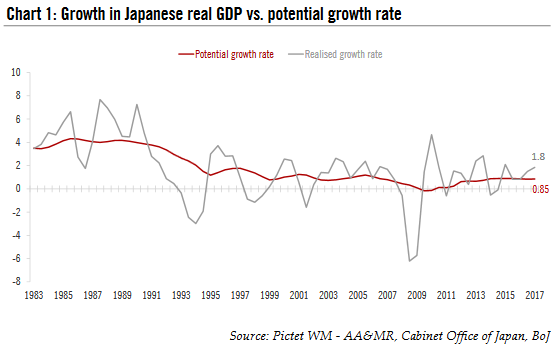

Momentum in the Japanese economy remains strongJapanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 – year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth, which currently stands at 0.85%, according to the Bank of Japan (BoJ, see chart1). |

Japanese Real GDP Growth, 1983 - 2017 |

| The most significant source of growth is exports, mainly through machinery and equipment demand. As the synchronised expansion of the world’s major economies is set to continue, we expect Japanese exporters to extend their stellar performance in 2018.

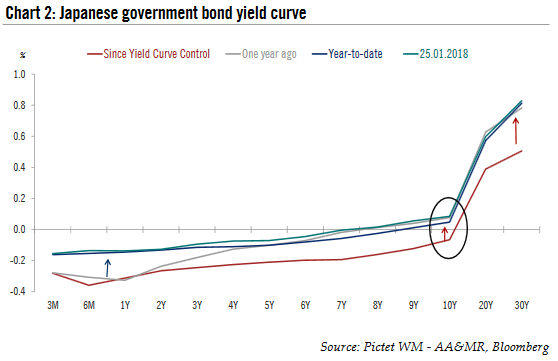

Domestic demand is also picking up. Consumer confidence is at its highest in more than four years. Household living expenditures rose by 1.7% y-o-y in real terms in November 2017, compared to a drop of 1.7% in 2016. Rising consumption has been partly driven by income growth, which is still modest but slowly building up. Bank credit is recovering, especially for corporate loans. On a year-over-year (y-o-y) basis, growth in corporate loans is up over 3% currently, compared to the drop of 4% back in 2011. Capacity constraints are becoming more evident. The unemployment rate had decreased from 5.5% in 2009 to 2.7% by December 2017. However, the acute labour shortage has not led to much wage growth or inflation pressure so far. Both labour and management in Japanese companies tend to prioritise the long-term stability of employment over wage increases. In addition, Japanese companies are increasing their spending on labour-saving technologies to cushion rising labour costs, which has so far enabled many of them to avoid hiking prices for their products. As a result, inflation remains sluggish. The latest core CPI figure for December 2017 showed a y-o-y increase of 0.9%. In 2018, we expect core CPI to rise by 1.0%, which is still way below the BoJ’s target of 2%. In the absence of any significant inflationary pressure in the foreseeable future, we expect the BoJ to keep monetary easing largely intact throughout 2018. In particular, we expect the central bank to maintain its yield curve control (YCC) framework, keeping the 10 – year JGB yield target at around 0% — although the amount of Japanese government bond (JGBs) purchases required to achieve that target has fallen. Japanese 10 – year yield to stay around 0% in 2018The 10-year Japanese government bond yield has been evolving in a tight channel around 0% since the BoJ implemented its YCC programme in late 2016. Nevertheless, Japanese inflation expectations, as measured by the 10-year inflation breakeven yield, have been rising on the back of rising global inflation expectations and core inflation picking up in Japan as well. This rise in inflation expectations should be compensated by falling real yields due to the BoJ’s massive purchases of JGBs. Consequently, over 2018, we do not expect any significant change in the 10 – year JGB yield , which we believe will remain around 0%. The Japanese yield curve has been undergoing a bear steepening, as only longer – maturity sovereign bond yields (> 10 years) move freely. Part of the reason lies in the BoJ’s recent announcement that it intends to reduce its purchases of long – term JGBs, which means that the long end of the curve is likely to rise slightly more than the short (see chart 2). In fact, the BoJ started to taper its bond purchases in late 2016, with the 3 – month moving average JGB purchases by the BoJ moving down from JPY7 trillion per month to JPY5 trillion per month currently. While the central bank has tapered its purchases somewhat, they still represent 80% of the JGBs issued each month. Moreover, the BoJ owns an impressive stock of 45% of JGBs out standing, making it by far the largest owner. In its attempt to achieve tight control over the 10 – year yield, the BoJ has clearly been successful and we expect neither significant change in its policy in 2018 — nor do we expect financial markets to challenge the central bank. |

