|

The solution is a new decentralized way of living that bypasses the chokepoints of centralized political and financial power.

I’m going to tell a story here using charts–a story that leads to one conclusion: we need a New American Social Revolution–a peaceful revolution that transforms our understanding of the corrupt, destructive status quo we currently inhabit, an understanding that leads to a withdrawal of our consent of the governed and a national search for new social, political and economic structures that actually serve the interests of the entire citizenry rather than the interests of a self-serving parasitic elite.

Solutions abound outside the confines of the elite-controlled centralized status quo.

The story has three dynamics: energy, debt and money. (If charts leave you cold, just read the short descriptions of the dynamics.)

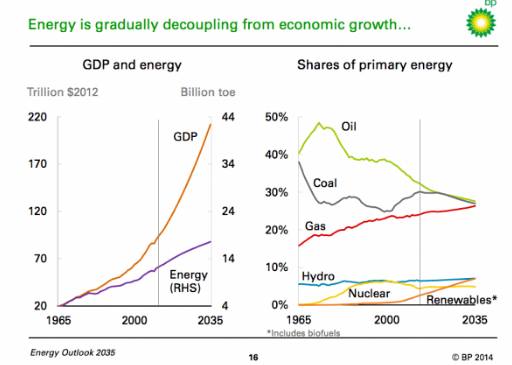

Here’s the happy story we’re told: economic growth no longer depends on rising energy consumption: our GDP can shoot to the stars while energy consumption continues moving higher at a modest rate of expansion.

|

GDP Energy |

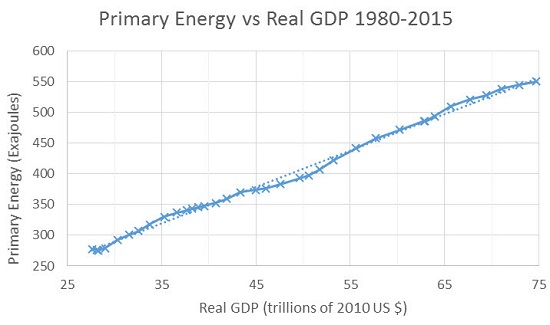

| This chart contradicts the happy story that we can grow consumption to the sky using only a bit more energy every year. What the first chart doesn’t show is what we’ve used to grow the GDP–debt, i.e. borrowing from future earnings and future energy consumption. |

Primary Energy vs. Real GDP , 1980 - 2015 |

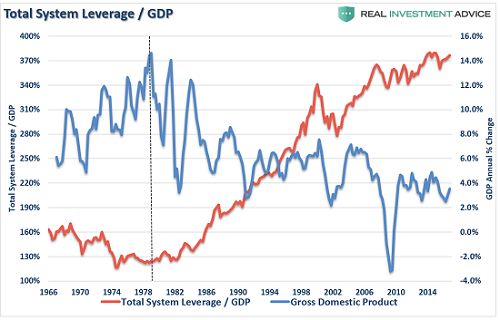

| My insightful colleague Lance Roberts of Real Investment Advice published this chart of total system leverage (i.e. the amount of debt piled on actual collateral) that shows leverage is climbing higher while GDP growth declines: the yield on increasing debt and leverage is diminishing rapidly. |

Primary Energy vs. Real GDP, 1966 - 2015 |

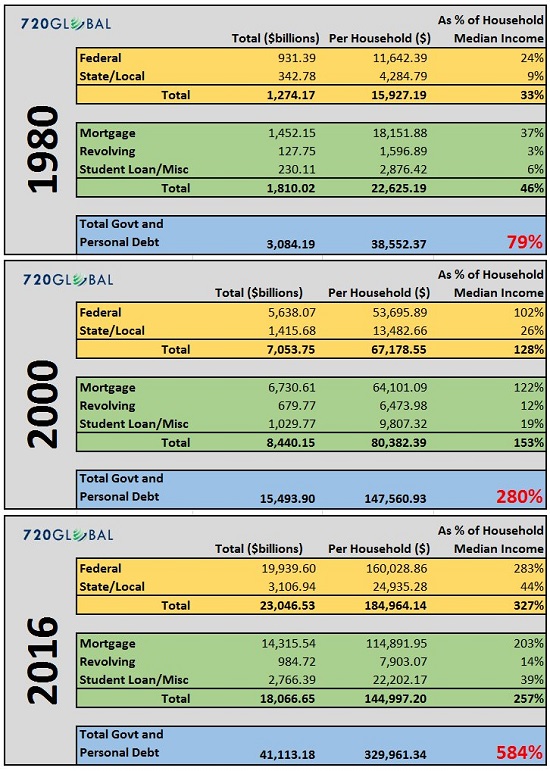

| Look at how debt in all sectors–household, corporate and government–has skyrocketed while GDP growth has been weak. Borrowing from future earnings and energy consumption only works when debt and leverage are low. Once the total cost of interest absorbs much of the national income, debt service chokes off growth. | |

| The rising tide of debt and financialization has eroded the share of the economy going to wages for decades. Simply put, financialization takes money out of the wage economy and funnels it to financial elites who are closest to central bank credit spigots. |

