Mathematical CertaintiesBased on the simple reflection that arithmetic is more than just an abstraction, we offer a modest observation. The social safety nets of industrialized economies, including the United States, have frayed at the edges. Soon the safety net’s fabric will snap. This recognition is not an opinion. Rather, it’s a matter of basic arithmetic. The economy cannot sustain the government obligations that have been piled up upon it over the last 70 years. |

|

| In other words, the post-World War II boom is nearly over and the bills are coming due. What’s more, greater and greater amounts of future growth are already claimed by existing debt obligations. This, in turn, inhibits that growth from making its way into the larger economy, thus limiting future economic growth.

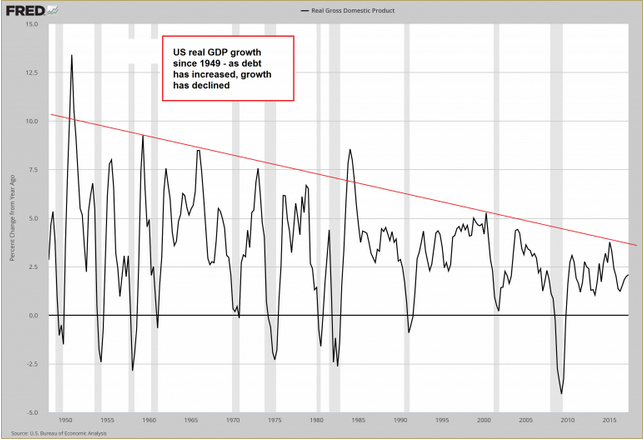

Perhaps this is why mature economies are finding it near impossible to attain 3 percent GDP growth. In fact, the last time U.S. GDP grew by 3 percent or more for a calendar year was 2005, about 12 years ago. Unfortunately, it doesn’t look like U.S. GDP growth will ramp up any time soon. Over the last 12 years, GDP growth in the European Union has been equally lethargic. However, Japan takes the cake. GDP growth in the Land of the Rising Sun has been stuck in a quagmire for 25 years. |

US annual GDP growth rates since 1949 – 2017 |

Fighting the Forces of ArithmeticAside from a generation of GDP growth stagnation, Japan also has another important distinction. The country is serving as the canary in the coal mine for what happens to an economy that has a rapidly aging population, burdensome debt obligations and stagnating growth. Specifically, Japan’s disagreeable demographic trend generally leads the trend in the European Union by about 5 years and that of the United States by roughly 9 years. Japan’s worrisome debt and growth trends lead those in the European Union and the United States by about 15 years, give or take. The simple arithmetic Japan faces, as reported by the Daily Times, includes:

Yet the Japanese government and its central bank, the Bank of Japan (BoJ), can’t be faulted for lack of effort. They’ve been at the cutting edge of executing policies aimed at fighting the forces of arithmetic for several decades. So far it has been a losing battle, resulting in slow growth and runaway debt. |

