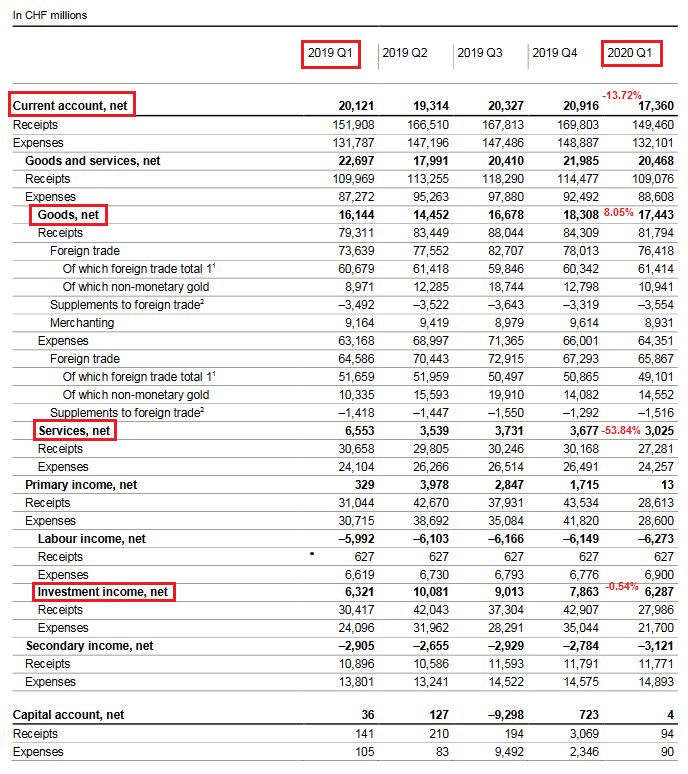

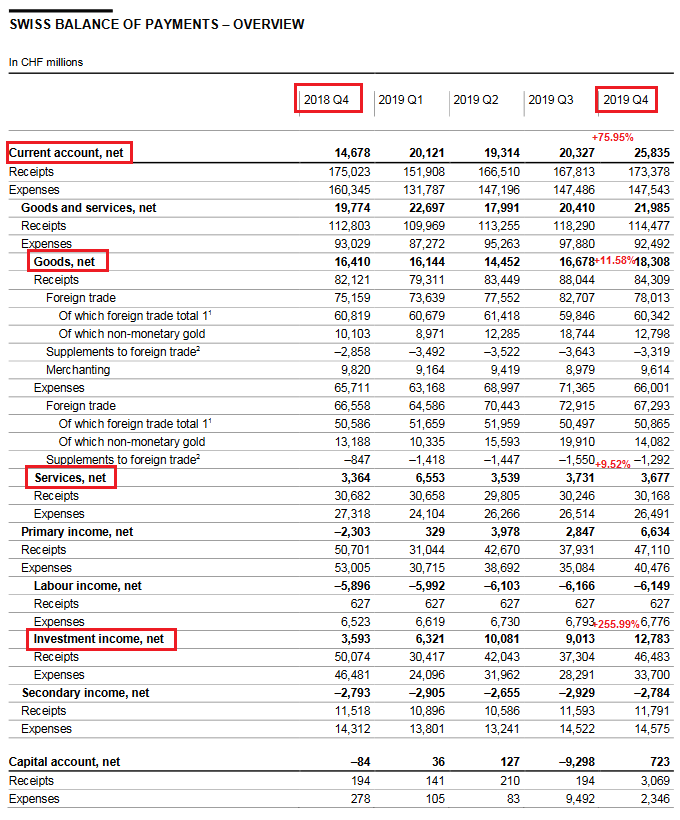

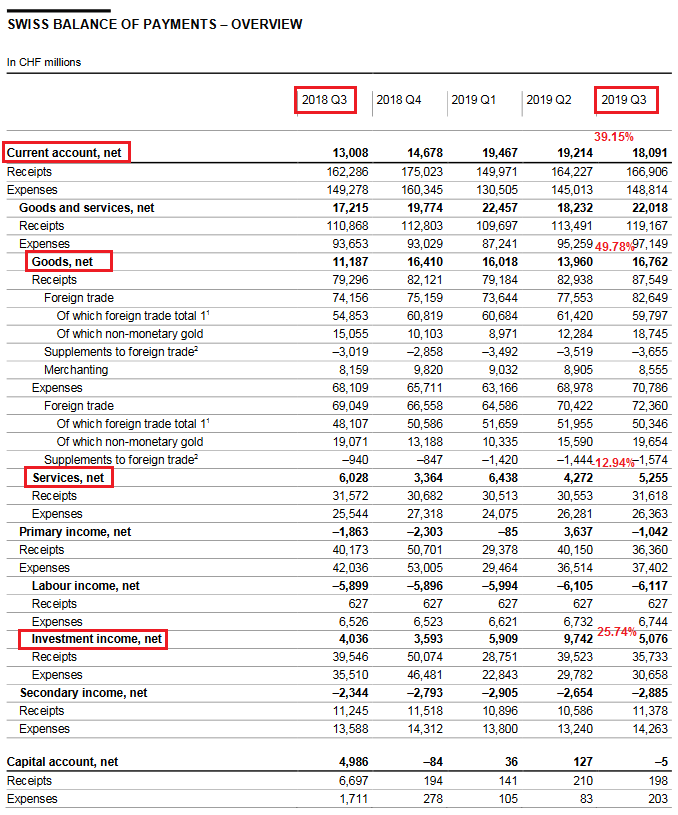

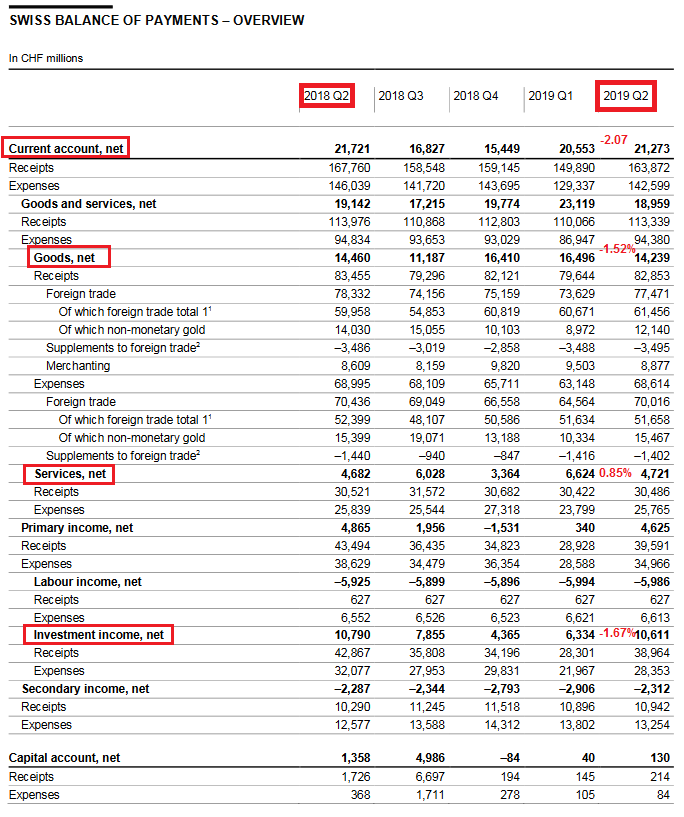

