Summary

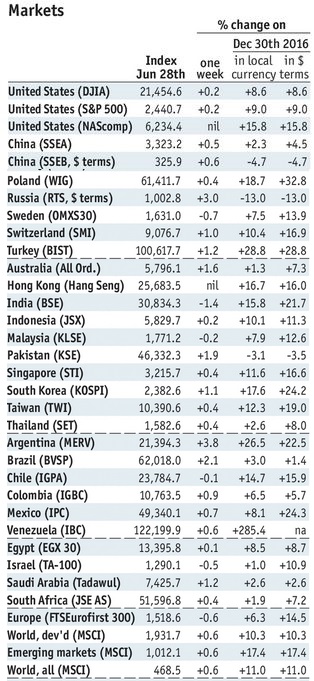

Stock MarketsIn the EM equity space as measured by MSCI, Brazil (+2.9%), Russia (+1.5%), and Turkey (+0.9%) have outperformed this week, while Czech Republic (-3.0%), Hungary (-1.2%), and Chile (-0.9%) have underperformed. To put this in better context, MSCI EM fell -0.1% this week while MSCI DM fell -0.3%.

In the EM local currency bond space, Brazil (10-year yield -13 bp), Colombia (-6 bp), and China (-5 bp) have outperformed this week, while South Africa (10-year yield +27 bp), Philippines (+17 bp), and Hungary (+17 bp) have underperformed. To put this in better context, the 10-year UST yield rose 14 bp to 2.28%. In the EM FX space, ILS (+1.3% vs. USD), BRL (+1.0% vs. USD), and SGD (up 0.8% vs. USD) have outperformed this week, while ARS (-2.5% vs. USD), ZAR (-1.4% vs. USD), and COP (-1.0% vs. USD) have underperformed. |

Stock Markets Emerging Markets, June 28 Source: economist.com - Click to enlarge |

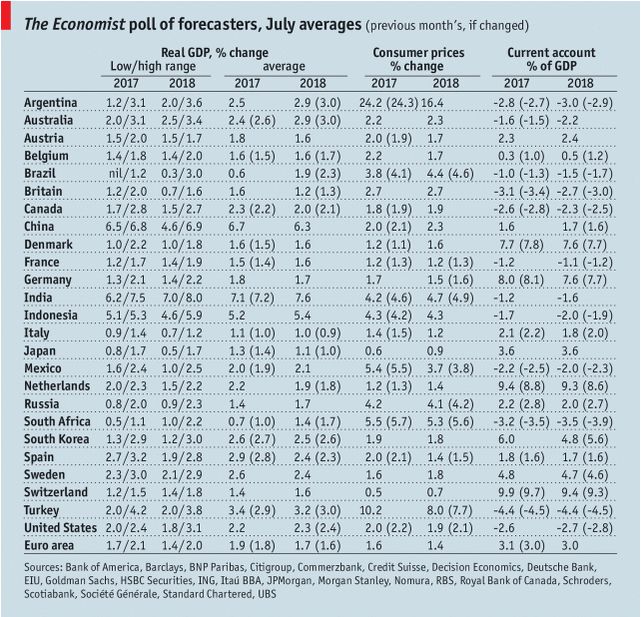

ChinaChinese President Xi visited Hong Kong for the first time. The visit commemorates the 20th anniversary of the Hong Kong handover. Xi stressed that the “one country, two systems” framework remains successful. USD/HKD traded at its highest level since January 2016. TaiwanThe US has proposed $1.3 bln of arms sales to Taiwan. The package would reportedly contain early warning radar, anti-radar missiles, and naval torpedoes. It was approved by the Defense Department and will move forward unless Congress blocks it within 30 days. Of course, Chinese officials objected. EgyptThe Egyptian government raised fuel and cooking gas prices significantly as part of the IMF program. Prime Minister Ismail said inflation (29.7% y/y in May) was likely to accelerate 4-5 percentage points as a result of the price hikes. After a 300 bp hike in conjunction with the EGP float, the central bank remained on hold until it hiked 200 bp more to 16.75% in May. South AfricaSouth Africa’s parliament has scheduled the no confidence vote on President Zuma. After several delays, the vote will be held on August 3. Parliament added that it has not yet decided on whether the vote will be done via secret ballot. BrazilBrazil’s central bank lowered its inflation target. The central bank will now target inflation at 4.25% in 2019 and 4.0% percent in 2020, down from the 4.5% target that has been in place since 2005. The tolerance band was kept at +/- 1.5 percentage points, which came into effect this year. Politics is taking center stage again in Brazil after President Temer was charged with corruption. This is connected to the recent secret recordings of an alleged conversation between Temer and Joesley Batista. The charges now need to be approved by two thirds of the lower house in order to proceed. Even if he survives the vote, the reform agenda will be delayed, if not derailed. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent