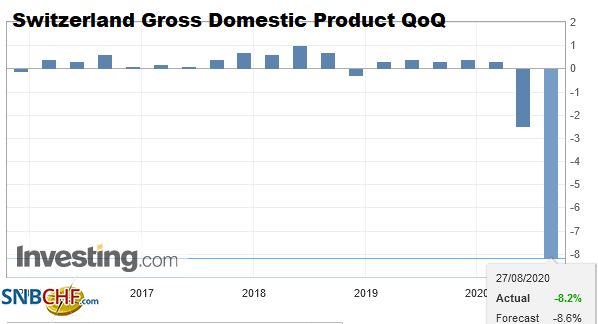

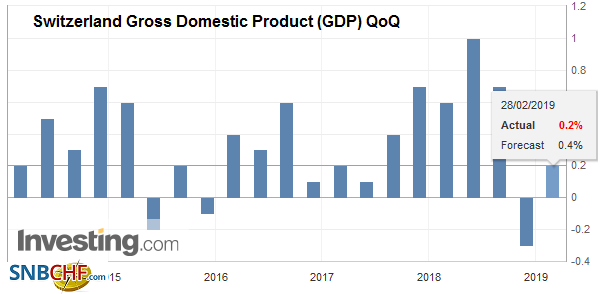

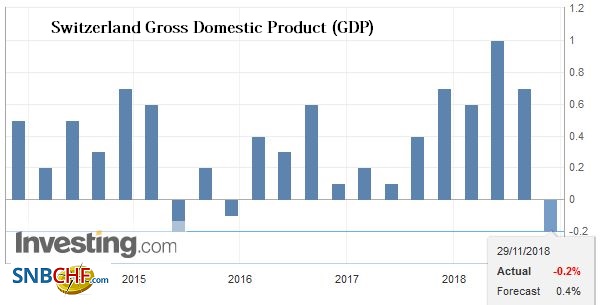

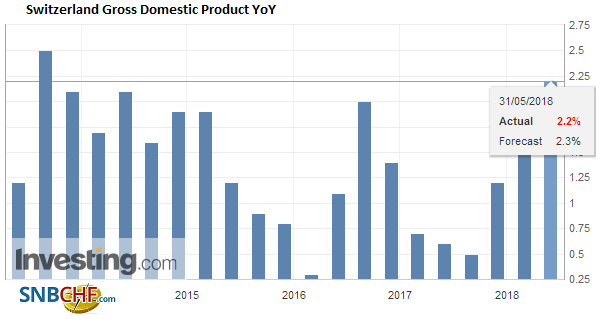

Switzerland Gross Domestic Product (GDP) YoY, Q1 2018(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

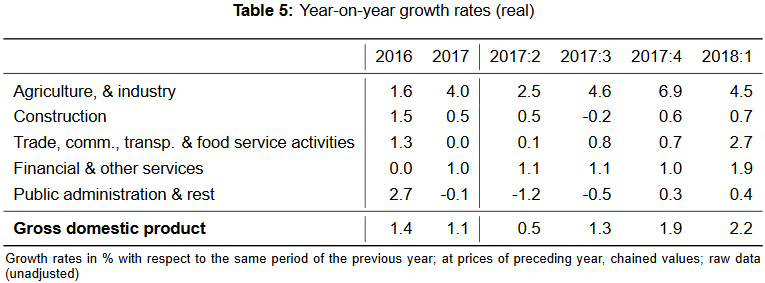

Production SideManufacturing (+0.2%) grew modestly after a few very strong quarters, while construction continued on its path of consolidation ( 0.0%). Economic growth was driven in particular by the service sector, where value added picked up in almost every sector. After a weaker previous quarter, trade (+0.8%) showed renewed signs of a modest recovery. Also the financial sector (+1.0%) continued its recovery. In some sectors, including transport and communications (+1.3%), healthcare (+1.2%) and business-related sectors (+0.5%), growth gathered pace in comparison to the previous quarter. There was also a surge in the entertainment industry (+7.3%), largely the result of various major international sporting events being held this year. By contrast, public administration recorded a significant fall ( 0.2%). |

