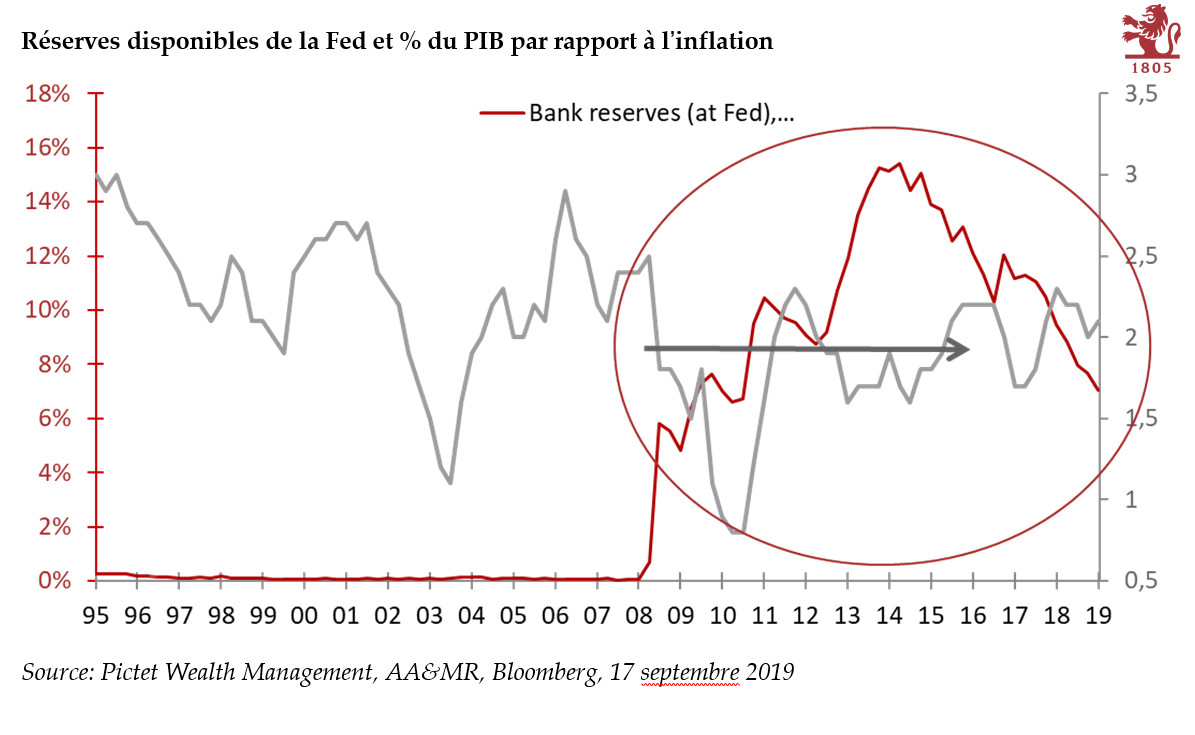

Market participants have enjoyed a protracted period of very low volatility, but it may well have come to an end in 2018. Central banks are often said to be responsible for the disappearance of volatility, for example through their large-scale asset purchases, which have compressed the term premium. But, now that the same central banks are heading for the exit from unconventional policies, they, too, need to relearn how to live with volatility. Frequent volatility spikes could well be the price to pay for monetary normalisation.

The ECB is unlikely to deviate from its (patient, persistent, prudent) normalisation strategy just because of a temporary correction in risk assets. Economic momentum looks stronger than ever, and the current low-inflation regime is expected to be temporary – whatever the appropriate measure of economic slack, it is diminishing at a very rapid pace, and this should ultimately generate inflationary pressure. Although euro area core inflation remains low at around 1%, the ECB’s confidence in the projected upward adjustment in wage growth and inflation is likely to have increased.

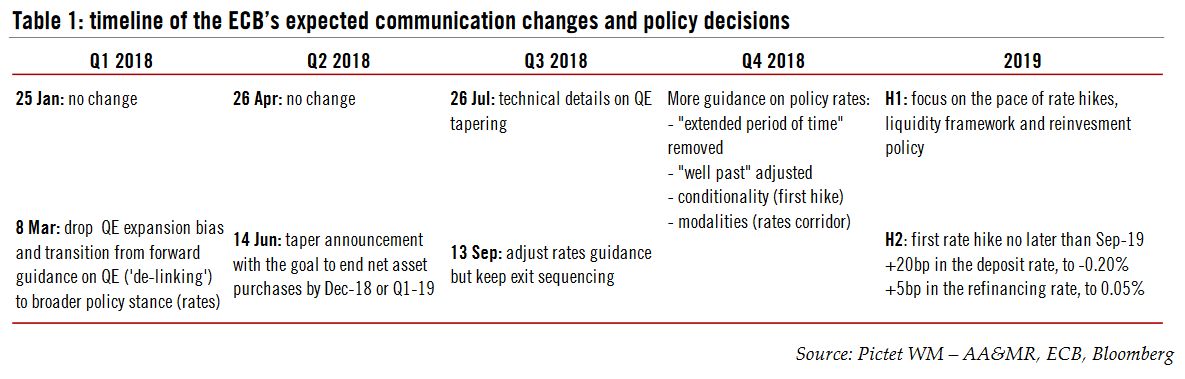

| We still believe that the ECB’s QE expansion bias should be removed in March (its commitment to increase asset purchases “in terms of size and/or duration”, if needed), along with the first incremental steps towards a forward guidance based on the broader monetary stance, including policy rates (“de-linking” and “rotating”). The risk is that those small steps are further delayed as ECB members fear an unwarranted tightening in financial conditions. Still, from a tactical perspective at least, it also makes sense for the ECB to move forward ahead of the Fed meeting on 21 March. |

