Net acquisition of financial assets

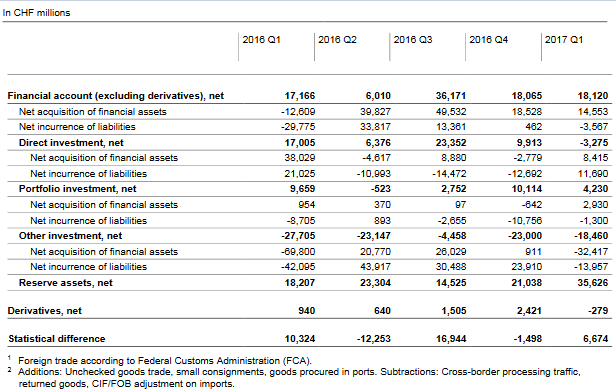

The net acquisition of financial assets totalled CHF 15 billion (Q1 2016: net reduction of CHF 13 billion). Reserve assets saw a net acquisition of CHF 36 billion (Q1 2016: net acquisition of CHF 18 billion) as a result of the SNB’s foreign currency purchases. Direct investment recorded a net acquisition of CHF 8 billion (Q1 2016: net acquisition of CHF 38 billion), with resident parent companies reinvesting profits in their non-resident subsidiaries and, additionally, strengthening the subsidiaries’ equity capital. Portfolio investment posted a net acquisition of CHF 3 billion (Q1 2016: net acquisition of CHF 1 billion), as resident investors purchased mainly collective investment schemes from non-resident issuers. By contrast, other investment recorded a net reduction of CHF 32 billion (Q1 2016: net reduction of CHF 70 billion). This was the result, first, of the SNB reducing its financial assets abroad that are not included in reserve assets and, second, commercial banks decreasing their claims against non-resident banks.

Net incurrence of liabilities

Overall, the liabilities side of the financial account registered a net reduction of CHF 4 billion (Q1 2016: net reduction of CHF 30 billion). Other investment recorded a net reduction of CHF 14 billion (Q1 2016: net reduction of CHF 42 billion), primarily due to commercial banks decreasing their liabilities towards non-resident banks. Direct investment saw a net incurrence of CHF 12 billion (Q1 2016: net incurrence of CHF 21 billion). In particular, this was the result of resident parent companies taking out loans from their non-resident subsidiaries. Portfolio investment showed a net reduction of CHF 1 billion (Q1 2016: net reduction of CHF 9 billion); while non-resident investors purchased debt securities from resident issuers, they sold comparatively more shares of resident issuers in terms of value.

Net

As in the year-back quarter, the financial account balance came to CHF 18 billion. This is calculated as the sum of all net acquisitions of assets minus the sum of all net incurrence of liabilities plus the balance from derivatives transactions. This positive financial account balance corresponds to the increase in the net international investment position resulting from cross-border investment.