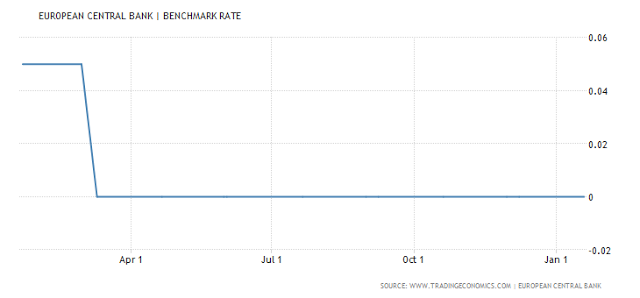

European Central BankWe discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. |

|

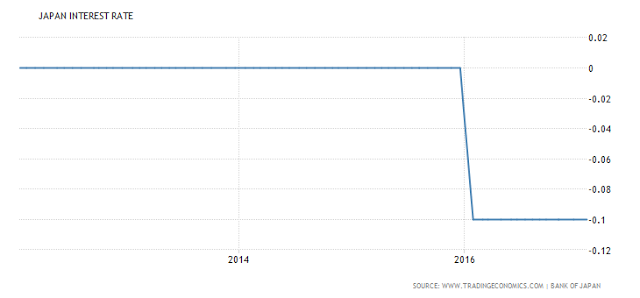

JapanThis ends badly every time Central Banks. You can run this model 1 Million iterations, and it plays out the same way, the financial bubble implodes in on itself where liquidity evaporates into nothingness. |

Japan Interest Rates - 2013 - 2017 March |

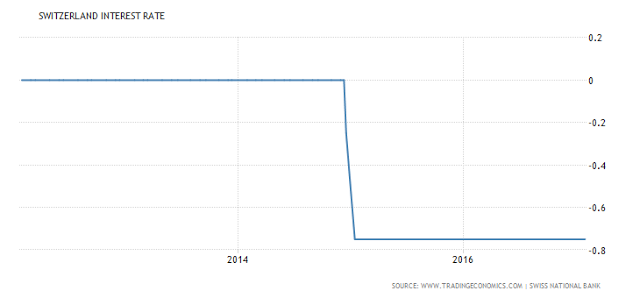

SwitzerlandIt is ironic that when the bubble pops, given all the Central Bank infused liquidity to create this bubble paradigm, that all liquidity dries up, and all the sudden there is no real liquidity at all in the system when everyone direly needs it! |

Switzerland Interest Rates - 2013 - 2017 March |

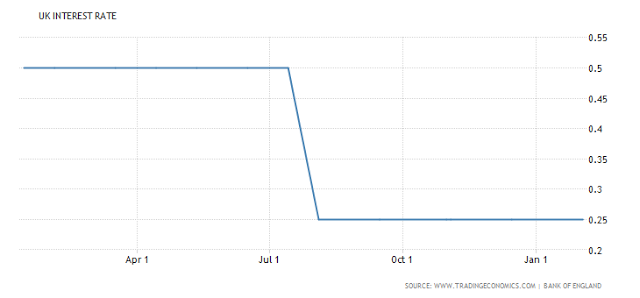

United Kingdom |

UK Interest Rates - March 2016 - 2017 |

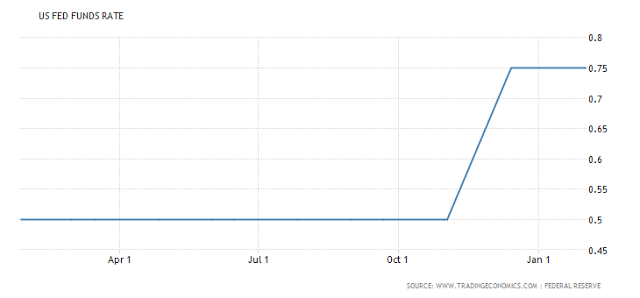

United States |

US Interest Rates - March 2016 - 2017 |

Conclusion:

Tags: Bank,Banking,Business,Carry Trade,central banks,Economic bubble,economy,Federal Reserve,Finance,Financial markets,Interest Rate,Japan,Monetary Policy,money,newslettersent,Switzerland,Systemic risk,Twitter,US Federal Reserve