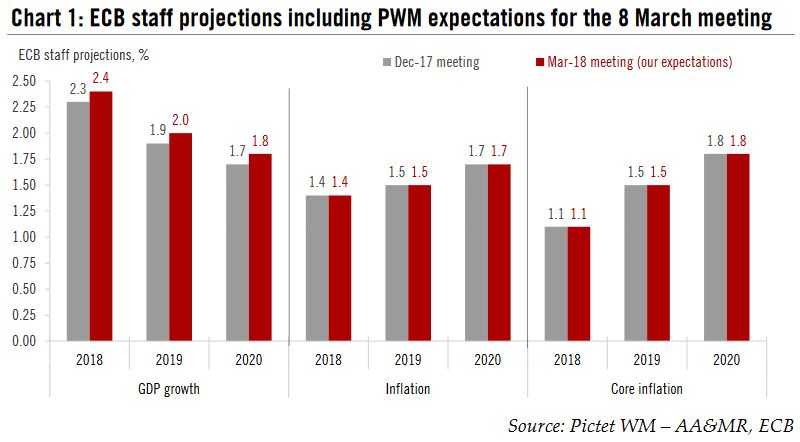

ECB Staff Projections Including PWM Expectations for the 8 March meeting, 2018 - 2020 |

One Direction (and a few bumps)

Recent press reports suggest that even small communication changes could indeed be delayed until the 26 April meeting, if not later, including the removal of the QE expansion bias and the de-linking of net asset purchases from the inflation outlook (hence the potential for a modest hawkish surprise, in our view). Mario Draghi’s hearing in the European parliament earlier this week was consistent with the ECB rotating towards a communication based on “the full set of monetary policy measures” including net asset purchases, reinvestments, policy rates and forward guidance. Moreover, “some members” of the ECB’s Governing Council wanted to drop the QE easing bias in January, according to the accounts of the last meeting.

Looking ahead, the more important decisions are likely to be made in June or in July, including the announcement of a tapering of asset purchases. In a recent speech, ECB Executive Board member Benoît Coeuré made a strong case for a smooth end to ECB QE, “without risking an unwarranted decompression in the term premium”, given that the stock effect of asset purchases is estimated to be amplified by a reduction in the so-called free float of German sovereign bonds1. The ECB will no doubt remain datadependent, but Coeuré’s arguments are likely to bear a large influence over the final decision. We expect asset purchases to be terminated by early 2019, with a risk of a shorter tapering.

| Looking ahead, the more important decisions are likely to be made in June or in July, including the announcement of a tapering of asset purchases. In a recent speech, ECB Executive Board member Benoît Coeuré made a strong case for a smooth end to ECB QE, “without risking an unwarranted decompression in the term premium”, given that the stock effect of asset purchases is estimated to be amplified by a reduction in the so-called free float of German sovereign bonds1. The ECB will no doubt remain datadependent, but Coeuré’s arguments are likely to bear a large influence over the final decision. We expect asset purchases to be terminated by early 2019, with a risk of a shorter tapering.

In all, the direction of travel looks clear barring an exogenous shock. The timing of communication changes and, ultimately, the pace of monetary tightening, will depend on developments in core inflation. |

ECB’s expected communication changes and policy decisions, 2018 - 2019 |

Higher confidence despite stable staff projectionsIn contrast with the tone of the ECB’s statement and press conference, which we expect to be bullish, the ECB staff projections are unlikely to be revised much (see Chart 1). The table blow shows our estimates of the financial inputs to be included in the forecasts, with a cut-off date on the 13 February. Broader financial conditions have tightened since the December meeting, but remain broadly accommodative overall, and some comfortable distance from the ECB’s pain thresholds, in our view. The combination of slightly higher oil prices, food prices and a stronger currency is likely to be neutral in terms of inflation projections. The exchange rate was an obvious source of concerns in the accounts of the January meeting following the comments from US Treasury Steven Mnuchin in Davos. Still, we expect the ECB to stick with the view that the passthrough from a stronger currency has diminished, not the least thanks to stronger domestic fundamentals. Excluding the Venezuelan currency2, we estimate that the trade-weighted EUR was 1.2% stronger than in the December projections. |

Financial inputs to be used in the ECB staff projections, 2018 - 2020 |

Meanwhile, macroeconomic developments have been consistent with the ECB’s positive assessment. Business confidence surveys have moderated in February, albeit from very high levels. If anything, some residual upside risks remain in terms of the ECB staff projections for 2018 GDP. The unemployment profile is likely to be revised lower again. Last but not least, credit data were strong in January, helping a majority of commercial banks to qualify for the lowest TLTRO-II rate (-0.40%), according to our estimates.

Notwithstanding the ECB’s rising confidence, the staff projections for inflation are likely to remain stable in March, taking into account recent HICP prints. At the margin, risks look tilted to the upside for headline inflation and to the downside for core inflation, but we see no compelling case for a revision to the medium-term forecasts.

International Women’s Day

The ECB is also expected to issue a formal opinion on the nomination of Spanish finance minister Luis de Guindos as the next Vice-President, pending a final vote in the European Parliament and confirmation from the EU Council of Heads of State and Governments by the end of March. This opinion is likely to come in the form of a polite-but-passionless endorsement of Guindos. During the press conference, which happens to coincide with International Women’s Day, we would expect journalists to grill President Draghi on the selection process and the gender problem, in particular.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newslettersent