Stock MarketsEM FX ended last week on a soft note despite lower US rates. The dollar regained some traction that it lost over the course of the week, when markets pushed out Fed tightening beyond March. Treasury Secretary Mnuchin also seemed to push out fiscal stimulus. There is a full slate of Fed speakers this week, and Wednesday sees the release of the Fed’s Beige book that was prepared for the March 15 FOMC meeting.

Idiosyncratic events helped EM last week too, as MXN was boosted by the FX hedging plan and signs of thawing US-Mexico relations. Looking ahead, China gives us its first glimpse of the mainland economy in February. EM trade and inflation data for February will also start to be reported, with stronger growth and rising price pressures making a case for monetary tightening this year in Asia and EMEA. |

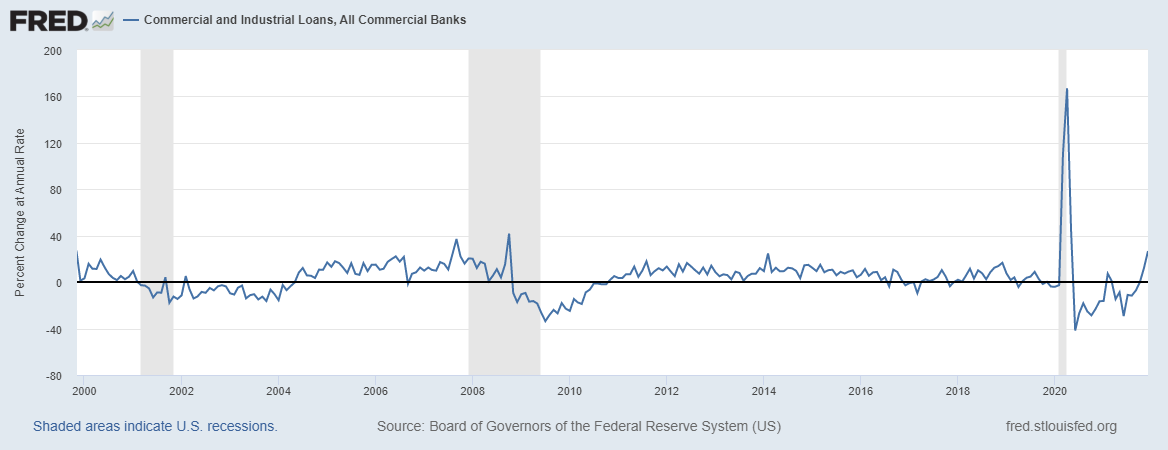

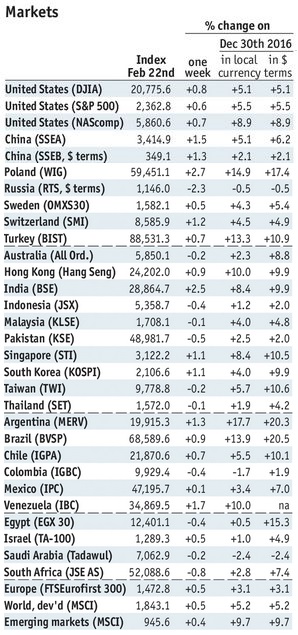

Stock Markets Emerging Markets February 22 Source: economist.com - Click to enlarge |

MexicoMexico reports January trade Monday, with a deficit of -$2.92 expected. Exports have risen y/y for two straight months now, driven by both petroleum and manufacturing. Imports have also risen y/y for two straight months now, driven mostly by intermediate goods. Consumer and capital goods imports are contracting still. Banco de Mexico releases its quarterly inflation report Wednesday.

IsraelBank of Israel meets Monday and is expected to keep rates steady at 0.10%. CPI has finally moved back into positive territory, rising 0.1% y/y in January. This is the first positive reading since July 2014. Low base effects should push inflation back into the 1-3% target range in H1, and we see no need for further easing.

