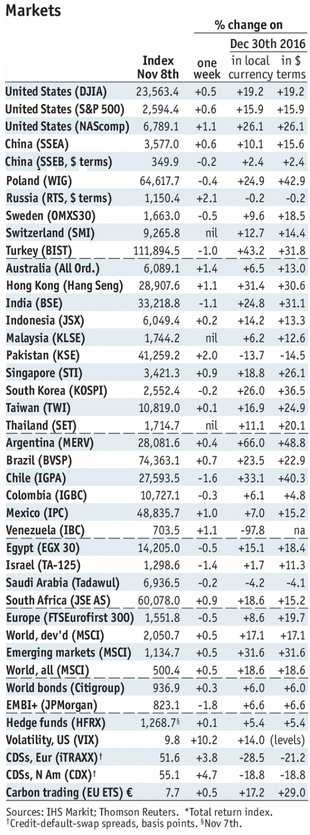

Stock MarketsEM FX closed the week on a soft note. For the week as a whole, best performers were MYR, PLN, and COP, while the worst were BRL, ZAR, and INR. US inflation and retail sales data will likely set the tone for EM. Also, the US fiscal debate is set to continue this week, so expect lots of choppy trading across many markets. |

Stock Markets Emerging Markets, November 13 Source: economist.com - Click to enlarge |

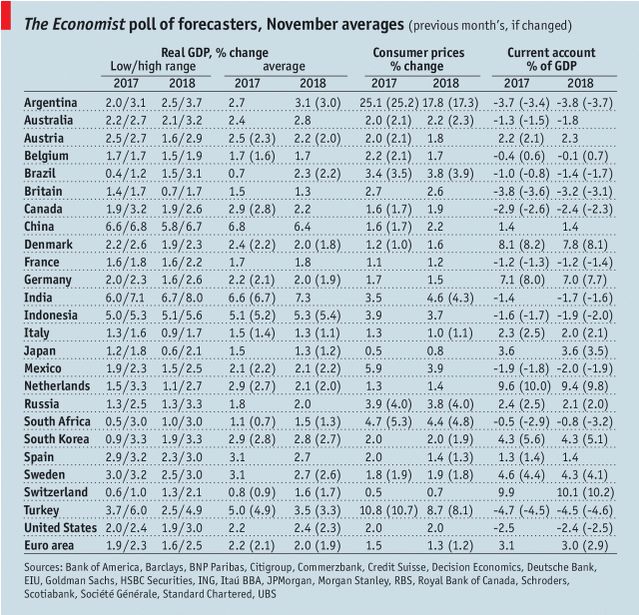

ChinaChina will likely report October money and loan data this week. October retail sales and IP will be reported Tuesday. The former is expected to rise 10.5% y/y and the latter by 6.2% y/y. Price pressures are picking up, but we not think the PBOC will change policy for the foreseeable future. TurkeyTurkey reports September current account data Monday. A deficit of -$4.1 bln is expected. If so, the 12-month total would continue widening to -$39.6 bln, the biggest since August 2015. Turkey is becoming more reliant on hot money flows to finance its external accounts even as investors are turning away from risk. IsraelIsrael reports October trade Monday. It then reports October CPI Wednesday, which is expected to remain steady at 0.1% y/y. Q3 GDP will be reported Thursday, which is expected to grow 2.9% SAAR vs. 2.4% in Q2. IndiaIndia reports October CPI Monday, which is expected to rise 3.45% y/y vs. 3.28% in September. If so, inflation would still be in the bottom half of the 2-6% target range. The RBI warned that inflation will move higher and so we see steady rates for now. Next policy meeting is December 6, no change seen then. India reports October WPI Tuesday, which is expected to rise 3.04% y/y vs. 2.6% in September. PolandPoland reports September trade and current account data Monday. It then reports Q3 GDP Tuesday, which is expected to grow 4.5% y/y vs. 3.9% in Q2. The economy remains robust even as wages are rising. Inflation will likely move higher and require tightening by mid-2018. RussiaRussia reports Q3 GDP Monday, which is expected to grow 2.0% y/y vs. 2.5% in Q2. Growth remains subpar, but low inflation should allow the central bank to continue cutting rates into next year. Next policy meeting is December 15, and another 25 bp cut to 8.0% is likely. BrazilBrazil reports September retail sales Tuesday, which are expected to rise 4.5% y/y vs. 3.6% in August. The economy is picking up nicely even as inflation has bottomed. We see one more 50 bp cut to 7% at the December 6 meeting and then steady rates for much of 2018. ChileChile central bank meets Tuesday and is expected to keep rates steady at 2.5%. CPI rose a higher than expected 1.9% in October, but remains below the 2-4% target range. Low inflation will allow the central bank to resume easing is the economy falters. IndonesiaIndonesia reports October trade Wednesday. Bank Indonesia meets Thursday and is expected to keep rates steady at 4.25%. CPI rose 3.6% y/y in October, which is still in the bottom half of the 3-5% target range. South AfricaSouth Africa reports September retail sales Wednesday, which are expected to rise 4.5% y/y vs. 5.5% in August. The recovery remains spotty, and yet the SARB is unlikely to cut rates again at the next policy meeting November 23. ColombiaColombia reports Q3 GDP Wednesday, which is expected to grow 2.0% y/y vs. 1.3% in Q2. The economy remains sluggish, and so we expect rate cuts to continue. Next policy meeting is November 24, and another 25 bp cut to 4.75% is possible then. SingaporeSingapore reports October trade Friday, with NODX expected to rise 8.3% y/y vs. -1.1% in September. CPI rose only 0.4% y/y in September. While the MAS does not have an explicit inflation target, low price pressures should allow it to keep policy on hold at the next policy meeting in April. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, November 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent,win-thin