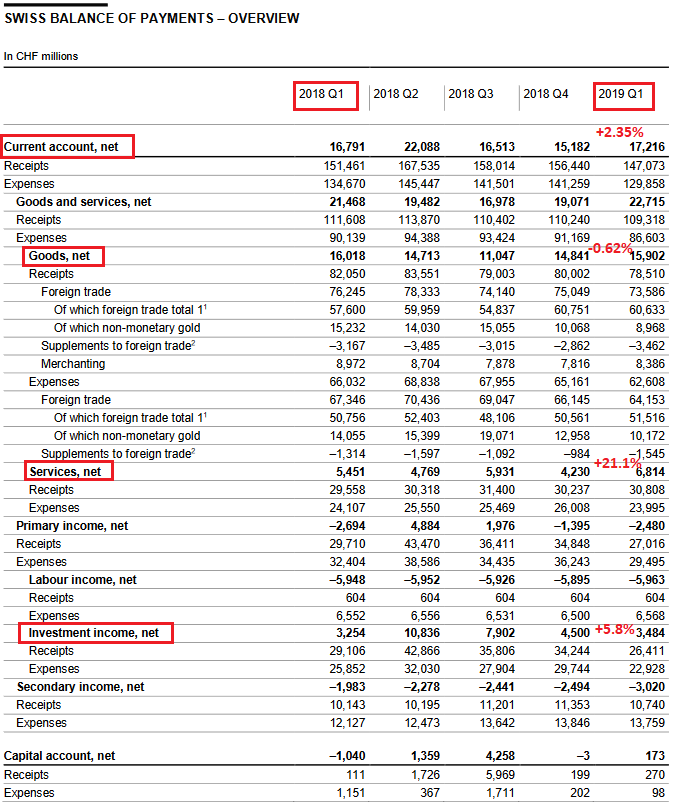

Current AccountThe current account was bellow 3.6% against the same quarter in 2016. Key figures: Current Account: -3.6% against Q2/2016 to 18,748 bn. CHF