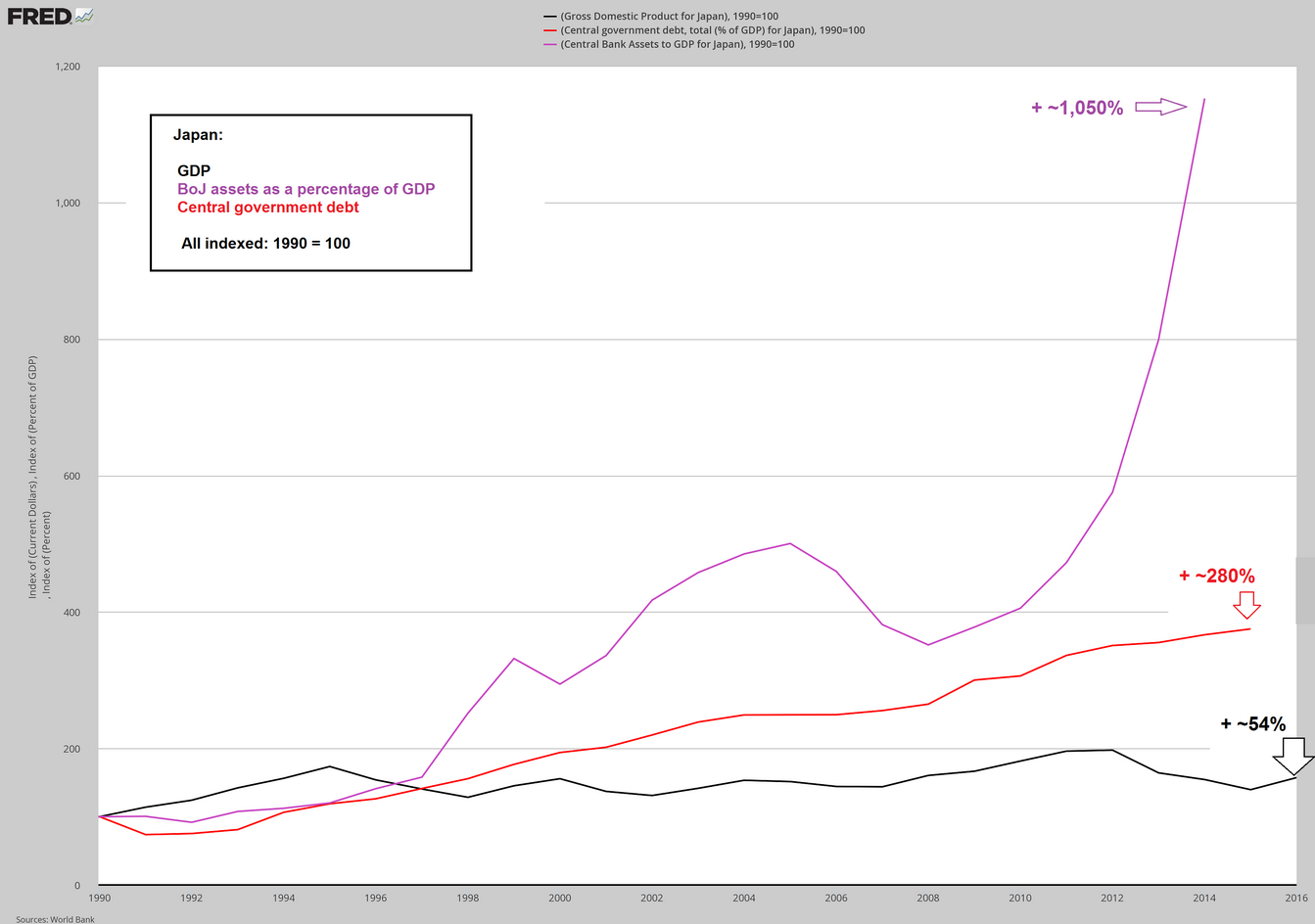

Japan GDP, BoJ assets as a percentage of GDP, Central Goverment Debt compared The “success” of implementing Keynesian and monetarist recipes in Japan to the hilt. In the past 17 years, nominal GDP is up 54%, government debt has nearly quadrupled and the central bank balance sheet is up 11.5-fold relative to economic output. This reflects the definition of insanity often ascribed to Einstein: doing the same thing over and over again and expecting a different result. [PT] - Click to enlarge |

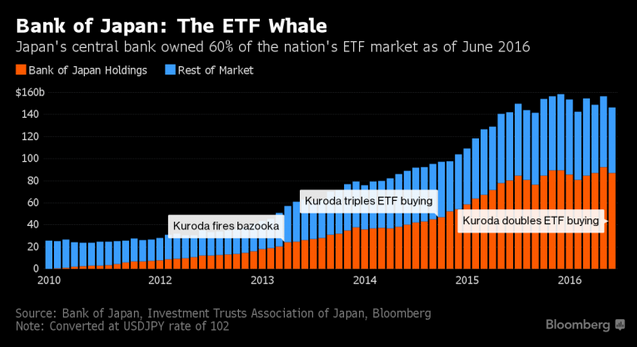

Yanking the Bank of Japan’s ChainIn today’s age, where expedient solutions are demanded, BoJ Governor Haruhiko Kuroda is compelled to do something. But what? He’s already borrowing money into existence and plowing it into the stock market via exchange traded funds (ETFs) at an annual rate of $53 billion. What this does to improve the real economy is unclear. But like all types of depravity, the BoJ is finding these asset purchases are much easier to start than to stop. As of April 2016, the BoJ was a top 10 shareholder in about 90 percent of Nikkei 225 companies. Moreover, at their present rate of ETF buying, the BoJ will be the top shareholder of 55 Nikkei 225 companies by the end of the year. What to make of it? |

Bank of Japan 2010-2017(see more posts on Bank of Japan, ) Introducing socialism through the backdoor: the BoJ owns an ever larger share of Japan’s stock market capitalization, by buying up ETF shares with money it literally creates from thin air. This absurd activity did succeed in boosting Japan’s money supply growth for a while, but wealth can possibly be increased by printing money. If that were possible, we could all just stop working and simply cash a central bank check every month. Allegedly the BoJ “must” do this in order to “increase inflation” (meaning: boost consumer prices). How society is supposed to benefit from things getting more expensive rather than cheaper as they would in a progressing free economy was never satisfactorily explained. There is neither sound theoretical support for this nonsense, nor does any empirical evidence to this effect exist – in fact, the opposite is true. [PT] - Click to enlarge |

| To start, this has had the direct effect of distorting stock market prices. In addition, the BoJ’s stock purchases can be thought of as a form of transfer payments to corporations and the wealthy. If corporations and the wealthy are getting direct funding via BoJ cheese, shouldn’t the common people?

These, no doubt, are the sort of unacceptable questions that come up when the rules of monetary policy are continually adjusted toward the expedient. Naturally, when a country goes down this slippery road to hell there is always an endless supply of expedient solutions. So, too, there is always an endless supply of crackpot economists to offer the next policy fix. For example, Gabriel Stein of Oxford Economics has a novel solution to Japan’s perceived “demand problem”. Since 2014 he’s been advocating that the BoJ pay Japanese citizens to shop:

Stein proposes BOJ-sponsored cash cards credited at about $8,000 or more per citizen. These cash cards would expire at the end of each year, so that households would be forced to consume. Could there be a more perfect economy? You get free money from the government that you can use to buy real stuff. Obviously, something doesn’t add up. Come on now Mr. Stein. You don’t think Kuroda just fell off the turnip truck, do you? Stop yanking his chain. |

Charts by St. Louis Fed, Bloomberg

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next postTags: Bank of Japan,central-banks,Haruhiko Kuroda,newslettersent