The Crypto-Bubble – A Speculator’s Dream in CyberspaceWhen writing an article about the recent move in bitcoin, one should probably not begin by preparing the chart images. Chances are one will have to do it all over again. It is a bit like ordering a cup of coffee in Weimar Germany in early November 1923. One had to pay for it right away, as a cup costing one wheelbarrow of Reichsmark may well end up costing two wheelbarrows of Reichsmark half an hour later. These days the question is how many wheelbarrows of US dollars one may need to pay for a bitcoin. Is it real? (As our readers know, the nature of reality poses certain problems). When we started writing this, bitcoin had just moved up by more than $600 in one week to its then level of $2,400 – within a little more than a day it reached an interim peak of $2,760, then plunged to an interim low of around $1850 in just two trading days, only to rally to a new high of $2,930 over the next two weeks. Currently it trades at $2,750 (don’t hold it against us if these figures are no longer true by the time this post is published). |

|

|

Naturally, the increasingly parabolic look of the bitcoin chart raises the question whether it represents a bubble, and if so, how large it will become. A good answer to the second part of the question is usually “larger than anyone thinks possible”. As to the first part, it may be fair to say that it has been in a bubble since shortly after its birth. At one point in 2009 the currency could be bought for 1/100 of 1 US cent (USD 0,0001). It rallied to 5 cents by 2010, which is quite a big move. We dimly remember a story about a pizza restaurant selling Margheritas for BTC 20,000 apiece at the time. In 2011 it reached a peak of $18.50 – and so on, and so forth. In recent weeks we occasionally watched in mute fascination as bitcoin fluctuated in ranges of several hundred dollars in the space of a few hours. On May 22 it had a little dip just below the $2,000 mark to give everyone a good entry point. But would it really be worth it? What if the bubble was about to collapse? Three days later the courageous dip buyers were up by almost 40%. Given how overbought bitcoin looks, one would have thought it a good idea to take the money and run, but of course we have no idea how crazy things will still get before everybody really starts dialing 1-800-GETMEOUT. A competing crypto-currency by the name of Ethereum (what a name!) has gained more than 2,400% this year, rising from $10 in January to $258 in early June. The move from $80 to $258 took just three weeks. So yes, it is a bubble of sorts, with an almost Tulipomania-like air about it. It is a speculator’s dream in many ways – BTC and ETH are undoubtedly great trading sardines. What interests us though is why this is happening. What is driving it? |

Bitcoin Daily Trade |

Fractal PatternsOne interesting thing about the chart of bitcoin is that it has a text-book Elliott wave shape (we have not labeled the chart, but it seems obvious to us that it lends itself to such labeling). This applies to the weekly chart shown further below as well and also to other time frames. Regardless of what one thinks of Elliott wave theory, price trends in financial markets definitely have fractal characteristics. Empirically they consist of sequences of patterns that are recurring over and over again in every conceivable time frame, i.e., the same patterns (or rather, very similar patterns, such as for instance triangles) that form on daily, weekly or monthly charts, also form on one minute, ten minute and hourly charts. These patterns appear to reflect various stages in the evolution of market psychology within the time frames captured by these charts. R.N. Elliott cataloged such recurring patterns in the stock market and tried to find out if they followed rules that could be defined and used for forecasts. Obviously such an endeavor is fraught with many difficulties. Particularly the validity of the theoretical framework that was created after the empirical identification of said patterns and the promulgation of the technical rules governing the Elliott wave principle seems questionable. But that is not really what we want to discuss here. One doesn’t necessarily have to believe that the Elliott wave principle is valid or useful for making accurate market forecasts in order to recognize that its leading practitioners have gathered a number of useful empirical insights. In this particular case we mention it mainly because typically, “textbook” Elliott wave patterns only emerge in markets with broad participation. Since these patterns reflect the predominant mood of market participants, or if you will, the “market mind”, recognizable shapes only tend to form in liquid markets with a large number of participants. While we cannot say what precisely the threshold is, i.e., at what point pure randomness is replaced with something that resembles a more orderly arrangement, the price chart itself conveys the information that the threshold has been crossed. The bid/ask spread of bitcoin is usually quite tight as well, although it has tended to widen amid the recent increase in volatility. We observed trading activity at one of the larger exchanges while it traded around $2,400 and a the time the bid/ask spread fluctuated from as little as 30 cents to short term wides of up to $7 when short term volatility spiked. Even at its widest the spread was therefore just ~0.2%, which also shows that this is market with broad participation. Keep in mind that we just observed the spread over a limited time window, it is therefore possible that it will occasionally be wider, but probably not by much. In short, a large number of market participants evidently regards bitcoin at the very least as a legitimate investment asset. Everything we write here will ultimately lead to the one question we really want to discuss, namely bitcoin’s status as “money”. We will get to that in Part 2, but we can tell you already that we continue to regard it as a secondary medium of exchange. |

Bitcoin Weekly Trade |

Exchanges in Trouble with Correspondence Banks – Honni Soit Qui Mal Y Pense!

