Monthly Archive: December 2016

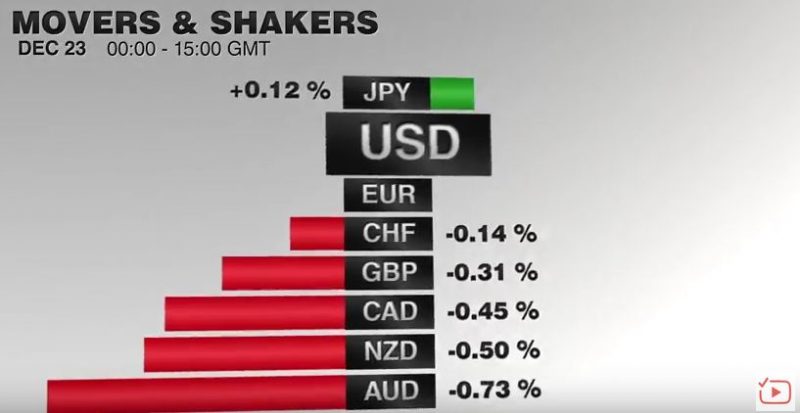

FX Daily, December 23: Markets Edge into Holiday Weekend

Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance.

Read More »

Read More »

Sentiment appears positive as investors close their books for the year

Ahead of the Christmas break, trading volumes were thin this week amid a lack of new market catalysts. Swiss and European equities were generally unchanged through the week, tracking global stock markets. Overall, sentiment appears to be positive as investors close their books for the year.

Read More »

Read More »

ECB Assets Hit 35 percent Of Eurozone GDP; Draghi Owns 9.2 percent Of European Corporate Bond Market

As global markets bask in the glow of the Trumpflation recovery, the ECB continues to be busy providing the actual levitating power behind what DB recently dubbed global "helicopter money", by buying copious amounts of bonds on a daily basis (at least until tomorrow when the ECB goes on brief monetization hiatus, and Italy will be on its own for the next two weeks).

Read More »

Read More »

Where Do US Companies Hire Abroad?

High-wage economies of Canada, EU, Japan and Australia account for nearly half of US corporate employment abroad. And even in low-wage regions, the high-wage parts tend to draw more US employment. The new US administration may have second thoughts about pivot to Asia, but US companies may not.

Read More »

Read More »

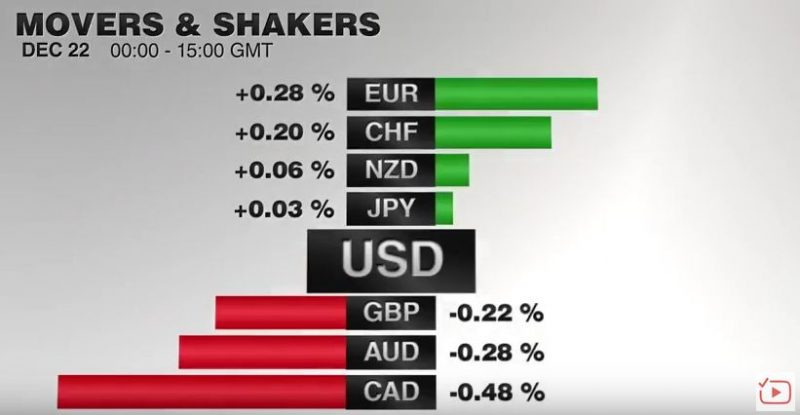

FX Daily, December 22: Mixed Dollar amid Light News as Investors Move to Sidelines

GBP/CHF rates have dipped over the past week, as the markets start to slowdown ahead of the Christmas period. Market trends become harder to predict at this time of year, due to the fact there is less capital injected by investors. Less liquidity ultimately equals less stability and the Pound may be suffering due to investors pulling their funds away from it and into safer haven currencies such as the CHF.

Read More »

Read More »

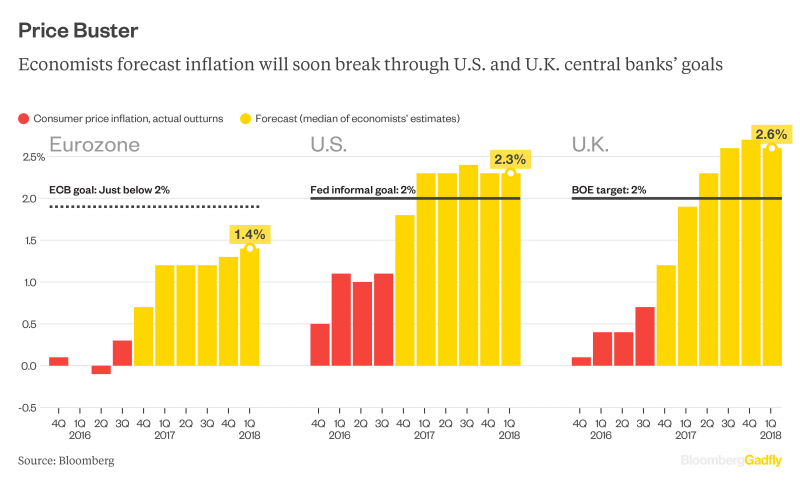

Inflation Sensation: The New Big Deal

It's finally coming. Inflation. President-Elect Donald Trump's promised a whole lot of infrastructure spending, raising the prospects for a great slug of price pressure the likes of which we haven't seen in years. Analysts' forecasts and financial markets show a dramatic shift in view on the outlook for inflation. These charts show some metrics worth watching.