Japanese Government Bond Yield Curve, Jan 2018 |

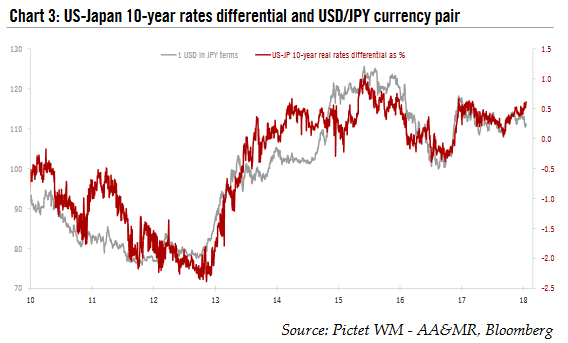

The yen is likely to remain a funding currency in carry tradeThe Japanese yen is a typical example of a funding currency,which must have two major characteristics. First, it has to be highly liquid. Second, the central bank which issues it must offer a very low short – term interest rate. The yen shares both these characteristics. Consequently, funding the purchase of higher – yielding assets by shorting the yen is inexpensive and attractive for a carry trade. Between 1994 and 2008, the yen featured the lowest short – term interest rate of any G10 currency .This has not been the case since 2009, but Japanese short – term rates are still close to zero and the BoJ’s JGBs purchase programme, which started in 2013, as weighed on the yen. Therefore, shorting the yen has remained a rational trade, with the central bank remaining on investors’ side. As a funding currency, two main factors impact the yen : First, the interest rate differential must show that the yield in Japan is indeed less attractive than elsewhere. This differential has played a role in the USD/JPY rate since 2010, with higher real rates in the US tending to favour a stronger greenback against the yen (see chart 3). The second factor impacting the yen is sustained risk appetite. One simple proxy for measuring risk appetite is the US implied volatility (VIX) index. If the VIX index spikes, risk appetite declines and in such instances the yen tends to appreciate as carry trades are unwound . But since 2016, the VIX index has been low and, therefore, risk appetite has been strong. Since we expect a more hawkish Fed over 2018 and a very accommodative Bank of Japan, real rate differentials between the US and Japan should increase and favour a weaker yen against the US dollar. |

US - Japan 10 - Year Rate s Differential and USD/JPY Currency |

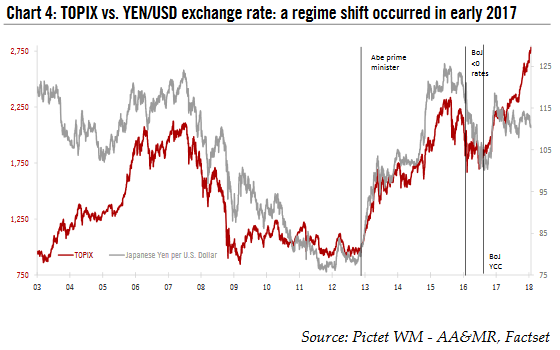

Japanese equity markets remain buoyantThe BoJ is the sole central bank directly buying equities as part of its monetary framework. Since September 2016 , the central bank has been committed to purchasing JPY6 trillion per year worth of equities through exchange traded funds (ETFs) on three indices: the TOPIX, the Nikkei 225 and the JPX – Nikkei 400. As a result, the BoJ now owns about 4% of the TOPIX’s market capitalisation and 60% of Japanese equity ETFs . Historically, ups and downs in Japanese equities were closely linked to foreign investor flows. This relationship has been altered by the BoJ , with Japanese equities rising sharply (22% in local currency) in 2017 despite foreigners’ lack of enthusiasm. The initial phase of the BoJ’s QE package introduced in March 2013 led to massive yen depreciation that boosted earnings and therefore equity prices, leading to a tight correlation between the JPY/USD exchange rate and equities. Since September 2016, however, the BoJ has distorted somewhat that correlation — although it has not destroyed it altogether due to the importance of exporters for earnings growth in Japan (see chart 4). Purely domestic companies on the TOPIX index are expected to have 2018 earnings growth of 4.8%, compared with 12.8% for companies with a more global footprint. |

TOPIX vs. YEN/USD Exchange Rate, 2003 - 2018 |

The BoJ’s activity is even more impressive in terms of equity inflows. In the aftermath of the sell – off of Japanese equities in Q3 2016, BoJ equity purchases accounted for 500% of annual net inflows into Japanese equity markets. (This figure has massively decreased since the market upturn and currently stands at 126 %.)

The earnings outlook (2018 earnings growth expectations of 9% for the Topix at end – January) and valuations in Japan (12 – month forward PE at 15.6x) are in line with European levels and still offer some more upside for Japanese equities.

The latest fiscal reforms in Japan could boost 2018 earnings expectations further, although investors remain sceptical about corporate tax cut that are much less extensive than those introduced in the US, the Japanese are temporary and contain many conditions.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newslettersent