| – Gold climbs over 12% in YTD, matching S&P500 performance – Palladium best performing market, surges 36% 2017 YTD – Gold outperforms Nikkei 225, Euro Stoxx 50, FTSE and ISEQ – Geo-political concerns including Trump and North Korea supporting gold – Safe haven demand should push gold higher in Q4 – Owning physical gold not dependent on third party websites and technology remains essential |

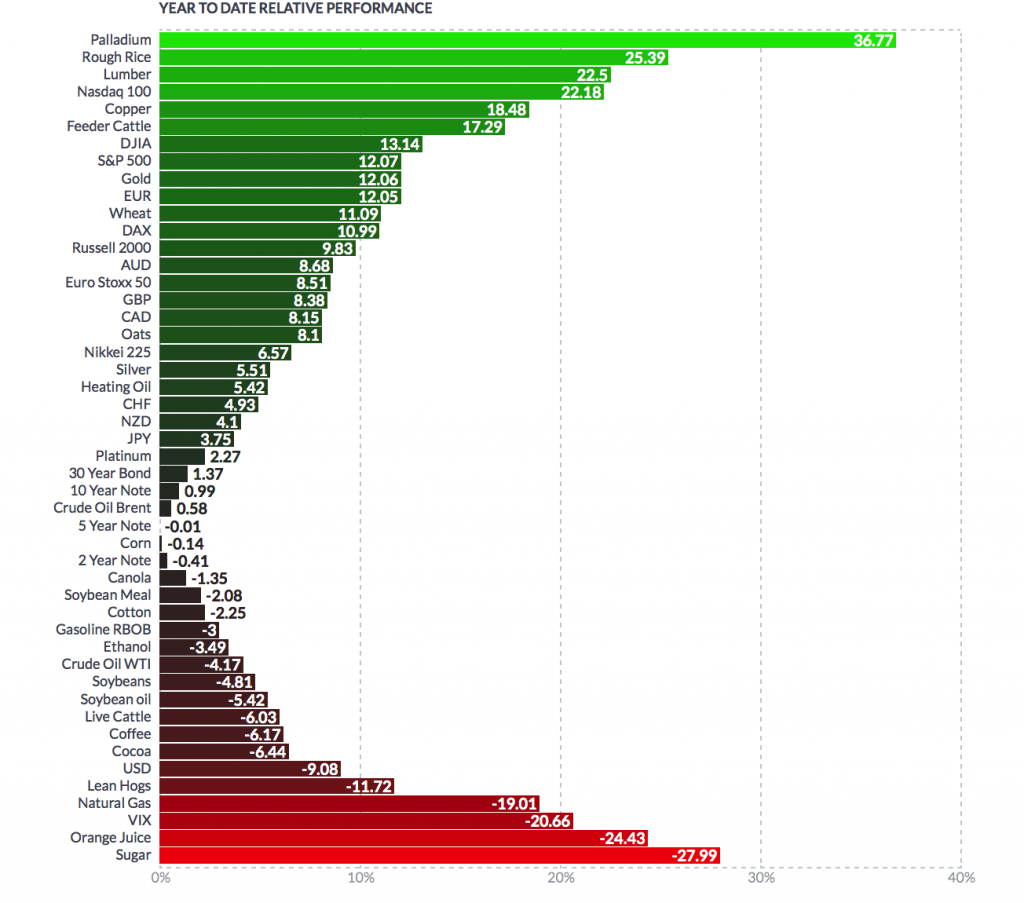

Year to Date Relative Performance |

| In the year-to-date the gold price performance has matched the S&P 500, climbing over 12%.

Gold’s matching of the S&P 500 is particularly impressive when you consider the record-breaking performance of the benchmark stock market index in the last year. Yesterday it advanced 0.1% to 2510.06, a new all time record high price. It is also impressive considering sentiment towards stocks is shall we say “irrationally exuberant”, while sentiment towards gold remains muted despite gold eking out gains in 2016 and now again in 2017. The precious metal has performed well predominantly due to rising uncertainties regarding North Korea, Trump and the political mess in the U.S. and other geopolitical tensions. Its strong performance is despite noise from the US Federal Reserve regarding its alleged plans to tighten money supply and increase rates. Other major central banks have also provided similar indications. Elsewhere, gold has outperformed both the Euro Stoxx 50 and Nikkei 225 which are 8.5% and 6.5% higher respectively. The UK’s FTSE and Ireland’s ISEQ are underperforming and have the hallmarks of markets that are topping out. The FTSE and the ISEQ are 2.5% and 4.25% higher year to date. Silver, platinum and palladium up 5.5%, 2% and 37% YTD respectively Gold wasn’t the only precious metal that performed well in the last three quarters. All four precious metals have climbed in price. Palladium has been the headline grabbing asset in the last year. In the year-to-date the industrial precious metal is up by nearly 37%. Holdings in exchange-traded funds backed are close to the highest since the beginning of the year. This week for the first time since 2001, palladium topped the platinum price. Palladium is predominantly used in pollution-control devices for gasoline-powered cars and trucks. In contrast platinum is used in diesel-powered engines. Governments have been slowly clamping down on diesel due to concerns over its role in pollution and emissions scandals. Platinum is up by only 2% this year. Some believe the metal has been oversold in recent days and there is too much heat in the palladium market. |

Platinum - Palladium Ratio, 2002 - 2017 |

| Meanwhile silver is refusing to go below $16/oz. Some investors may feel disappointed that it has failed to break above $19/oz this year, despite strength in gold.

