| With less than 30 days to go, the Italian general election remains highly unpredictable. The new electoral system and the fact that 37% of seats are to be allocated on a ‘first-past-the-post’ system make projecting seats from voting intentions particularly hard.

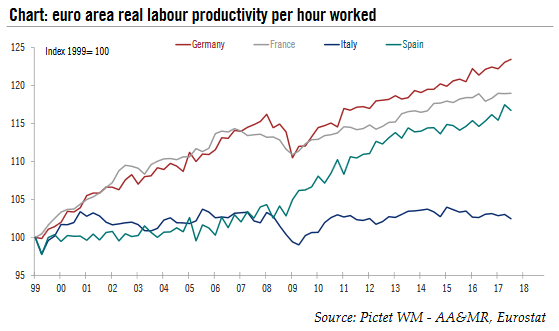

Importantly, Italy is going into this election with an economy that is performing relatively strongly relative to recent history. However, cyclical strength is masking structural weaknesses. Over the past few years, Italy has endeavoured to address certain these weaknesses, but some reforms have not gone as far as necessary. Labour productivity remains a problem : while the other big euro area economies have seen 1% annual average productivity growth since 1999, in Italy productivity has been stagnant (see Chart), a key factor behind the poor performance of potential output over recent years. And a fragmented government will reduce the prospects of reforms to improve things on this front. Among election candidates, there has been not much discussion about labour productivity so far. Increasing pension benefits and unfunded tax cuts are the most popular pledge. Nevertheless, improving long-run potential growth in Italy is key to managing the public debt burden, which is at 134% of GDP (Q3 2017). With interest rates still very low, public debt sustainability risks are likely to be limited in the near term. However, investors are likely to be much less sanguine on the medium-term outlook as monetary and external tailwinds are likely to gradually wane. |

Euro Area Real Labour Productivity, 1999 - 2018 |

Tags: Macroview,newslettersent