Wages and Salaries as Percent GDP, 1960 - 2017 |

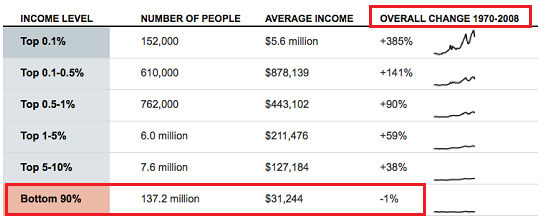

| This reality is visible in measures of rising wealth inequality. The incomes of the bottom 90% have gone nowhere for 45+ years when adjusted for inflation. The financial elites have enjoyed a nearly 400% increase in income during the same time span. | |

|

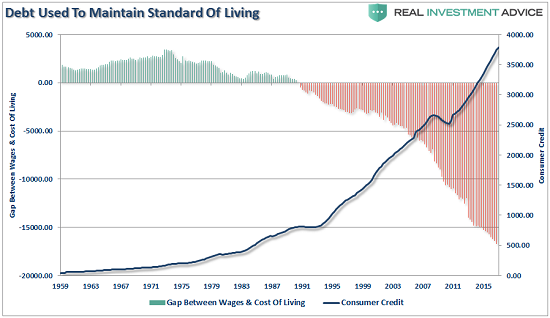

This chart, again courtesy of Lance Roberts, depicts how the bottom 90% has managed: by borrowing money to fill the gap between the rising cost of living and their stagnating real income. All that debt accrues interest, which flows to banks and the owners of the debt.

And we don’t “owe it to ourselves:” the vast majority of financial wealth such as debt (bonds, etc.) is held by the top 5% of households, and the vast majority of that concentrated wealth is owned by the top .5%.

|

Cost of Living Debt, 1959 - 2017 |

|

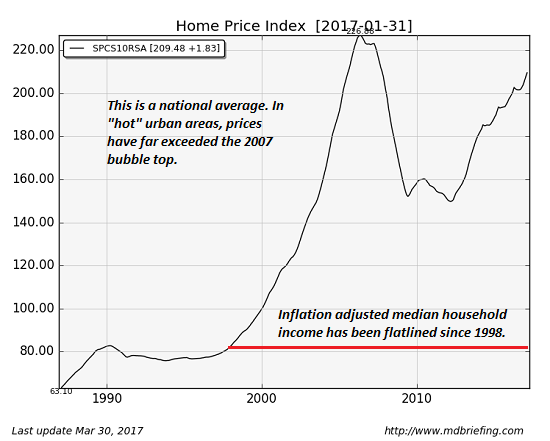

Here’s how the status quo has attempted to mask the destructive consequences of relying on massive expansions of debt to paper over our insolvency: rising home prices. As real incomes have gone nowhere and the debt loads on the average household have soared, the financial trick that makes it all right is to boost the price of homes so the owners experience a “wealth effect”: you’re not poorer, you’re richer–look at your expanding home equity.

|

Home Price Index, 1990 - 2017 |

That these sorts of credit-asset bubbles eventually pop is not mentioned. Once the asset bubbles pop, the illusion of wealth that can be drawn upon for decades to come vanishes.

The solution is a new decentralized way of living that bypasses the chokepoints of centralized political and financial power. Technologies enable such arrangements; now all we need is a social revolution in which we become aware that the dominance of a parasitic, self-serving elite class is not ordained; it is the output of the way we create and distribute currency at the top of the wealth-power pyramid rather than at the bottom, where people are actually working to improve their communities and households.

Why do we need a social rather than a political or economic revolution? Political and financial systems–including money–are social constructs. Political revolutions simply substitute one elite for another–Meet the new boss, same as the old boss.

The bedrock of systemic solutions is social revolution that re-aligns the social constructs of governance (politics), money and production / work / ownership (economics).

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the book's website.

Full story here

Are you the author?

Previous post

See more for

Next post

Tags: newslettersent