|

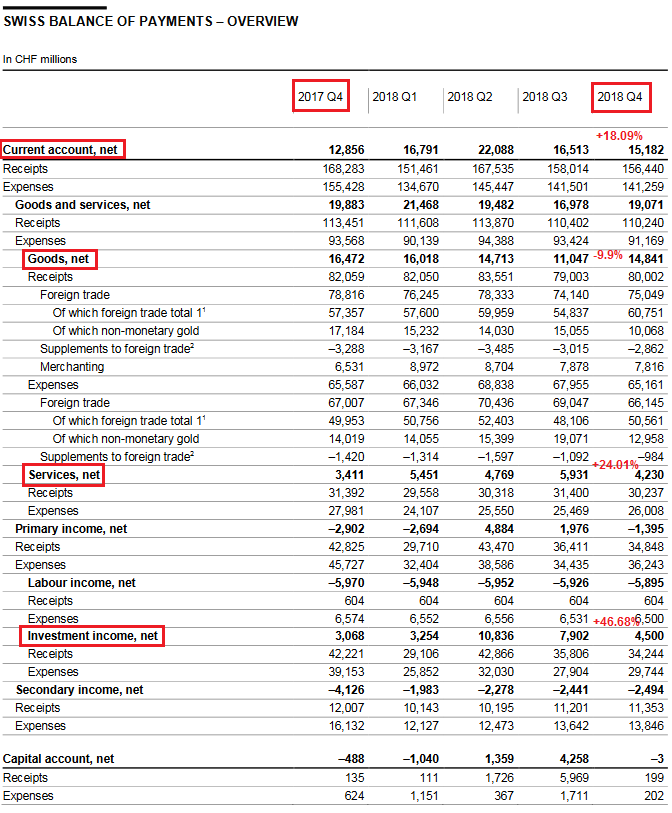

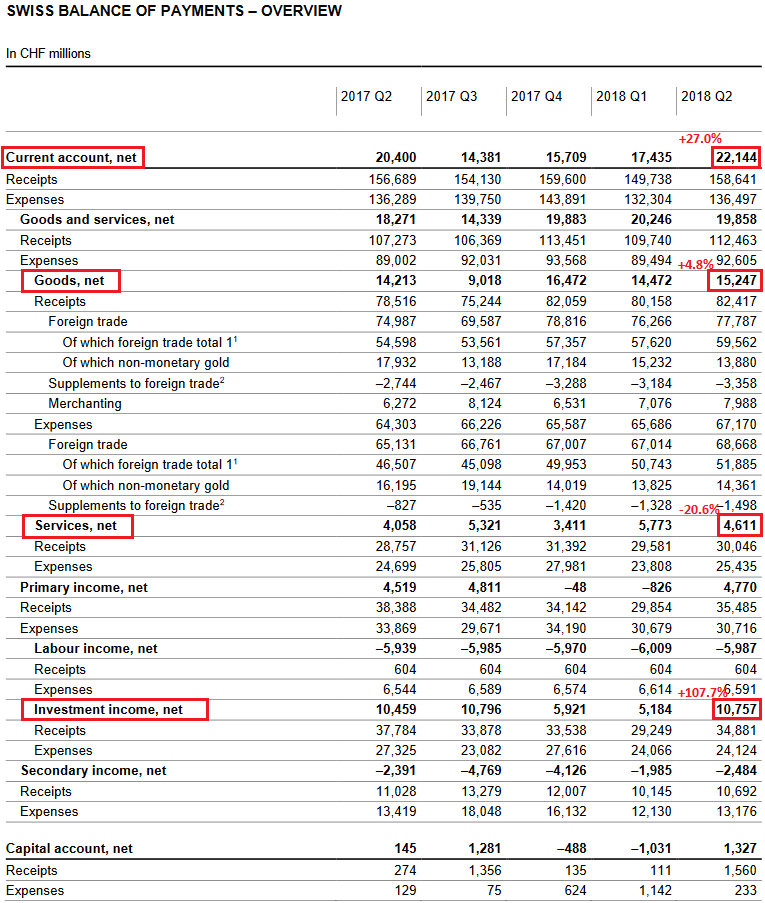

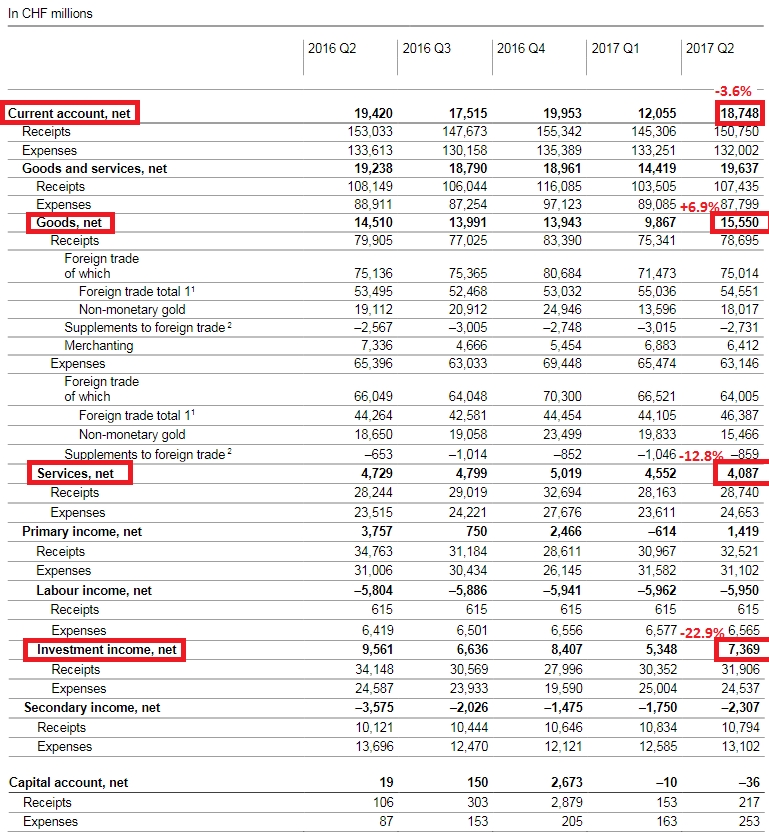

Swiss Balance of Payments Q2 2017(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Source: snb.ch - Click to enlarge |

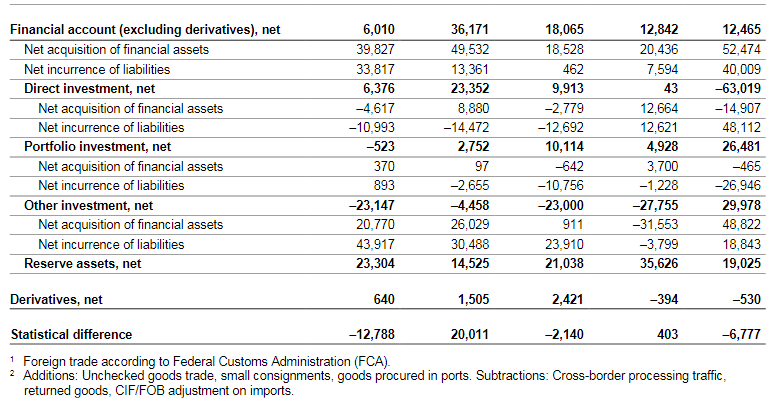

Financial Аccount

|

Switzerland Financial Account(see more posts on Switzerland Balance of Payments, Switzerland Capital Account, Switzerland Current Account, Switzerland Financial Account, ) Extract from the Balance of Payments Q2 2017 Source: snb.ch - Click to enlarge |

