Monthly Archive: November 2017

FX Weekly Preview: Events + Market = Potential for Combustible Price action

There are a number of events and economic reports in the week ahead that will help shape the investment climate in the weeks and months ahead. In recognition of the importance of initial conditions, let's briefly summarize the performance of the dollar and main asset markets.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX ended the holiday-shortened week on a soft note. While most were up on the entire week, notable laggards were TRY, CLP, and ZAR. All three currencies underperformed due to rising political risks, and we suspect that will continue. We believe MXN and BRL are likely to rejoin the laggards in the coming days.

Read More »

Read More »

Switzerland’s 1.3 billion franc payment to EU proves divisive

Switzerland’s deal with the EU involves a financial contribution. The sum announced by the Federal Council is CHF 1.3 billion over the next 10 years.The arrangement, announced on Thursday to coincide with a visit by european commission president Jean-Claude Juncker, extends a previous 10 year deal.

Read More »

Read More »

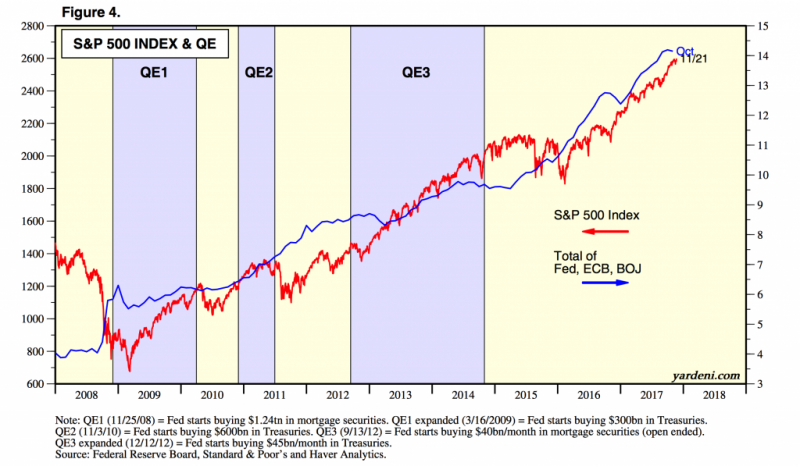

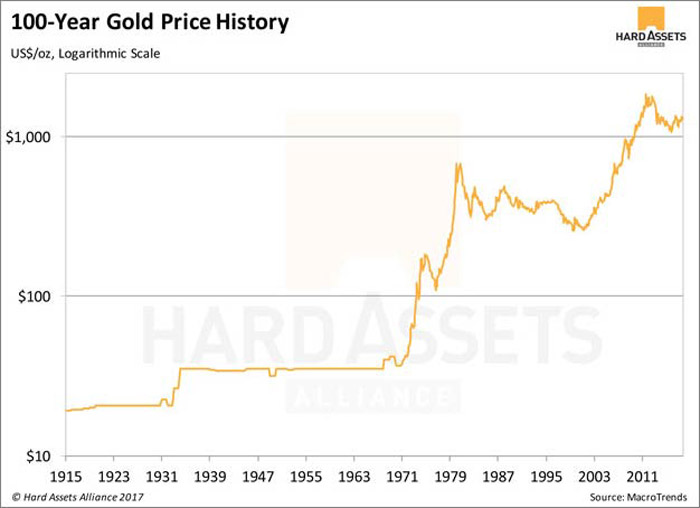

Buy Gold As Fed Shows Uncertainty And Concern Over Financial ‘Imbalances’

FOMC minutes show uncertainty and concern about markets are affecting officials’ decision-making. Officials were cautious when evaluating market conditions and the ‘damaging effects on the economy’. Worry about ‘potential buildup of financial imbalances’ and a sharp reversal in asset prices’. Members seem oblivious to impact of inflation on households and savings. Physical gold and silver remain the only assets for real diversification and...

Read More »

Read More »

Stress rises among Swiss workers

A recent report by Travail.Suisse shows around 40% of Swiss workers report feeling often or very often stressed by their work.Stress and emotional exhaustion is a daily reality for many says Travail.Suisse. Between 2015 and 2017, the percentage suffering work related stress or emotional exhaustion has risen from 38% to 48%.

Read More »

Read More »

Richest get richer – Switzerland’s top 300

The wealthiest people in one of the world’s wealthiest nations - Switzerland, have increased their assets by CHF60 billion over the past year. According to the latest edition of the German-language business magazine, Bilanz, the 300 richest residents of the country have assets totalling CHF674 billion.

Read More »

Read More »

Geopolitical Risk Highest “In Four Decades” – Gold Demand in Germany and Globally to Remain Robust

Geopolitical risk highest “in four decades” should push gold higher – Citi. Elections, political and macroeconomic crises and war lead to gold investment. Political uncertainty in Germany means “gold likely to remain in good demand as a safe haven” say Commerzbank. “There has rarely been such political uncertainty in Germany at any time in the country’s post-war history” – Commerzbank. Reduce counter party risk: own safe haven allocated and...

Read More »

Read More »

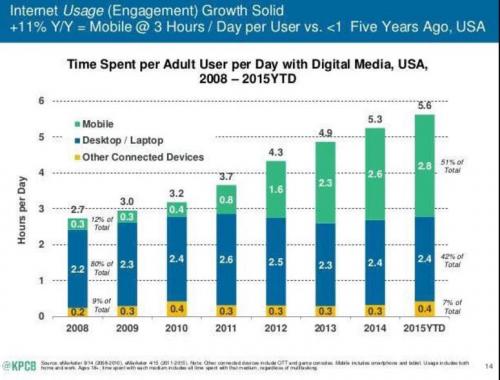

Addictions: Social Media & Mobile Phones Fall From Grace

Identifying social media and mobile phones as addictive is only the first step in a much more complex investigation. For everyone who remembers the Early Days of social media and mobile phones, it's been quite a ride from My Space and awkward texting on tiny screens to the current alarm over the addictive nature of social media and mobile telephony.

