Switzerland’s real gross domestic product (GDP) grew by an above-average 0.6% in the 4th quarter of 2017.1 Growth was broad-based across the various business sectors, with manufacturing, construction and most service sectors, particularly financial services, providing momentum. On the expenditure side, growth was underpinned by consumption and investment in construction but was hindered by investment in equipment and foreign trade. 2017 as a whole saw a real GDP growth rate of 1.0%. After a sluggish start to the year, the economic recovery became more broad-based and gained momentum in the second half of the year.

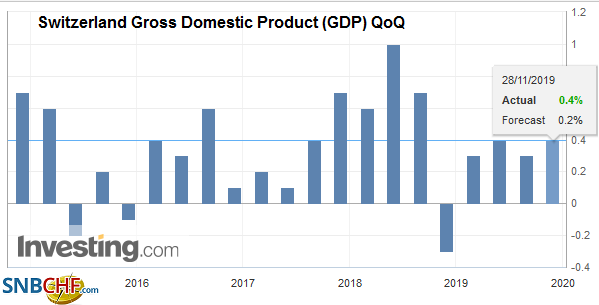

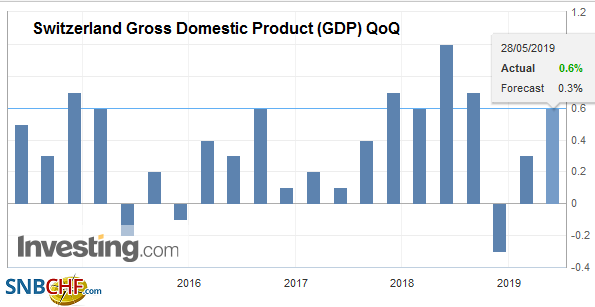

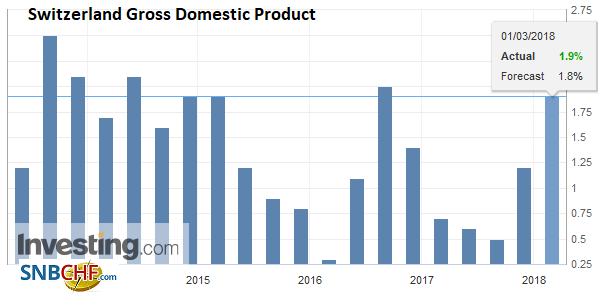

| Switzerland’s GDP grew by 0.6% in the 4th quarter of 2017. After a (revised) rate of 0.7% in the previous quarter, for the second time in a row the quarter-on-quarter growth resulted notably above-average. |

