Summary

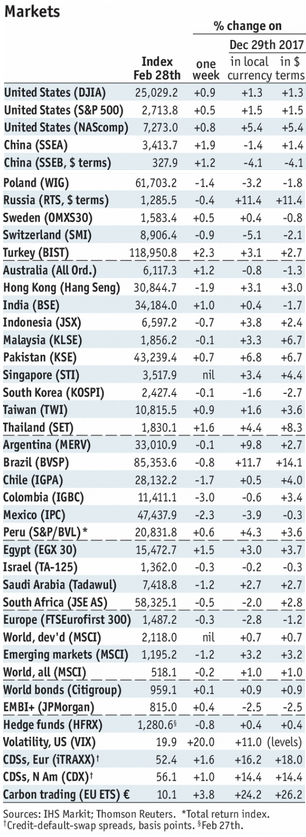

Stock MarketsIn the EM equity space as measured by MSCI, Thailand (+1.0%), Hong Kong (+0.5%), and the Philippines (-0.1%) have outperformed this week, while Colombia (-6.0%), Qatar (-6.0%), and Chile (-5.7%) have underperformed. To put this in better context, MSCI EM fell -3.1% this week while MSCI DM fell -3.0%. In the EM local currency bond space, Poland (10-year yield -16 bp), Brazil (-15 bp), and Hong Kong (-12 bp) have outperformed this week, while Colombia (10-year yield +43 bp), South Africa (+16 bp), and Hungary (+14 bp) have underperformed. To put this in better context, the 10-year UST yield fell 7 bp to 2.85%. In the EM FX space, ILS (+1.2% vs. USD), MYR (+0.4% vs. USD), and EGP (+0.3% vs. USD) have outperformed this week, while ZAR (-3.8% vs. USD), RUB (-1.9% vs. USD), and MXN (-1.8% vs. USD) have underperformed. To put this in better context, MSCI EM FX fell -0.6% this week. |

Stock Markets Emerging Markets, March 03 Source: economist.com - Click to enlarge |

IndonesiaBank Indonesia Deputy Governor Perry Warjiyo was nominated by President Widodo to be the next Governor. Current Governor Martowardojo’s five-year term ends in May. Warjiyo will be confirmed by parliament as early as next month. KoreaBank of Korea Governor Lee was reappointed by President Moon for a second term. Lee’s first 4-years term ends March 31. This makes him the first governor to serve a second term since the 1970s, and is noteworthy since Lee was first appointed by previous President Park. HungaryHungary ruling party candidate lost the mayoral vote in Hodmezovasarhely. Independent candidate Peter Marki-Zay got 58% of the vote vs. 42% for Fidesz’s Zoltan Hegedus. The fractured opposition was able to field a unified candidate and comes just before general elections next month. Fidesz is polling 51% support among decided voters, while the nationalist Jobbik party has 17% and the Socialists 13%. RussiaS&P upgraded Russia to BBB- with stable outlook. Our own ratings model showed Russia’s implied rating steady at BBB-/Baa3/BBB-. As noted last month, “S&P’s and Moody’s ratings of BB+ and Ba1, respectively, appear to still have some upgrade potential. Fitch’s investment grade BBB- rating now seems to be correct.” South AfricaSouth Africa President Ramaphosa shuffled his cabinet. As expected, Gigaba was moved back to Home Affairs from Finance and was replaced by former Finance Minister Nene. Former Finance Minister Gordhan was named Public Enterprises Minister. Those that were axed include Mineral Resources Minister Zwane, Cooperative Governance Minister van Rooyen, and Public Service Minister Muthambi. Ramaphosa said this cabinet is “transitional” and may get another chance to reshape it when the government finishes a study on whether to cut the size of the cabinet, now at 35. South Africa lawmakers have agreed to the principle of land seizures without compensation. Parliament’s Constitutional Review Committee must now report back to lawmakers on the necessary changes to the constitution by August 30. President Ramaphosa said land seizures would only be carried out in a way that doesn’t harm the economy or agricultural output. PeruPeru President Kuczynski is under renewed pressure. Former Odebrecht representative Jorge Barata said under questioning by Brazilian prosecutors that his company had financed the electoral campaigns of Kuczynski and three of his predecessors. Barata said Odebrecht donated millions of dollars to the campaigns of at least six Peru politicians between 2006-2013, including opposition leader Keiko Fujimori. |

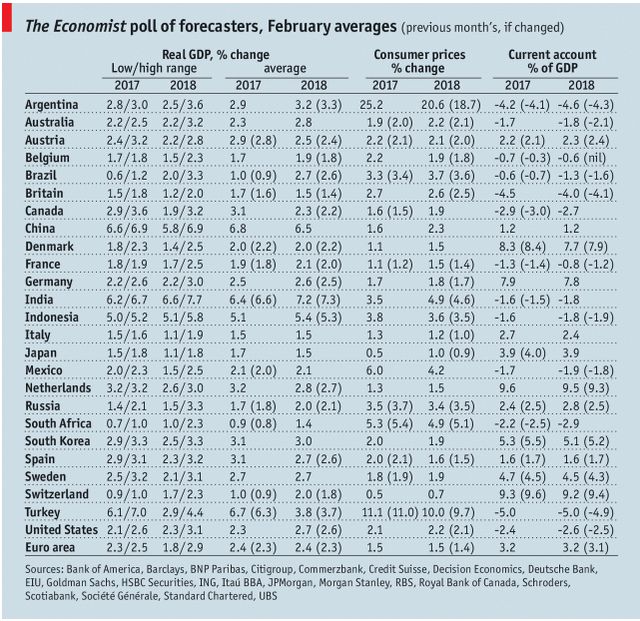

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Hungary,Indonesia,Korea,newslettersent,Peru,Russia,South Africa,win-thin