Read More »

Read More »

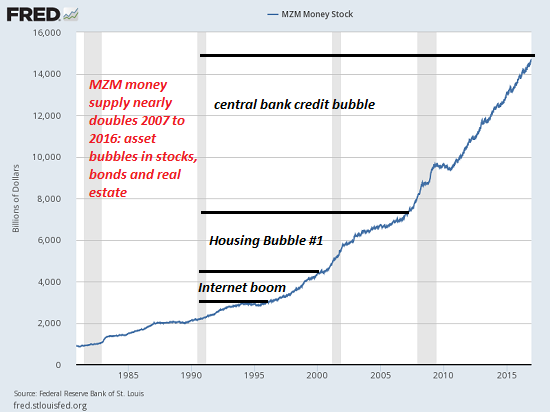

Why the Massive Expansion of “Money” Hasn’t Trickled Down to “The Rest of Us”

There are numerous debates about money: what it is, how we measure it, and so on. In recognition of these debates, I'm referring to "money" in quotes to designate that I'm using the Federal Reserve's measure of money stock (MZM). Nowadays, "money" is often credit. We buy stuff not with currency/ cash, but with credit extended by lenders.

Read More »

Read More »

The hidden cost of Christmas gifts

If you haven’t had a chance to go Christmas shopping don’t despair, gifts destroy value. For example, someone on a diet is unlikely to place much value on a box of chocolates. The difference between what was paid for the chocolates and what the recipient would have paid represents destroyed value. They could have been left on the shelf for someone who would have fully valued them. Economists call this deadweight loss.

Read More »

Read More »

Kosten eines Vollgeld-Systems sind hoch (Costly Sovereign Money)

Eine Umsetzung der Vollgeld-Initiative würde grossen Schaden anrichten und dürfte im Ergebnis selbst die Initianten enttäuschen. Verbesserungen verspricht dagegen eine «sanfte» Reform: die Einführung von elektronischem SNB-Geld für alle.

Read More »

Read More »

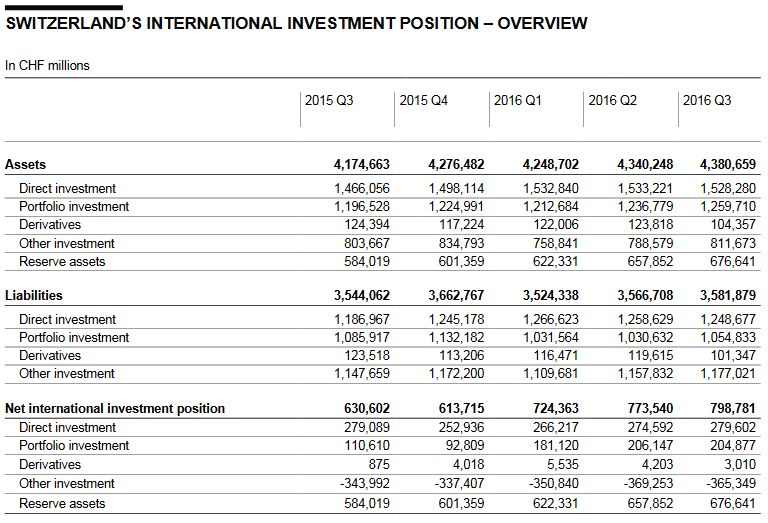

Swiss balance of payments and international investment position: Q3 2016

In the third quarter of 2016, the current account surplus amounted to CHF 21 billion. This was CHF 2 billion less than in the year -back quarter. As a result of lower receipts from direct investment, the receipts surplus in primary income (labour and investment income) declined by CHF 4 billion to CHF 1 billion. The surplus of receipts from trade in goods increased by CHF 2 billion to CHF 17 billion, while the surplus of receipts for trade in...

Read More »

Read More »

Swiss watch exports poised for worst year since 1984: chart

The number of watches Switzerland exports is on track to reach the lowest level since 1984, when digital timepieces were in vogue and Swatch Group AG had just been formed in reaction to low-cost competition.

Read More »

Read More »

FX Daily, December 21: Dollar Mixed in Thinning Activity, Dow 20,000 Watch Continues

The US dollar is narrowly mixed as the holiday markets make for light turnover. Global equity markets are not finding much encouragement from the new record highs by the Dow Jones Industrials. There have been a few developments to note.