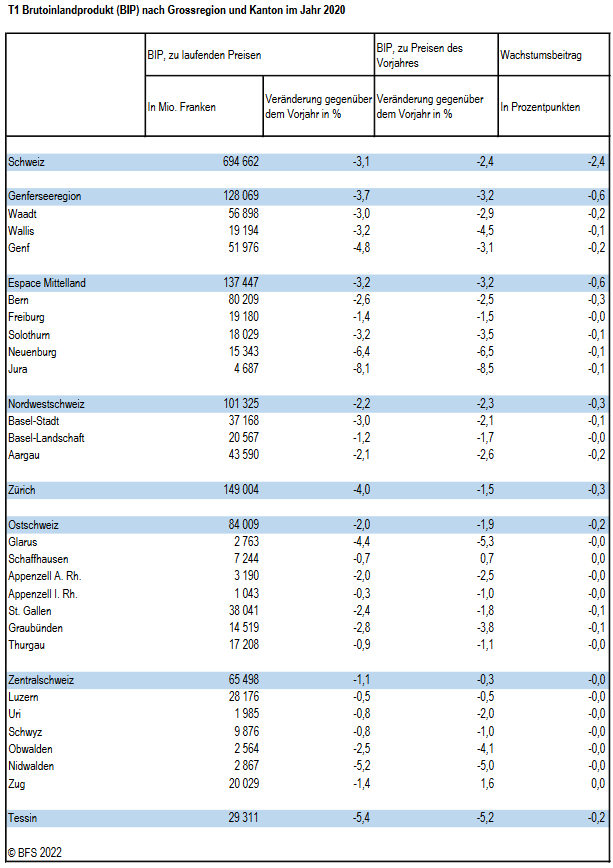

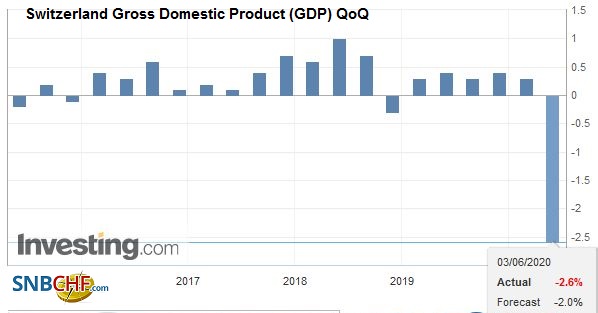

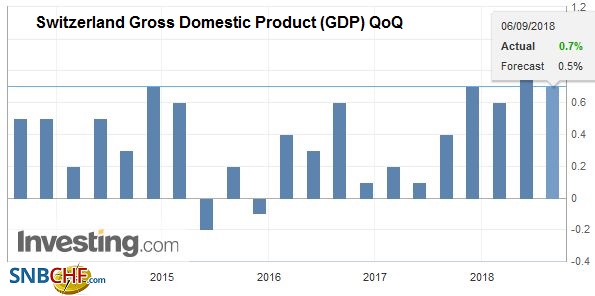

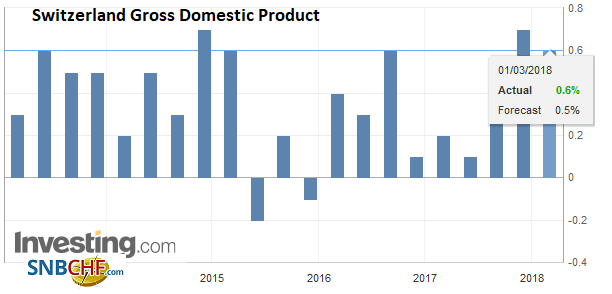

Switzerland Gross Domestic Product (GDP) YoY, Q4 2017(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| On the production side of GDP, growth was broad-based and almost equally driven by the industry and service sectors. |

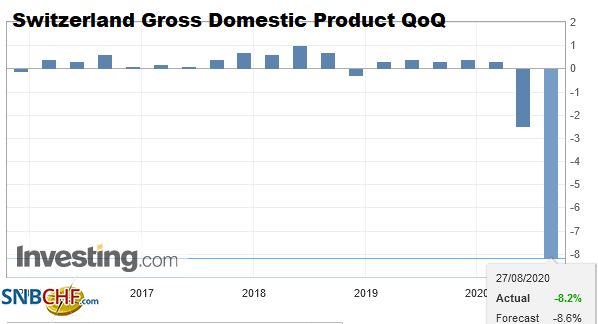

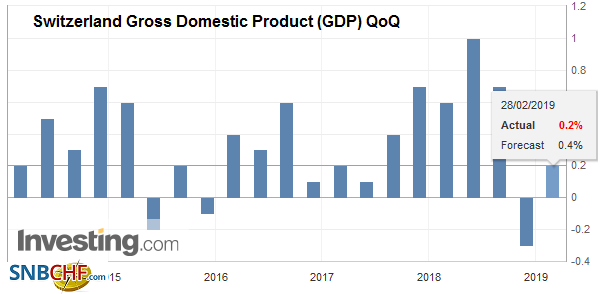

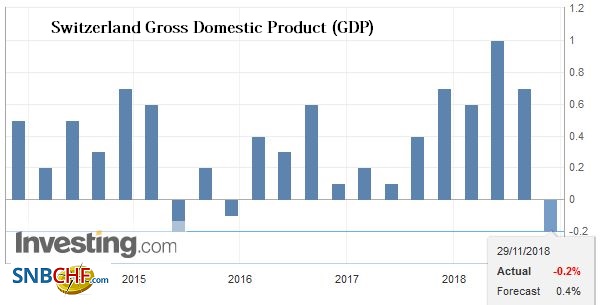

Switzerland Gross Domestic Product (GDP) QoQ, Q4 2017(see more posts on Switzerland Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

Production SideManufacturing once again proved the most substantial boost to growth. Although at +1.2% it did not quite match its strong performance of the previous quarter, the sector continued to grow dynamically. After three slightly negative quarters, construction achieved above-average growth of 1.4%. The energy sector was the only industry sector to deliver a negative quarterly result (-2.8%). Value added also contracted slightly (-0.1%) in the trade sector, while most other service sectors expanded. After a slight drop in the previous quarter, financial services rallied particularly well (+2.3%). Accommodation and food services (+1.6%), the transport and communications sector (+0.7%), public administration (+0.5%) and healthcare (+0.4%) all picked up considerably too. Business services, on the other hand, stagnated (+0.0%). |

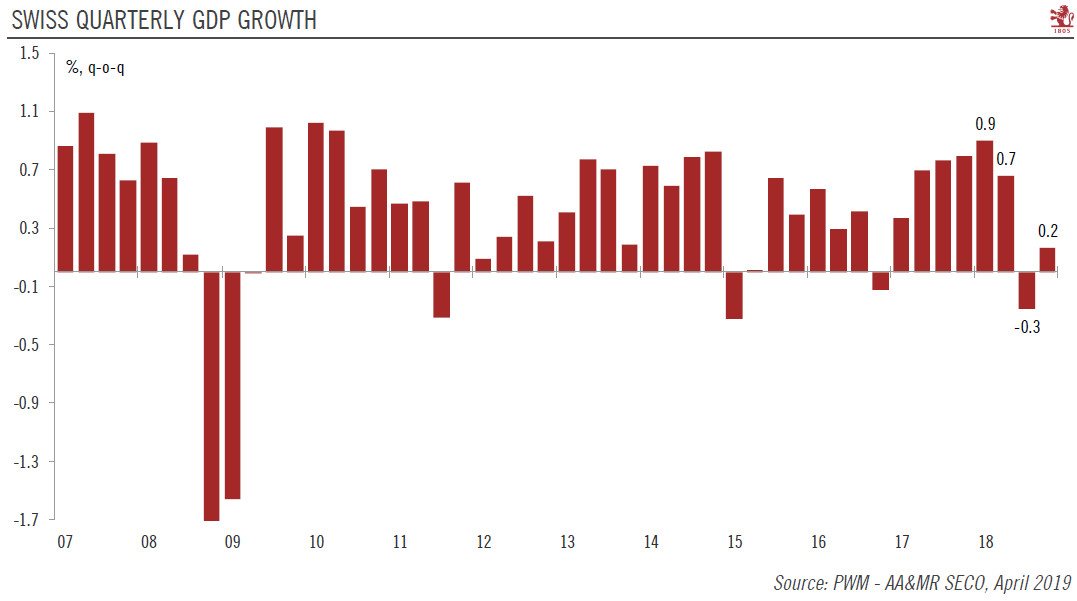

GDP YoY Growth Source: GDP-QNA - Click to enlarge |

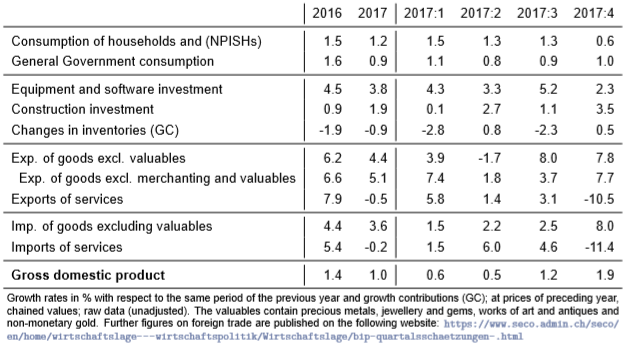

GDP GrowthOn the expenditure side of GDP, domestic final demand supported growth. Private consumption expanded moderately (+0.2%), underpinned in particular by healthcare, housing and energy as well as hotel and restaurant services. Government consumption grew in line with its long-term average (+0.5%). Investment in construction accelerated considerably to 1.1% after a weaker previous quarter. At -1.3%, investment in equipment recorded its first negative quarterly result for almost three years. However, this is largely due to a steep decline in the volatile research and development segment. By contrast, investment in vehicles and IT was stepped up. |

Quarter on Quarter Growth Rates ESVG, Q4 2017 Source: GDP-QNA - Click to enlarge |

ExportsForeign trade in goods2 and services hampered GDP growth in the 4th quarter. Exports in goods2 fell (-1.4%), albeit after a very strong previous quarter. Among other things, merchanting and energy exports dipped, while exports of chemical and pharmaceutical products, machinery and metals continued the positive trend of the previous quarters. Exports of services also dropped (-2.7%), largely driven by the licences and patents segment. Imports of services (-5.1%) also declined, for instance in the area of business and consultancy services. Imports of goods2 rose sharply (+4.4%), particularly in the vehicles, machinery and metals segments. |

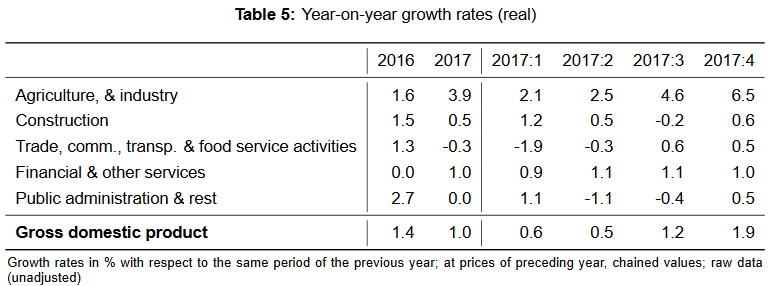

Year on Year Growth Rates ESVG Source: GDP-QNA - Click to enlarge |

Initial provisional results for 2017

2017 as a whole saw a provisional real GDP growth rate of 1.0%. Growth was still modest at the beginning of the year; specifically, most service sectors – including trade, the healthcare sector and public administration – grew only slightly.3 GDP growth accelerated sharply during the year and was increasingly broad-based across the various sectors, putting the Swiss economy on course for a broad and healthy recovery at the end of the year.

While manufacturing proved the most significant driver of growth for the whole of 2017, the service sectors such as accommodation and food services and financial services also provided a significant boost. On the demand side, GDP growth in 2017 was underpinned by both foreign trade and domestic final demand. Private and government consumption, gross fixed capital formation and exports grew modestly, while imports saw below-average growth.

Full story here Are you the author? Previous post See more for Next postTags: newslettersent,Switzerland Gross Domestic Product