Investors in silver must continue to take heart that silver does still stand to gain whenever the U.S. dollar loses strength or concerns about the stock market creates demands for assets to hedge risk with. Geo-political concerns with North Korea and elsewhere fuel demand In a recent Bank of America Merrill Lynch survey the biggest ‘tail risk’ seen by investors was North Korea’s missile risk. This was ahead of policy missteps in central banks of the US and China, and credit tightening in China. However, worries over nuclear war are not the only concern fuelling the price of gold. Uncertainty regarding political haggling and stalemate in Washington are also providing key support. |

|

| Critics of President Trump are concerned that he and his team have achieved very little since his inauguration. Any plans that have been proposed are seemingly poorly devised and quickly shot-down.

This week the Republicans failed once again to defeat Obamacare, a key component of Trump’s election promises. Also the White House announced a plan for a lower corporate tax rate and to cut the highest individual income tax rate. Critics argued however that the plan was awash with cronyism and helped the wealthy. There was also little indication given as to how the tax cuts would be funded amid risks that deepening U.S. deficits may further weaken the dollar. Expect more safe haven demand next quarter As we all know, gold is a barometer for uncertainty. With a 12% climb in the last year and no sign of risks abating, there is little reason to not expect the price to continue to climb. Should gold reach $1,400, then this will be a four-year high and a sure sign of a bullish breakout for the precious metal. We shouldn’t invest in gold because of some ambulance-chasing punt on geopolitical disaster. Gold should play a key role in your investment portfolio as a tool for protecting against risk and hedging declines in stock and other markets and currency devaluations. In truth, there is still a huge amount of uncertainty regarding the outlook for the global economy and global markets. No one knows how central banks’ attempts to unwind the last decade of monetary policy will play out, nor does anyone know how President Trump’s government will survive in an America that will continue to feel more pressure from the likes of Russia and China. Investors need to stay focused on the medium and especially the long-term and the bigger picture. |

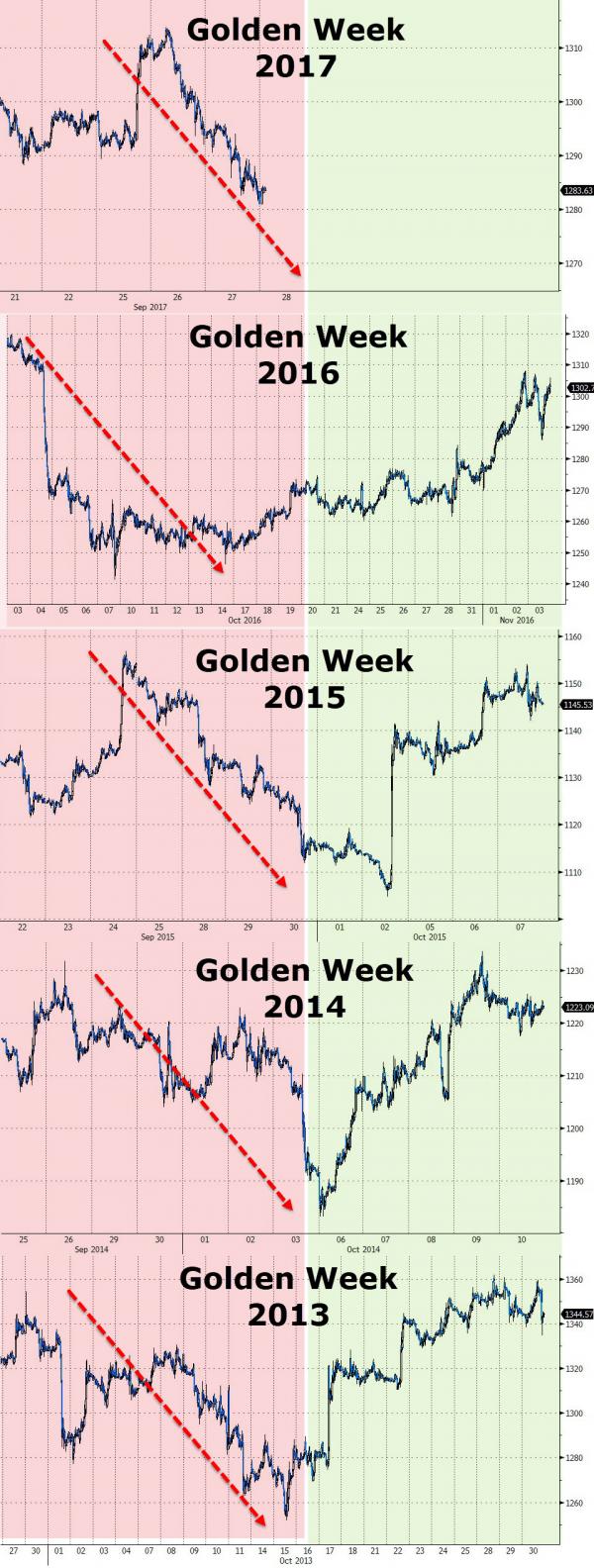

Golden Weeks, 2013 - 2017 |

Editors Conclusion

Sentiment in the gold market remains quite poor. Most of the public remains on the sidelines and there is very little positive coverage of gold.

Nor is there an appreciation of the scale of economic, geo-political and monetary risks facing investors and savers today.

There remains a fundamental lack of knowledge of the still very strong supply and demand factors driving the physical gold market and a lack of understanding as to why gold remains a vitally important asset to own in a portfolio.

Many stock markets are at record highs. Many bond markets are at record highs. Many property markets are at record highs. This makes gold which is remains nearly 33% below its record high very attractive from a hedging and diversification perspective.

Real diversification through owning allocated and segregated gold not dependent on third party websites and technology remains essential.

The old Wall Street adage to always keep 10% of your wealth in gold and hope that it does not work remains prudent.

Lets hope for the best but be prepared for less benign financial scenarios…

Source: Zerohedge

Full story here Are you the author? Previous post See more for Next postTags: newslettersent,Weekly Market Update