Read More »

Read More »

Lessons from Squanto

Governments across the planet will go to any length to meddle in the lives and private affairs of their citizens. This is what our experiences and observations have shown. What gives? For one, politicians have an aversion to freedom and liberty. They want to control your behavior, choices, and decisions. What’s more, they want to use your money to do so.

Read More »

Read More »

Great Graphic: Is that a Potential Head and Shoulders Pattern in the Euro?

The euro is breaking out to the upside. The measuring objective is near $1.2150, which is near the 50% retracement of the euro's drop from the mid-2014 high. Key caveat: It is about the upper Bollinger Band and rate differentials make it the most expensive to hold since the late 1990s.

Read More »

Read More »

Les banques centrales demandent aux banques commerciales de créer la monnaie. La preuve.

M Marc Luckx Ghisi, ancien conseiller de M Jacques Delors apporte la preuve que nous défendons depuis des années sur ce site: Les banques centrales ne créent pas de monnaie. Elles s’endettent auprès des banques commerciales!

Read More »

Read More »

Where an average Swiss household spends its income

A recent report from Switzerland Federal Statistical Office shows how an average Swiss household spends its income. In 2015, the mean income was CHF 9,946 per month, including all forms of income and any 13th month payment received at the end of the year.

Read More »

Read More »

Ne conservez pas votre or dans une banque. Egon Von Greyerz

Ne détenez pas d’or dans une banque suisse ou dans n’importe quelle autre banque. Nous voyons régulièrement des exemples dans des banques suisses de taille moyenne et de grande taille qui devraient fortement inquiéter les clients. En voici quelques-uns : Un client entrepose de l’or physique dans une banque, mais lorsqu’il souhaite le transférer vers des coffres privés, l’or n’y est plus et la banque doit s’en procurer.

Read More »

Read More »

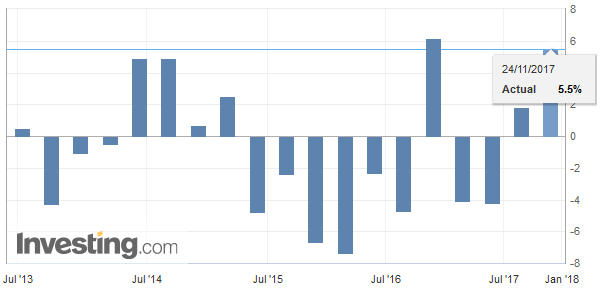

Durable Goods Only About Halfway To Real Reflation

Durable goods were boosted for a second month by the after-effects of Harvey and Irma. New orders excluding those from transportation industries rose 8.5% year-over-year in October 2017, a slight acceleration from the 6.5% average of the four previous months. Shipments of durable goods (ex transportation) also rose by 8% last month.

Read More »

Read More »

Construction Industry Production, Orders and Turnover Statistics: lncrease in construction production in Switzerland in Q3 2017

Secondary sector production rose by 7.4% in 3rd quarter 2017 in comparison with the same quarter a year earlier. Turnover rose by 6.2%. This is the greatest increase since the 1st quarter 2008.

Read More »

Read More »

FX Daily Rates, November 24: Euro Continues to Push Higher

The euro is edging higher to trade at its best levels since the middle of last month. It is drawing closer to the $1.1880 area, which if overcome, could point to return to the year's high seen in early September near $1.2100. There is a combination of factors lifting the euro. The recent data, including yesterday's flash PMI, suggests that the regional economy is re-accelerating here in Q4.

Read More »

Read More »

Gold Versus Bitcoin: The Pro-Gold Argument Takes Shape

Gold versus Bitcoin: The pro-gold argument takes shape. Why cryptocurrencies will not replace gold as a store of value. Similarities between crypto and gold but that does not make them substitutes. Gold remains a highly liquid market, cryptocurrencies continue to be fragmented and difficult to spend. Bitcoin does not make it an effective hedge against stocks

Read More »

Read More »

Second class-action law suit lodged against Tezos

A second class-action lawsuit has been lodged in the United States against the founders of the tokenised blockchain project Tezos, and the Swiss-based foundation that houses hundreds of millions of dollars of investors’ money. The law firm Silver Miller Law presented its complaintexternal link in Florida this week, following a California lawsuit issued last monthexternal link.

Read More »

Read More »

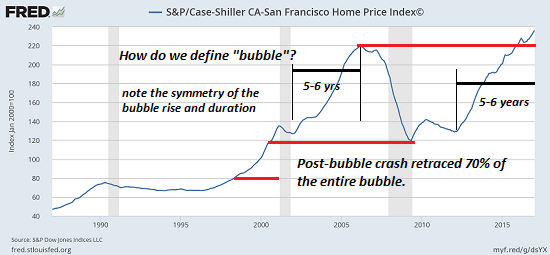

Beware the Marginal Buyer, Borrower and Renter

When times are good, the impact of the marginal buyer, borrower and renter on the market is often overlooked. By "marginal" I mean buyers, borrowers and renters who have to stretch their finances to the maximum to afford the purchase, loan or rent.

Read More »

Read More »