| Investors are anxiously awaiting more details on the new US Administration’s economic policies and priorities. Part of the challenge is that the cabinet represents a wide range of views and it is not clear where the informal power lies, or whose call is it. In terms of economic policy, trade is being given priority. It is seen as the key to the jobs and growth objectives.

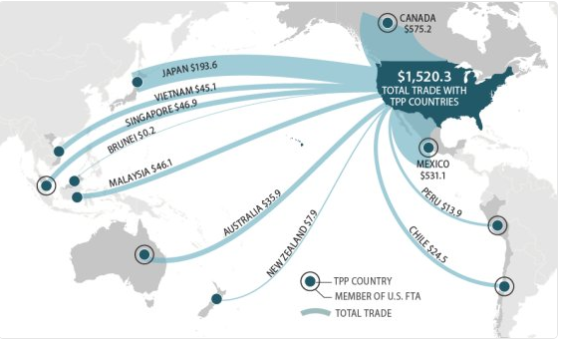

There have been two initiatives: formally withdrawing for the Trans-Pacific Partnership and indicating a desire to re-open NAFTA. Neither one is surprising, but will likely nevertheless have far-reaching ramifications. In the previous administration, the two issues were tied together. NAFTA was understood to need updating, but rather than re-open negotiations per se, Obama opted to include Canada and Mexico into the TPP would supplant NAFTA. For the Trump Administration, not participating in TPP, exposures a greater importance of re-opening NAFTA. For the Obama Administration, TPP was a compliment to the “pivot to Asia.” It was a case of the flag following the trade. For more than 30-years, more goods cross that Pacific than the Atlantic. Without TPP, the economic compliment, the pivot to Asia take on a more militaristic tenor, which concerns China as a new form of containment. The Great Graphic posted here is from Cato Institute economists and depicts US trade with TPP countries. In fairness, none of the last three candidates for President (Trump, Clinton, and Sanders) supported TPP. Australia and Japan are pushing to keep TPP without the US, which is possible. It is also still possible that Trump negotiates a bilateral free-trade agreement with Japan. Many investors and economists do not seem to recognize the importance of NAFTA. The trade that is covered by the agreement accounts for almost a third of US trade, or roughly $1 trillion. In comparison, China is about a sixth and the UK, which appears to be moving higher in the queue under in the Trump Administration, accounts for a tenth of US trade. |

Trans-Pacific Partnership |

The auto sector has been a bit of a lightening rod for the new Administration. Industry figures suggest that Mexican-made vehicles are made of about 40% American parts on average. The US exported about $22 bln in vehicle parts to Canada in 2015 and $20 bln to Mexico. About 12% of US-made care are from Mexican parts. A little over half of Mexican-made cars are exported to the US. GM, Ford, and Chrysler account for almost half of Mexico’s light vehicle production.

President Trump seems to prefer bilateral agreements rather than the large multilateral deals, like TPP. New bilateral agreements could replace NAFTA, but a key element for the new Administration may be the domestic content rules. Also, some like Commerce Secretary Ross is also concerned about the VAT that Mexico has lifted from 10% to 16%, and which is deductible for exporters. Ross has argued this discourages exports and encourages manufacturers to build production facilities in Mexico.

We have argued that for historical reasons US companies pursued a direct investment strategy over the more traditional export drive. The dollar was very strong under Bretton Woods, and as countries rebuilt after WWII, direct investment was a way around protectionism. Under the floating exchange rate period, direct investment was also embraced as a way to insulate companies from the new volatility of currencies. If the Trump Administration is going to discourage the direct investment strategy, Corporate America will be undergoing a more dramatic re-orientation than many seem to realize.

Full story here Are you the author? Previous post See more for Next post

Tags: NAFTA,newslettersent,Trade,U.S. Crude Oil Inventories