Read More »

Read More »

You Know what Happened to Nominal Exchange Rates, but What about Effective Exchange Rates?

Yen is up slightly this year on an effective trade weighted basis. The euro has gained about 1% this year on an effective trade weighted basis. Sterling's decline has been significant on an effective basis. The yuan's decline looks to have corrected overshoot and is still holding an 11-year uptrend on the BIS real effective basis.

Read More »

Read More »

The Reign of Bubble Finance

Financialization Genius BALTIMORE – When we left you last time, we were in the middle of describing the crooked hind leg of crony capitalism. We used billionaire businessman Wilbur Ross – Donald Trump’s pick for the Department of Commerce – for illustration purposes. Not that there is anything wrong with Mr. Ross. He plays the game, just as everyone else does. He’s particularly good at it.

Read More »

Read More »

Police say no terror links to Zurich mosque gunman

Police say the man responsible for the shooting incident at the Zurich Islamic Centre on Monday evening was a 24-year-old Swiss with Ghanaian roots. They said there appears to be no link to radical groups. The man's motive for the mosque shooting and a separate murder on Sunday remains unclear.

Read More »

Read More »

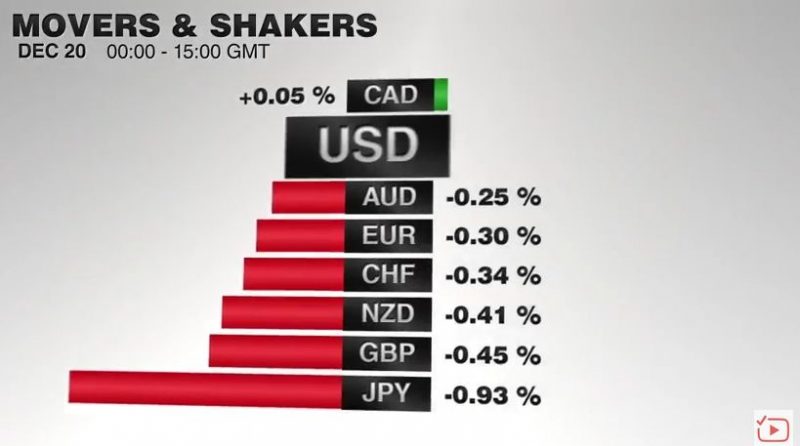

FX Daily, December 20: Yen Surrenders Yesterday’s Gains, while Euro Struggles to Hold above $1.04

The yen's incredible ride this year has been recapitulated in recent days. Consider that before last weekend; the US dollar reached a little above JPY118.40. At its extreme yesterday, the dollar fell to JPY116.55. Today it reached traded near JPY118.25 in the European morning, where it was encountering some offers.

Read More »

Read More »

Swiss National Bank further strengthens provisions for currency reserves

The Swiss National Bank uses a strange formula on the basis of economic growth for the provisions for FX losses. It would be much easier to connect this number to the size of the balance sheet, e.g. 10% of the balance sheet.

Read More »

Read More »

Swiss to avoid EU clash as immigration bill passes final hurdle

After three years of uncertainty, Switzerland may just have solved its immigration dispute with the European Union. Lawmakers in Bern on Friday passed a bill designed to curb EU immigration by giving locals a head start on filling job vacancies. By supporting the measure — which sidesteps quotas — they aim to prevent a deeper dispute that could cost the country crucial trade deals.

Read More »

Read More »

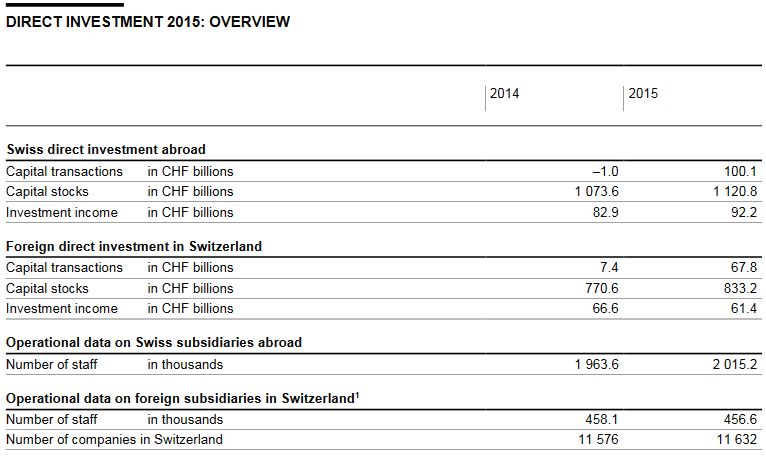

Direct Investments in 2015

Swiss direct investment abroad. Companies domiciled in Switzerland invested CHF 100 billion abroad, compared with disinvestment of CHF 1 billion the year before. Thus, Swiss direct investment abroad was significantly above the average for the past ten years. At CHF 54 billion, over half of the investment was made by finance and holding companies (2014: CHF 3 billion).

Read More »

Read More »