Summay

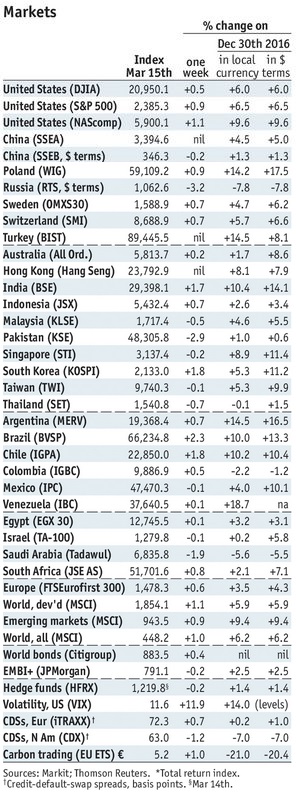

Stock MarketsIn the EM equity space as measured by MSCI, Russia (+4.8%), Mexico (+4.7%), and Poland (+4.1%) have outperformed this week, while Qatar (-0.8%), UAE (-0.4%), and Hungary (+0.4%) have underperformed. To put this in better context, MSCI EM rose 4.3% this week while MSCI DM rose 1.0%. In the EM local currency bond space, Turkey (10-year yield -37 bp), Indonesia (-26 bp), and South Africa (-16 bp) have outperformed this week, while Argentina (10-year yield +43 bp), Romania (+22 bp), and Czech Republic (+18 bp) have underperformed. To put this in better context, the 10-year UST yield fell 7 bp to 2.50%. In the EM FX space, ZAR (+3.2% vs. USD), TRY (+3.1% vs. USD), and COP (+2.4% vs. USD) have outperformed this week, while EGP (-2.5% vs. USD), ARS (-0.3% vs. USD), and PKR (flat vs. USD) have underperformed. |

Stock Markets Emerging Markets, March 18 Source: Economist.com - Click to enlarge |

ChinaThe People’s Bank of China increased the rates it charges for open-market operations and for its medium-term lending facility by 10 bp. The bank stressed that these moves didn’t equate to hikes in the policy rates, noting that banks still have strong incentives to expand credit. We note that both rates were raised 10 bp earlier this year. Indian Prime Minister Modi’s BJP won elections in the state of Uttar Pradesh. The party won 312 seats in the 403-seat state assembly, up sharply from 47 seats in 2012. The win suggests that Modi can move ahead with nationwide structural reforms such as the GST. The win also shows that Modi’s popularity did not really suffer from the November demonetization. Czech RepublicCzech central bank broached the possibility of a koruna cap exit later than mid-2017. That is the current forward guidance, but Vice Governor Hampl said that an exit “slightly” beyond that would be “safer.” If current economic trends continue, we favor an exit at either the May 4 or June 29 policy meetings. KuwaitKuwait became the first OPEC member to call for extended output cuts. Officials want to extend the cuts beyond June. Kuwait also successfully issued its first global bond, with $29 bln in bids for the $8 bln issue allowing for tighter than expected pricing. BrazilMoody’s raised the outlook on Brazil’s Ba2 rating from negative to stable. We agree with this move, as our own sovereign ratings model has Brazil’s implied rating at BB/Ba2/BB. Actual BB/Ba2/BB ratings thus appear to be correct. The economic outlook this year is poor, but we see scope for further improvement in Brazil’s implied rating if the cyclical recovery begins this year. Brazilian prosecutor Janot has given the Supreme Court a list of dozens of politicians that are suspected of receiving bribes. Though the list remains sealed, local press is reporting that it includes ten governors, several members of Temer’s cabinet, the House and Senate leaders, and several lawmakers. Stay tuned. ColombiaFitch revised its outlook on Colombia’s BBB rating from negative to stable. The agency cited the government’s “disciplined policy response” to lower oil prices, which included an unpopular sales tax hike. The negative outlook had been in place since last July. Our own sovereign ratings model shows Colombia’s implied rating at BBB/Baa2/BBB. Actual ratings of BBB/Baa2/BBB appear to be correct. |

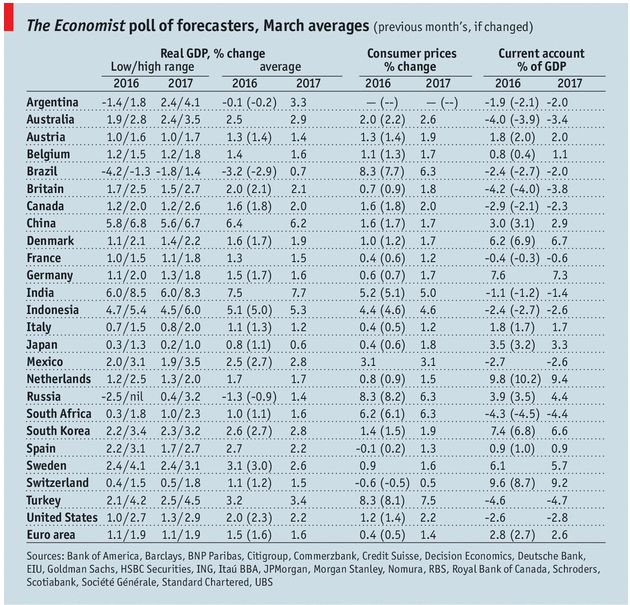

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, March 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent