| In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank’s interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the “the BoJ comes in big, the average return on the [Nikkei] is about 14 basis points higher” with Nomura calculating that “the BoJ has provided a cumulative boost to the Nikkei of about 1,400 points”… |

Nikkei 225 vs. BoJ ETF Holdings 2011-2017 |

| … the one thing about the BOJ is that it keeps its interventions local, and tends to mostly prop up Japanese stocks, whether the Nikkei 225 or the Topix.

The answer was revealed on Friday when the hedge fund known as the “Swiss National Bank” posted its latest 13-F holdings. What it showed is that, as rumored, the Swiss National Bank had gone on a record buying spree in the first quarter, boosting its total equity holdings to an all time high $80.4 billion, up $17 billion from the $63.4 billion at the end of 2016, the biggest quarterly increase in “AUM” in history. |

|

| Yet while we are long beyond the point of debating the central bank intervention in equity markets (we do want to remind readers that until several years ago, it was considered “fake news” to even mention it, and those who accused central bankers of manipulating stock markets were said to be paranoid tinfoil basement dwellers), we want to point out that unlike the BOJ, which at least keeps its capital markets distortion local, the SNB, which likewise creates money out of thin air (then sells it for dollars in an attempt to keep the Swiss franc depressed) is actively resulting in even greater price distortions in the US.

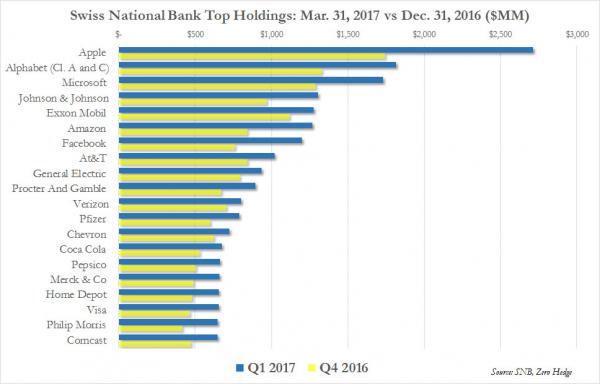

While we doubt this will be investigated with stocks are at all time highs, we look forward to the Congressional hearings after the crash when the scapegoating and fingerpointing begins, and everyone is “stunned” to learn that central banks were responsible for blowing the biggest asset bubble the world has ever seen by directly buying stocks. What else did the SNB reveal in its 13F? Two main things. First, its top 20 holdings are as shown in the following chart. The central bank was clearly not shy in adding to its top positions, especially the top position. |

Swiss National Bank Top Holdings: Q1 2017 vs Q4 2016 |

| And while we don’t know if Warren Buffett was actively frontrunning the SNB when he more than doubled his AAPL stake in Q1, making him a top 5 holder of the tech giant, a look at the SNB’s holdings of AAPL stock which increased from 15 to 18.9 million shares, shows why the Nasdaq – as observed earlier in the day by Goldman Sachs – just refuses to drop hitting daily all time highs.

The chart above may also explain why Goldman is bullish on the Nasdaq 100: after all, when a central bank can and does create money out of thin air, then splurges on the company that accounts for 12% of the weight in the Nasdaq, pushing the Nasdaq and all indices higher, what is the point of even talking about “risk”? Source: SNB 13-F |

Swiss National Bank AAPL Holdings 2014 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Japan,Business,Capital Markets,Capitalism,central banks,Equity Markets,Finance,Financial markets,Goldman Sachs,NASDAQ,Nasdaq 100,newslettersent,Nikkei,Nikkei 225,Nomura,SNB Apple Holdings,SNB equity holdings,stock market,Swiss Franc,Swiss National Bank,Warren Buffett

1 comments

Stefan Wiesendanger

2017-05-10 at 11:24 (UTC 2) Link to this comment

The article echoes a common misunderstanding among anglo-saxon commenters of the SNB’s actions. While the Fed is creating USDs out of thin air thanks to the international use of the USD (the “exorbitant privilege”), the SNB is doing nothing of the kind. The SNB is investing hard-earned savings of Swiss actors in their aggregate dealings with the rest of the world. In the old days, if these same Swiss actors repatriated their profits into the CHF, the SNB would convert the corresponding claims against the rest of the world into gold. Nowadays, gold has lost that role (NB by agreement of debtor countries), leaving as the only alterantive other investable assets. It is nothing but understandable that the SNB diversifies these assets also into shares with a small proportion of 20%.

In summary, from a Swiss perspective, the American allegations are outrageous:

While the US can create currency with which to finance the government and buy foreign assets including companies at practically no cost, Switzerland does the same with hard, real cash savings, like in the old days of the gold standard.

While the Fed really is creating money out of thin air, the SNB is simply rendering a fiduciary service to Swiss savers by temporarily taking their foreign assets on its balance sheet for as long as they are reluctant to invest abroad themselves. The negative interest is the stick to tell them that this safe haven can only be temporary. Not convinced that this is what’s happening? Just compare the current account of Switzerland with the SNB balance sheet and it will become obvious.

And finally, how can the American criticism be reconciled with the fact that on purchasing power terms, the CHF is among the most overvalued currencies in the world? The answer is: it simply can’t.