Summary

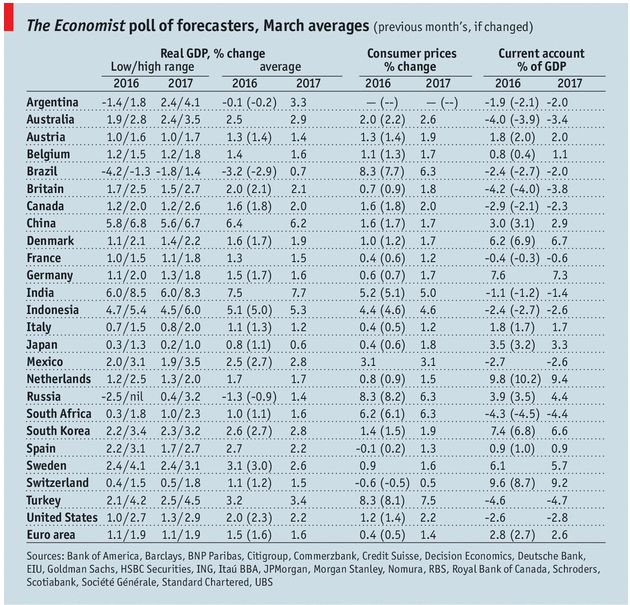

Stock MarketsIn the EM equity space as measured by MSCI, Egypt (+3.5%), Korea (+0.9%), and Hong Kong (+0.5%) have outperformed this week, while Peru (-5.1%), Russia (-4.6%), and Brazil (-3.0%) have underperformed. To put this in better context, MSCI EM fell -0.4% this week while MSCI DM fell -0.1%. In the EM local currency bond space, Peru (10-year yield -5 bp), South Africa (-4 bp), and Israel (-4 bp) have outperformed this week, while the Philippines (10-year yield +24 bp), Hungary (+18 bp), and Russia (+15 bp) have underperformed. To put this in better context, the 10-year UST yield rose 10 bp to 2.58%. In the EM FX space, ILS (+0.6% vs. USD), INR (+0.3% vs. USD), and COP (+0.2% vs. USD) have outperformed this week, while EGP (-8.3% vs. USD), BRL (-1.3% vs. USD), and RUB (-1.0% vs. USD) have underperformed. |

Stock Markets Emerging Markets, March 10 Source: Economist.com - Click to enlarge |

North KoreaNorth Korean banks subject to international sanctions have been banned from using Swift. The Society for Worldwide Interbank Financial Telecommunication said it had been informed by Belgian authorities that they would no longer provide the “necessary authorizations” for it to continue offering services to North Korean banks covered by United Nations sanctions. Korea’s Constitutional Court upheld Parliament’s motion to impeach President Park. A new election will be held within 60 days. The three leading contenders (according to the most recent Gallup poll) to replace Park are Moon Jae-in and Ahn Hee-jung of the largest opposition Democratic Party of Korea, and Ahn Cheol-soo of the smaller opposition People’s Party. Macro policy will remain prudent whoever is elected, but there are likely to be positive micro changes (with regards to how the chaebol operate) in the next administration. SingaporeSingapore eased some property market curbs after a three-year decline in home prices. Specifically, the stamp duty for sellers was reduced and debt ratio rules for some mortgages were eased. Measures will go into effect March 11. EgyptEgypt partially reversed a cut in bread subsidies. A senior official had defended the cuts to the program as necessary to cut waste and corruption. Demonstrations against the subsidy cuts took place across the country. Inflation is running at 30.2% y/y in February, and so any subsidy cuts would hurt consumers even more. NigeriaNigeria’s President Buhari returned to the nation after spending nearly two months in the UK. However, Buhari said that his Vice President Osinbajo will remain in charge of running the government. This suggests that his illness (whatever that may be) is still an issue that is preventing a return to a more normal situation. Moody’s moved its outlook on Argentina’s B3 rating from stable to positive. The agency noted that the nation’s improved policy stance will support a return to economic growth in 2017. That in turn will allow Argentina to begin reducing its fiscal deficits in 2018. Our own sovereign ratings model showed Argentina’s implied rating fall a notch to B/B2/B in Q1. This suggests Moody’s is decision was correct. S&P’s B- ratings may also be adjusted but Fitch appears on target with its B rating. BrazilPress reports that Brazil is considering a tax on FX transactions. Officials denied it but of course, this brings back memories of the IOF (financial transactions) tax on FX inflows that was introduced back in 2010 to help prevent excessive BRL gains. We need to see more evidence or details about this IOF story, but markets would likely take it as BRL-negative. |

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, March 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent