Much of recent ECB dovish rhetoric has been building around the (not-sonew) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good reasons.

We expect the ‘higher potential’ rhetoric to fuel the ECB’s cautious stance in the early stages of the normalisation process. But, this line of reasoning is not without drawbacks. First, insofar as it implies a shift from more pessimistic views of the supply-side, the argument might suffer from a confirmation bias. Second, it is not fully consistent with another explanation for subdued inflation that the ECB has favoured since last year, namely the broad unemployment hypothesis (larger slack, but for bad reasons). Third, higher potential growth would be consistent with a higher terminal rate, implying a more hawkish outcome eventually.

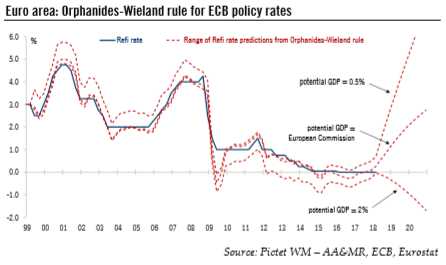

| Either way, potential growth cannot and should not be used for policy decision in real time because the output gap is hardly observable and subject to massive ex post revisions. The chart below shows the projections for ECB policy rates using a (admittedly arbitrary) policy rule based on various estimates of potential growth. In two extreme cases, the Orphanides-Wieland rule would be consistent with the ECB cutting rates further, or raising them to around 5% by 2020. We can easily posit that the reality lies somewhere in between, but potential growth is too flimsy for the ECB to be conclusive. |

Euro Area: Orphanides-Wieland Rule for ECB Policy Rates, 1999 - 2018 |

Tags: Macroview,newslettersent