Summary

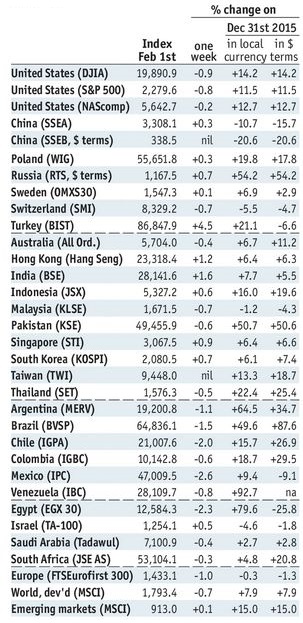

Stock MarketsIn the EM equity space as measured by MSCI, Turkey (+5.7%), Colombia (+2.5%), and Mexico (+2.4%) have outperformed this week, while Qatar (-4.2%), UAE (-3.8%), and the Philippines (-1.6%) have underperformed. To put this in better context, MSCI EM rose 0.6% this week while MSCI DM was flat.

In the EM local currency bond space, Brazil (10-year yield -28 bp), Turkey (-20 bp), and Russia (-12 bp) have outperformed this week, while Taiwan (10-year yield +6 bp), Thailand (+6 bp), and Hungary (+5 bp) have underperformed. To put this in better context, the 10-year UST yield fell 6 bp this week to 2.43%.

In the EM FX space, TRY (+4.6% vs. USD), COP (+3.0% vs. USD), and MXN (+2.8% vs. USD) have outperformed this week, while CZK (flat vs. EUR), MYR (+0.1%% vs. USD), and PHP (+0.1% vs. USD) have underperformed.

|

Stock Markets Emerging Markets February 06 Source: economist.com - Click to enlarge |

PhilippinesPhilippine Environment Department suspended 5 mines and closed 21 after a nationwide audit. Environment Secretary Gina Lopez said that the moves were made to enforce environmental standards. She added that the mines closed account for nearly half of the nation’s nickel output, which itself accounts for nearly a quarter of global output.

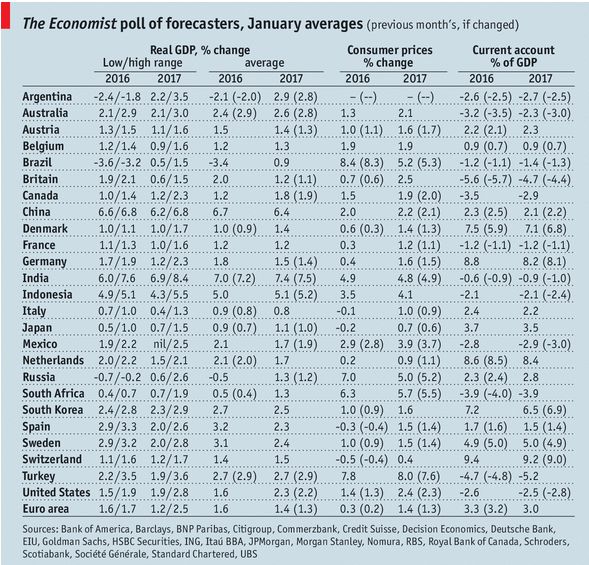

TurkeyThe Turkish central bank raised its end-2017 forecast from 6.5% to 8% due largely to the weak lira. It said that the 5% target is unlikely to be met until 2019. January CPI was reported at a much higher than expected 9.22% y/y. The central bank refrained last month from hiking the benchmark rate whilst instead conducting backdoor tightening.

Central Bank of Turkey finally got around to releasing the schedule of its MPC meetings this year. We don’t know if they ever announced it, but the number of meetings have been reduced from 12 last year to 8 this year. The next meeting is March 16. Whilst a lot of banks have changed the frequency of policy meetings, it’s hard not to feel that this is just another move away from transparency under Erdogan.

Fitch downgraded Turkey last Friday to sub-investment grade BB+, as expected. Outlook is stable. Earlier in the day, S&P moved the outlook on its BB rating from stable to negative. We think further cuts are warranted as Turkey is edging closer and closer to BB-/Ba3/BB- in our own ratings model.

BrazilAllies of Brazil President Michel Temer now head up both houses of congress. Incumbent Rodrigo Maia was re-elected speaker of the lower house, while Eunicio Oliveira was elected Senate president. These posts set the legislative agendas for both houses, and so their election bodes well for Temer’s reform plans.

MexicoPress reports that the Mexican government has told state governors that it is canceling the planned gasoline price increase tomorrow. Press reports cited Graco Ramirez Garrido Abreu, president of the national governors’ conference (Conago). However, the Finance Ministry later said that the price hike has been delayed, not canceled. Stay tuned.

|

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent,win-thin