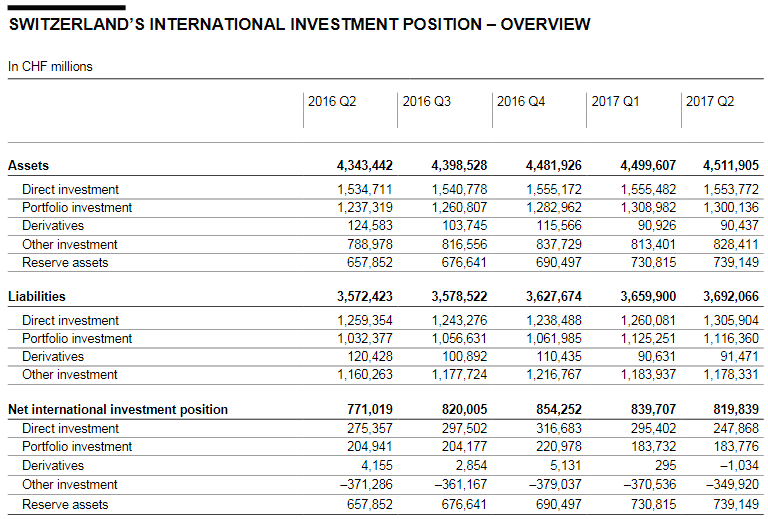

Switzerland’s International Investment Position

|

Switzerland International Investment Position(see more posts on Switzerland International Investment Position, ) Switzerland International Investment Position - Q2 2017 Source: snb.ch - Click to enlarge |

Tags: newslettersent,Switzerland Balance of Payments,Switzerland Capital Account,Switzerland Current Account,Switzerland Financial Account,Switzerland International Investment Position