Part of “reflation” was always going to be banks making more money in money. These days that is called FICC – Fixed Income, Currency, Commodities. There’s a bunch of activities included in that mix, but it’s mostly derivative trading books forming the backbone of math-as-money money. The better the revenue conditions in FICC, the more likely banks are going to want to do more of it, perhaps to the point of reversing what is just one quarter shy of a decade-long decay.

Having been stung almost universally by the “rising dollar” (conventional wisdom always says, or said, banks only make money in this space when volatility is higher; like many other money clichés, it has been proven false quarter after quarter), there was for many an expectation that “reflation” would even if temporarily turn things around. In FICC, Q2 2017 wasn’t very good at all.

Leading the way to the downside was Goldman Sachs. Revenue in money dealing tumbled an alarming 40% year-over-year, following Q1 that wasn’t all that good to begin with. At just $1.16 billion, that’s down from $2 billion in Q4 2016 at the peak of the minor “reflation” frenzy, and the worst since the heaviest (volatility) of the “rising dollar” in Q4 2015 ($1.12 billion).

If I had to guess, Goldman was likely stung being caught not expecting the depth and persistence of anti-“reflation.” As a card carrying member of “interest rates have nowhere to go but up”, the bank very well might have been positioned for all that “rising rates” should mean in the textbook sense. The textbook hasn’t been correct for a very long time, which is one big reason why these parts of the monetary system just can’t get out of their own way.

| Goldman Sachs was not alone in its downside, however. Practically all the big dealer banks with the exception of Morgan Stanley reported negative FICC comps. JP Morgan, once the unquestioned king of derivatives, saw its Q2 revenue drop almost 20% Y/Y. Bank of America’s was down 14%, while the new king Citigroup and its more aggressive purchase of “reflation” (at least according to the OCC reports for Q1 2017) resulted in “only” -6% revenue (making up for bad positions by volume?).

The primary issue restraining “dollars” is the risk/return profile of engaging in eurodollar activities of all dimensions and types. So long as that system remains, there is no changing this basis. Regulation has made the business of money dealing more “expensive”, but if there was opportunity in it banks wouldn’t care in the least. They would put to work, as they always had, their armies of lawyers, lobbyists, and accountants to find their way through regulations new and old in order to grab their share of the spoils. Lacking in FICC still in 2017, and to such a considerable degree, simply shows that risk/return is all the former and not anywhere close to enough of the latter. Not even rumors of Dodd-Frank’s demise, Volcker Rule and all, might be enough to positively shake off what is, again, almost ten years of varying degrees of harmful funk. |

Quarterly Report on Bank Derivatives, Jan 1998 - 2017 |

In wrote near the bottom in January 2016:

Or, as specific to Goldman Sachs, from October 2015:

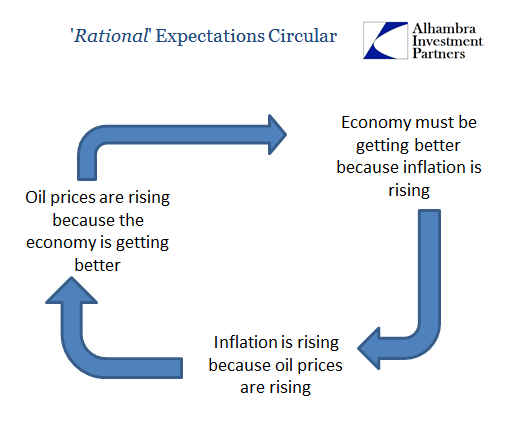

So these banks made a little more money as the world of “reflation” started to make sense again to them. Then it all changed in 2017, and now they can’t make money in FICC. It’s as if they are all caught up in the textbook tautology of circular reasoning. |

Rational Expectations Circular |

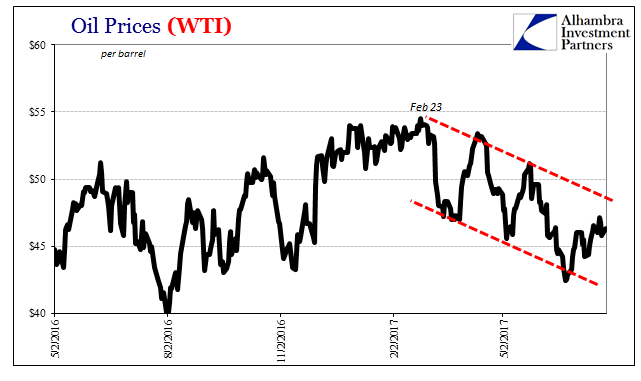

US Oil Prices, May 2016 - July 2017(see more posts on oil prices, ) |

|

US Consumer Price Index Changes on Energy, Jan 2016 - Jul 2017(see more posts on U.S. Consumer Price Index, ) |

|

Two Sides of Reflation, Aug 2016 - 2017 |

|

| And so the world is stuck on a monetary system that makes no real sense: banks make money when the economy returns to normal, but the economy won’t return to normal until monetary conditions do, and monetary conditions can’t unless banks can make money in money. After ten years of this, it seems painfully clear that it can’t change on its own, leaving drastic, radical intervention as the only real solution. The eurodollar as a credit-based monetary system has far exceeded its useful life.

To get off the hamster’s wheel of monetary-driven malaise and stagnation will require new money. A system that isn’t loaded with such inherent contradictions would be a good place to start. Using one more old quote, this time from December 2015:

It is increasingly turning out that even this non-QE “reflation” is the same as those prior drenched in QE rhetoric and expectations. All that is left to drive home the message is for the next round of FICC job cuts to start. |

Missing Modern Money, Dec 1994 - 2006 |

Missing Modern Money, Mar 2008 - 2017 |

Tags: currencies,economy,EuroDollar,eurodollar system,Federal Reserve/Monetary Policy,Goldman Sachs,Markets,money dealing,newslettersent,oil prices,U.S. Consumer Price Index