Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden years of millions of retirees across the world. None of the econometrics models provide a solution for the growing gap in pension funding, other than unsustainable debt accumulation.

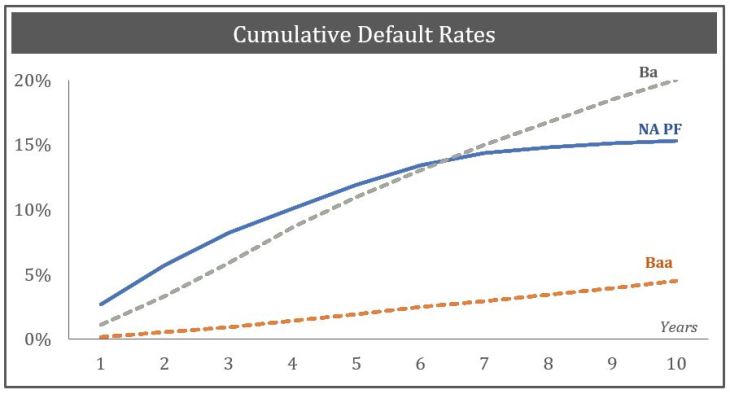

| Creativity cascaded to the less sophisticated pension fund managers. In a desperate reach for yields they increased exposure to project finance. Perceived higher returns, long-term investment horizon and inflation protection made it the perfect match for pension funds. However, like their central banker peers, pension fund managers were completely mistaken. Actual risks were largely underestimated. The binary nature of cashflow risks makes conventional risk measures meaningless. This is best illustrated by looking at the cumulative default rates of project finance (1991-2011) in North America, which exceeded the default rate of the non-investment grade Ba bonds in the first 6 years and is more than triple that of investment grade default rates.

The European Investment Bank (EIB) decided to ride the wave of project finance and waste taxpayers’ money by providing loans and insurance on risks that EIB cannot remotely comprehend. They ignored the fact that mono-liners in the US did the same a decade ago and paid a hefty price when the bubble burst where almost all bond insurers went out of the market. EIB did not find a better place to start its program other than Spain. A country with a remarkable record of failed PPP infrastructure projects and more than 30 bankrupt ghost airports for sale. The clueless EIB bureaucrats invested in the EUR 1.4 Billion Castor Gas Storage project. A marvelous system that stores one third of Spain’s gas consumption but has a single problem. Operating the facility causes “minor” earthquakes. In less than a year, it was permanently closed and EIB left the indebted Spanish government with an additional EUR 1 Billion to pay. Eventually, the next financial shock will catchup to EIB and no one knows if taxpayers will be able to bail them out. In the meantime, retirees continue to bear the consequences of the compounded creativity of central bankers, pension fund managers and government bureaucrats with nothing left to do other than electing equally creative politicians. |

Cumulative Default Rates 10Years |

Full story here Are you the author? Previous post See more for Next post

Tags: Banking,bubble,central-banks,Economics,Europe,Finance,Monetary Policy,newslettersent