Honni Soit Qui Mal Y Pense (shame on anyone who thinks ill of it). The motto appears on a representation of the garter surrounding the Shield of the Royal coat of arms of the United Kingdom. It already appeared in the 16th century on the coat of arms of John of Gaunt. One of the things that make bitcoin so attractive is that it allows anonymous, untraceable payments to be made, without middlemen. We actually have to amend that a bit: there are middlemen, since transactions have to be processed, or rather “confirmed” by bitcoin miners, and they charge a fee for that. These fees have recently risen sharply as the number of transactions has spiked, while the technical capabilities of the blockchain to handle them in a timely manner remains limited (a.k.a. the scalability problem). In fact, bitcoin first came to the broader public’s attention when it was revealed that the “Silk Road” market for illegal drugs and unregistered weapons on the darkweb used bitcoin as its medium of exchange. When news of this were reported in the press for the first time, the third bitcoin bubble got going. We actually don’t believe such marketplaces should even be illegal, as we have grave reservations regarding the prohibitions that make them so, but obviously, the anonymity of bitcoin transactions is a helpful feature for shadow economy entrepreneurs. When people learned about this, their assessment of bitcoin’s potential to become a legitimate medium of exchange, i.e., money, changed drastically. It is little surprise that bitcoin exchanges have often turned out to be somewhat opaque institutions as well. The formerly biggest one, Mt. Gox, found an ignominious end in 2013, with most of its customers bitcoins ending up stolen. Two of the largest (by volume) exchanges today are BTC-e and Bitfinex. No-one even knows where the servers of BTC-e are physically located, and only the first names of its owners are publicly known (they sound Russian). The exchange is as anonymous as a botcoin wallet, so to speak. And yet, it is the second-largest bitcoin exchange in the world. Bitfinex is located in Taiwan and has been at great pains to project an image of legitimacy, but that hasn’t helped it from being hampered by one of the interfaces with the world outside of bitcoin it urgently needs to actually function in the long run. To be precise, what happened was that its US correspondence bank Wells Fargo stopped servicing Bitstamp and its customers. At the same time Wells Fargo also withdrew from servicing Tether and its customers. Tether issues the “Tether Dollar” (USDT) – a crypto-currency that is backed 1:1 with US dollars, but can be used for transactions over blockchain type wallets and has become a popular replacement for USD on bitcoin exchanges. Although every USDT in issue seems indeed backed by one dollar, it has become impossible to exchange them unless one is a resident of Taiwan. In the meantime these problems have spread to other bitcoin exchanges and several of them now find themselves unable to transfer or receive US dollars. This has created a very interesting situation. In a way, Bitfinex has become a closed system, as most of the dollars that are already deposited there will have to remain there for the time being. In response to this development, many traders exchanged their dollars at Bitfinex for bitcoin, as bitcoin balances can of course still be transferred to bitcoin wallets without a hitch. Banking cartel members cannot get in the way, nor can anyone else. This has caused bitcoin to temporarily trade at premiums of more than $100 at Bitfinex and was no doubt a major factor in fueling the recent rally. |

