Italian asset markets continue to fare better than many expected. The political uncertainty following the March election has been followed by confidence that the Five Star Movement and the (Northern) League will be able to put together a government in the coming days. If so, Italy would have taken half the time Germany did to cobble a government together after inconclusive elections.

Politics makes for strange bedfellows, the saying goes, and Italy is not an exception. The Five Star Movement campaigned against being in a coalition with any of Italy's political parties, and the center-right campaigned hard against it. Since the election, the Five Star Movement has managed to peel away the League from Berlusconi's Forza Italia. At first, the League resisted and then Berlusconi relented.

Recall that Berlusconi was banned from holding electoral office for past misconduct. He appealed to the European Court of Justice, but before it could rule, the Italian judiciary cut short Berlusconi's prohibition by a year for good behavior. He is allowed to hold office now. However, the support for his party has waned, and the League has consistently outpolled it. Given that the center-left PD has done poorly in the polls, and split between a realos and fundos wing, Forza Italia may be the largest opposition party. Moreover, with a poor track record of finishing a term, Italian politics remain fluid, and Berlusconi remains a force with which to reckon.

It is tough to classify the Five Star Movement. It has toned down the anti-establishment and anti-Europe rhetoric. Perhaps Greece's experience dissuaded it from repeating the same confrontational approach. Its anti-corruption thrust distinguishes it from others. In some ways, it is within the social democrat tradition. The League is not populist, but nationalist and nativist. It is trying to rebrand itself so it is not seen as a party of the wealthier northern Italians. It too has de-escalated its rhetoric regarding ditching the euro or antagonizing the EU.

The M5S and the League economic agenda is the likely flashpoint with the EU. There are three planks. First, and the most costly of the initiatives, is what is being called a flat tax. It is tax simplification to be sure, but it is more progressive than flat. What is being proposed is a 15% tax that is boosted to 20% for households with annual income more than 80k euros (~$96k). The current tax schedule ranges from around 23% to 43%.

The tax initiative comes from the League. The M5S pushed for a universal basic income scheme. However, like the flat tax, what they appear to have in mind is a new transfer payment program that is aimed at the unemployed, but also for those that have been unable to secure a job.

The M5S and the League agree on reversing the increase in the retirement age. This may be the most controversial for the EU to accept. The cut in the tax burden is thought to stimulate growth. Arguably, the lack of growth in Italy has played an under-appreciated role in the sovereign indebtedness and strains on the banking system. A new social program may not sit well with the EU, but this too can bolster aggregate demand. Pushing the retirement age lower could ostensibly encourage more participation by younger cohorts, but there may be other more efficient ways, and it goes against the adjustments being made among high-income countries.

Of course, the M5S and the League play down the costs of their program, but private sector estimates put it at the upper end of the 65-100 bln euro range, according to the local press. It is not clear if there will be an offset or a way to enhance revenue. Stronger growth can help but is unlikely to be sufficient, even using some dynamic accounting. There is also a little flexibility given that its budget deficit has been gradually falling. The last time it was above 3% of GDP, the mandate in the Stability and Growth Pact was 2011. Before the election, many economists had anticipated a deficit this year below 2%.

Full story here

Are you the author?

Previous post

See more for

Next post

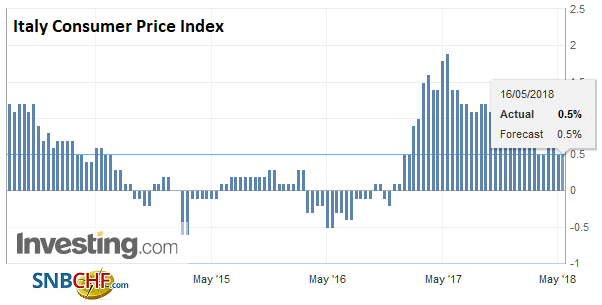

Tags: $EUR,Italy,Italy Consumer Price Index,newslettersent,Politics

Home › 4) FX Trends › 4.) Marc to Market › Italy Defies Gravity and Risk to Fiscal Rectitude

Permanent link to this article: https://snbchf.com/2018/05/chandler-italy-defies-gravity-risk-fiscal-rectitude/

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

2026-01-21 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

8 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Physical Gold vs ETFs: Ownership, Risk and Liquidity Compared

-

Meine Top Favoriten: Edelmetalle für 2026! #thorstenwittmann #edelmetalle #finanzstrategien

-

Wenig Gehalt, trotzdem glücklich?

Wenig Gehalt, trotzdem glücklich? -

Why Silver Shortages Appear Without Spot Price Spikes

-

How to Buy Gold Online Safely

-

unknown

unknown -

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos

Gibt es den Cost-Average-Effect? Saidi zerlegt diesen Finanz-Mythos -

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet!

Eilmeldung: Attentat auf Trump: Täter in Mar-A-Lago getötet! -

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”!

Eilmeldung: Supermarkt Fachkraft für Warenverräumung fleißig bei der “Arbeit”! -

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

Die Performance der Kryptowährungen in KW 8: Das hat sich bei Bitcoin, Ether & Co. getan

More from this category

- Martin Armstrong: Empires always fail

11 Feb 2026

- General Kujat: War, Diplomacy, and the Risks of Escalation

4 Feb 2026

Ron Paul: War Is Bipartisan

Ron Paul: War Is Bipartisan26 Jan 2026

- World War III: A film that challenges everything we have been told

17 Jan 2026

- Inflation as a moral hazard

19 Dec 2025

- Korruption & Machtmissbrauch – Die dunkle Seite der Politik!

11 Dec 2025

- Bastiat’s enduring legacy

17 Oct 2025

- A conversation with Catherine Austin Fitts

10 Oct 2025

- Investing in times of policy volatility

29 Aug 2025

- Storing gold in the right place and in the right way

30 Jul 2025

- Geopolitical theater and implications for investors (or lack thereof)

11 Jul 2025

- Swiss public opinion on nuclear energy is shifting

20 Jun 2025

- A Politically Incorrect “Where Are We Now?”

9 Jun 2025

- The Great Taking!

29 May 2025

- The Reece Committee: Lessons from history

29 Apr 2025

The Swiss houses that must be demolished

The Swiss houses that must be demolished7 Mar 2025

- The Case Against Fordism

5 Mar 2025

- The Case Against Fordism

5 Mar 2025

- “Does The West Have Any Hope? What Can We All Do?”

24 Feb 2025

- “Does The West Have Any Hope? What Can We All Do?”

24 Feb 2025