|

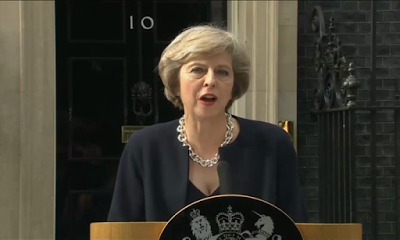

The Pound has had its worst day in two months yesterday, with exchange rates against most of its major currencies now reaching a two month low, and Swiss Franc exchange rates reaching down to the much dearer end of the 1.20’s once more. Theresa May’s comments yesterday were inflammatory but still fairly vague. She gave little away but markets were all collectively worried enough about the potential reaction that this caused a run against the Pound. She made a few comments that hinted we could not pick and choose individual aspects of the Brexit that suited us, and, which was suggestive that we were heading towards a harder Brexit than some of their recent rhetoric has suggested. David Davis, the Brexit Secretary, had previously said that it was likely the UK would continue to pay for preferential access to the single market only a month ago in a deposition to Parliament. It seems markets are given two sides to the same story. Davis is showing the aims for Parliament, and May is posturing as part of the pre-negotiation phase. However, similar posturing comments from the likes of French President Francois Hollande and the German Chancellor Angela Merkel in quick succession caused a complete flash crash on the Pound. GBP/CHF fell by more than 5 cents on the day. |

GBP/CHF - British Pound Swiss Franc, January 10(see more posts on GBP/CHF, ) |

The dual hit for CHF buyers is that in times of uncertainty the Swiss Franc gains even further value as a safe haven currency. So the sudden loss in value for the Pound was coupled with a hefty gain on CHF value, meaning that GBP/CHF was one of the heaviest losers on the day yesterday.

Markets are still reeling from the news, with GBP/CHF beginning the day 0.7 cents down on the day.

There is still the potential for improvements this week, but in a panicking market, often the sensible option is simply to draw a line under any planned purchase and accept the current levels of exchange. This hypersensitivity could lead to further drops.

Pound Sterling is still feeling the effects of UK Prime Minister, Theresa May’s comments regarding the Brexit over the past weekend, with GBP/CHF now trading in the 1.23’s as the Pound continues to weaken.

Sterling lost almost 1% during Monday morning as investors digested May’s comments. She alluded to the government focusing on controlling immigration and it appears that this is a priority as opposed to retaining access to the single market.

May also said that the UK cannot keep ‘bits’ of EU membership and financial markets also interpreted this as a move in the direction of a so-called ‘Hard Brexit’ which as usual resulted in weakness for the Pounds value.

Moving forward I expect to see the Pound weaken further as we await the outcome of the Supreme Court’s impending decision on whether or not the UK government requires parliamentary approval before beginning the process of exiting the EU.

The markets are generally expecting to see the pound fall further if the government is successful in their appeal, as a successful appeal would result in the Brexit beginning at the end of March as May has previously planned.

If you wish to be kept up to date with how the appeal unfolds, along with any other potential big moves between the GBP/CHF pair, feel free to get in touch.

Supreme Court Judgement could cause big swings on GBP/CHF

The supreme court judgement on whether parliament will get the vote on triggering article 50 is ongoing. I expect the ruling to come through between 12th-17th January. This could have serious implications on GBP/CHF. If parliament do get the vote there is the probability that there will be a soft brexit. If there are temporary trade deals in place while the new trade deals are being negotiated it will take some of the uncertainty away from the market with regards to the future of the UK economy. I would expect to see Sterling strengthen significantly.

If parliament do not get the vote, a hard brexit becomes more likely. Trade negotiations will be elongated and the pound will suffer as a a result. Sir Ivan Rogers, the UK ambassador to the EU recently resigned after making his concerns known about the unrealistic time frame for trade negotiations to be completed. He estimates it could take as long as a decade when the target is a mere two years.

I think the ruling will go in favour of parliament getting the vote and Sterling will rally as a result. Swiss Franc sellers may wish to consider trading before the ruling is announced.

Swiss data releases of consequence next week

Monday morning will see the release of Swiss Retail sales date and I would expect a slight increase following Christmas spending , so we may see CHF rally. Keep an eye on unemployment data on Tuesday morning which could also cause a swing in GBP/CHF levels.

Full story here Are you the author? Previous post See more for Next postTags: gbp-chf,newslettersent