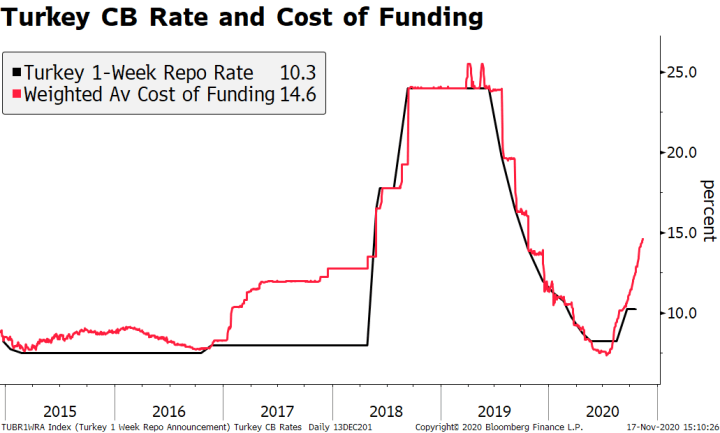

South AfricaSouth Africa reports January money and loan, trade, and budget data Tuesday. The budget for FY2017/18 focused on austerity at the expense of growth. Monetary tightening is likely over for now, but further fiscal tightening will be another headwind for the economy. Next policy meeting is March 30, and no rate hike is likely. TurkeyTurkey reports January trade Tuesday, with a deficit of -$4.15 bln expected. It then reports February CPI Friday, which is expected to rise 9.74% y/y vs. 9.22% in January. CPI would move further above the 3-7% target range, but the central bank has hesitated to hike rates outright. Instead, it has used the rates corridor in recent months to push interbank rates higher. Next policy meeting is March 16. If the lira remains firm, then no rate hike is likely..

ChileChile reports January manufacturing production Tuesday, which is expected to be flat y/y vs. -0.3% in December. The central bank releases minutes Wednesday. January retail sales will be reported Friday, which are expected to rise 3.7% y/y vs. 4.1% in December. The economy remains sluggish even as price pressures are easing. Next policy meeting is March 16, and another 25 bp cut is possible then. The bank started the easing cycle with a 25 bp cut in January but stood pat in February. HungaryNational Bank of Hungary meets Tuesday and is expected to keep policy steady. The bank plans to review its unconventional policy (benchmark deposit cap) at the March meeting. With inflation rising, the central bank may tilt less dovish in the coming months. Hungary reports January retail sales Friday, which are expected to rise 4.0% y/y vs. a revised 3.3% in December.

KoreaKorea reports February trade Wednesday. Exports are seen rising 13.6% y/y and imports are seen rising 21.2% y/y. It then reports January IP Thursday, which is expected to rise 2.0% y/y vs. 4.3% in December. Korea reports February CPI and January current account data Friday. Inflation is seen easing to 1.8% y/y from 2.0% in January.

ChinaChina reports official and Caixin February PMI readings Wednesday. The official PMI is seen easing a tick to 51.2, while the Caixin PMI is seen falling slightly to 50.8. The mainland economy is stabilizing, but markets should not expect robust growth in 2017.

ThailandThailand reports February CPI Wednesday, which is expected to rise 1.53% y/y vs. 1.55% in January. This is within the 1-4% target range. Low base effects could push inflation into the upper half of the range this year, necessitating a more hawkish stance from BOT. Next policy meeting is March 29, no change is expected then.

BrazilBrazil reports February trade Wednesday. COPOM minutes will be released Thursday. At that meeting, it cut rates 75 bp to 12.25% and the accompanying statement suggested potential for a faster pace of easing. Minutes could clarify the conditions for this. At the very least, we expect another 75 bp cut to 11.50% at the next meeting April 12.

NegaraBank Negara meets Thursday and is expected to keep rates steady at 3.0%. CPI jumped 3.2% y/y in January, the highest rate since February 2016. While the central bank does not have an explicit inflation target, rising price pressures will keep it in hawkish mode this year. Malaysia reports January trade data Friday. Exports are expected to rise 15% y/y and imports are expected to rise 10.4% y/y.

ColombiaColombia reports February CPI Saturday, which is expected to rise 5.37% y/y vs. 5.47% in January. If so, this would still be above the 2-4% target range. The pace of disinflation appears to be easing. Last Friday, the central bank unexpectedly cut rates 25 bp to 7.25%. Steady rates were expected.

|

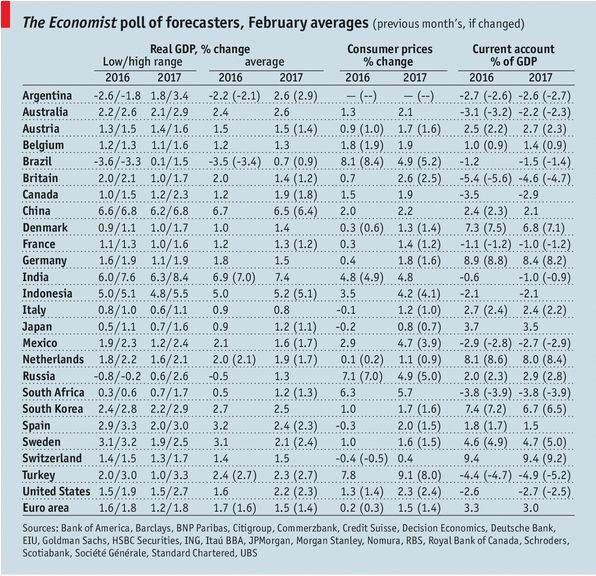

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, February 2017 Source: Economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent,win-thin