|

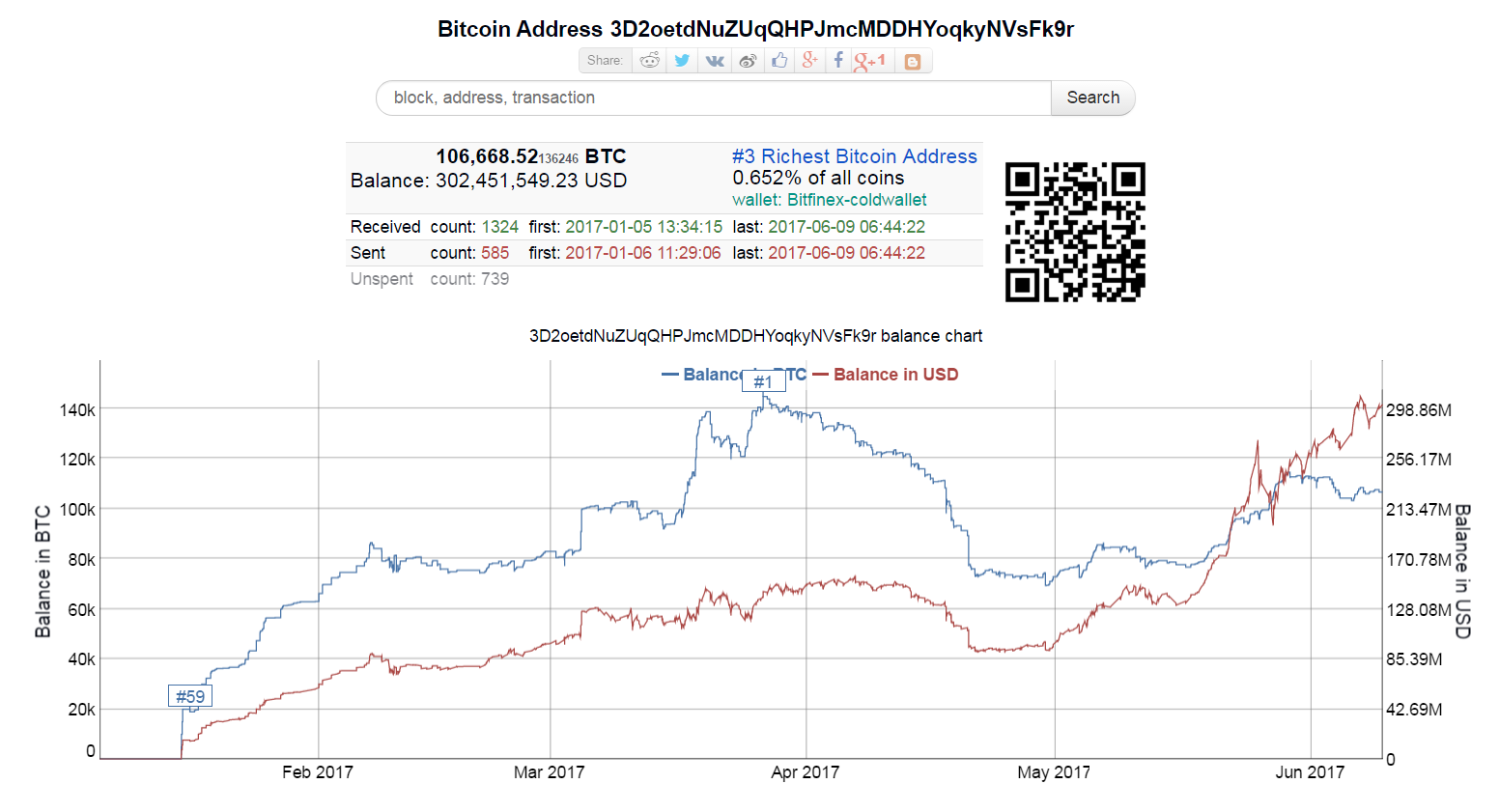

| The contents of the Bitfinex “cold wallet” – the third richest bitcoin address in the world, which holds the bitcoin of Bitfinex customers. The plunge in the wallet’s balance in April was triggered by the exchange’s banking problems. There seems to be hope that the problem will be resolved eventually, so balances have slightly increased again from their previous low point. Moreover, clients based in Taiwan are not affected by the correspondence bank issue and can still withdraw or deposit any currency they like.

In the meantime many speculators in Asian countries, from Korea to Japan to China seem to have become active in the bitcoin market and are adding more fuel to the fire, but we suspect that the increasing problems with getting US dollars or other fiat currencies in and out of numerous bitcoin exchanges is actually the major factor driving the rally. At the same time it has become known that Fidelity is now a bitcoin miner, accepts bitcoin as payment in its cafeteria and has hooked up with Coinbase, another bitcoin exchange. We have not yet heard about Coinbase experiencing correspondence bank problems, so it looks almost as if traders are herded into specific exchanges. As we said above: Honi soit qui mal y pense! What makes this interesting to us is the fact that one of the reasons why bitcoin functions as a secondary medium of exchange is precisely the fact that it is considered “liquid”, i.e., that it can be exchanged for fiat currencies at any time at a reasonably small bid/ask spread. We currently don’t believe that all bitcoin exchanges will be cut off from the fiat money system, but some sort of concerted attempt at suppression of these exchanges is clearly underway. |

Bitcoin Balance Chart, January 2017 - June 2017 |

“Moneyness”It may well be that Wells Fargo and other banks are merely concerned about potential regulatory issues if they continue to work with bitcoin exchanges – but why now all of a sudden and not before? In any case, the issue is important in connection with the potential for bitcoin and other crypto currencies to become genuine media of exchange, i.e., money that is accepted widely for the final payment for other goods and services in the economy without reservations. In Part 2 we will return to discussing bitcoin in the context of monetary theory. We already pointed out in past articles that a good case can be made that bitcoin does not conflict with Menger’s theory on the origin of money or the related regression theorem of Ludwig von Mises. We have given the issue some more thought in the meantime and have come up with a few new ideas in this context which we think support this argument. We still prefer gold as the premier “stateless” money – or let us rather say, monetary asset, since gold is nowadays not really money in the strictest definition of the term, even though the markets of course treat it as they would any other currency. But that doesn’t mean that bitcoin is not a viable contender for “moneyness” as well – particularly as it is a creature of the free market, just as gold money is. The fact that assorted fiat monies have recently declined faster against bitcoin than against gold is irrelevant in this context. In our opinion gold still enjoys advantages bitcoin cannot hope to match. More on this in part 2. Addendum and Bonus ChartAs we finish writing this article, bitcoin trades at $2855 – it hasn’t taken very long for it to gain another $100. And here is a daily chart of the closest bitcoin competitor ethereum (ETH-USD) – which as you might guess, has risen a bit further as well: |

Ethereum |

Tags: newslettersent,Virtual Currencies