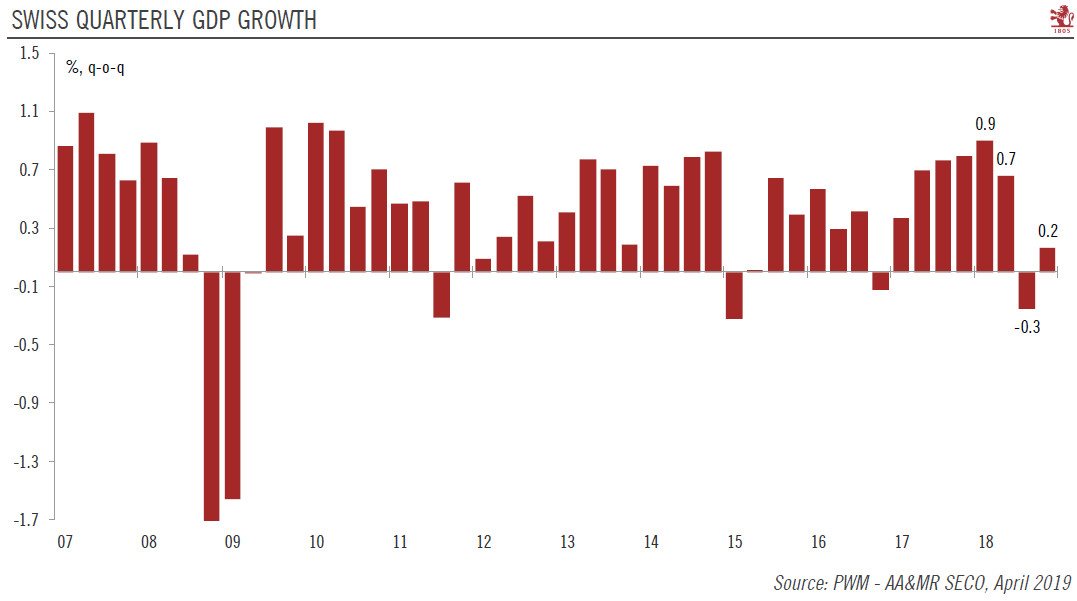

GDP YoY Growth Source: GDP-QNA - Click to enlarge |

GDP GrowthOn the expenditure side of GDP, growth was underpinned by final domestic demand in the 1st quarter. Private consumption (+0.4%) expanded in line with its long-term average. The increase in consumer expenditure was fairly broad-based, with rises in spending not just on healthcare and food but on mobility as well, for example. Investment in equipment (+3.6%) also enjoyed robust and broad-based growth, with the greatest momentum coming from investment in research and development, vehicles and IT. Conversely, investment in construction ( 0.4%) and government consumption ( 0.3%) declined. |

Quarter on Quarter Growth Rates ESVG, Q1 2018 Source: GDP-QNA - Click to enlarge |

ExportsIn the 1st quarter, the contribution of foreign trade in goods** and services to GDP growth was slightly negative. In accordance with the accelerating final domestic demand, imports of goods** (+2.9%) once again recorded above-average growth following a very strong previous quarter. Imports of chemical and pharmaceutical products, vehicles and machinery boosted growth in particular. Imports of services (+0.8%) expanded modestly after two negative quarters, thanks to a renewed increase in the licences and patents segment. Licences and patents were also the main contributing segment behind the upturn in exports of services (+0.9%), which was roughly in line with the long-term average. Exports of goods** (+2.0%) enjoyed robust growth, underpinned in particular by merchanting and exports of precision instruments, watches and jewellery. In addition, the positive development in machinery and metals also continued. |

Year on Year Growth Rates ESVG Source: GDP-QNA - Click to enlarge |

The impact of major sporting events

GDP is the decisive factor in evaluating the macroeconomic situation in a country. In accordance with the applicable regulations (ESA 2010), Swiss GDP also encompasses the value added from Switzerland-based organisers of major international sporting events. The regular cycle of these events is reflected in their value added and thus in GDP, which can complicate the interpretation of business cycle developments. For this reason, on top of the existing data, SECO is now publishing additional time series using the production approach for GDP, whereby the impact of major sporting events is evened out.*** These time series can be used as an aid to interpreting data for the purposes of business cycle analyses.

Adjusted for sporting events, the Swiss economy grew by 0.4% in the 1st quarter of 2018. Even after this adjustment, it is confirmed that, while the economic recovery has slowed, it is increasingly reaching domestically-oriented sectors.

A press briefing will be held at the SECO offices at 36 Holzikofenweg in Bern at 9.30 a.m. on 31 May 2018, where Head of the Economic Policy Directorate Eric Scheidegger will explain and interpret the new time series.

Initial provisional results for 2017

2017 as a whole saw a provisional real GDP growth rate of 1.0%. Growth was still modest at the beginning of the year; specifically, most service sectors – including trade, the healthcare sector and public administration – grew only slightly.3 GDP growth accelerated sharply during the year and was increasingly broad-based across the various sectors, putting the Swiss economy on course for a broad and healthy recovery at the end of the year.

While manufacturing proved the most significant driver of growth for the whole of 2017, the service sectors such as accommodation and food services and financial services also provided a significant boost. On the demand side, GDP growth in 2017 was underpinned by both foreign trade and domestic final demand. Private and government consumption, gross fixed capital formation and exports grew modestly, while imports saw below-average growth.

Download Press Release: Gross domestic product in the 1st quarter of 2018

Full story here

Are you the author?

Previous post

See more for

Next post

Tags: newslettersent,Switzerland Gross Domestic Product