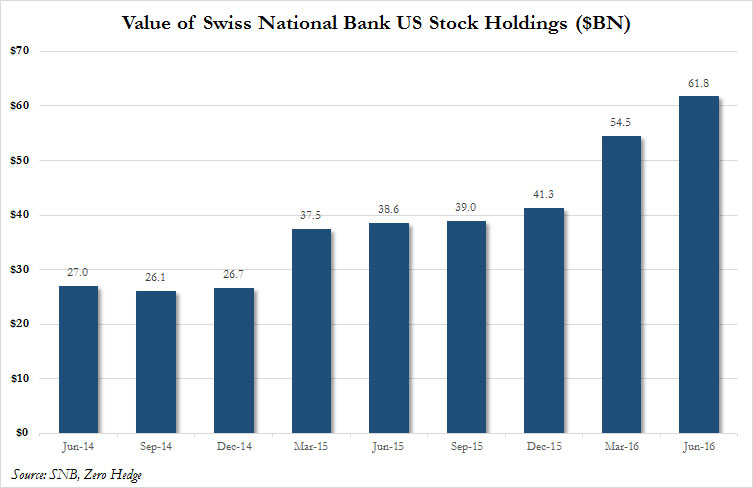

| By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank… |

Value of Swiss National Bank US Stocks Holdings(see more posts on SNB Holdings, ) |

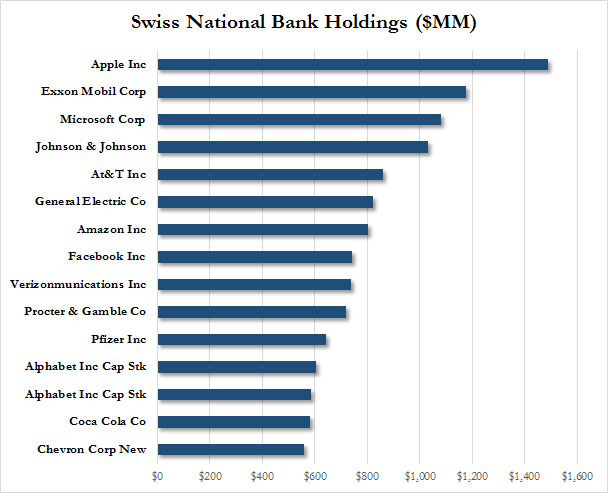

| … which has shown a particular appetite for AAPL stock: |

Swiss National Bank Top Holdings(see more posts on SNB Holdings, ) |

| However, it is far less known that not only is the Swiss National Bank also a publicly traded stock, but is also one of the best performing stocks in the world this year. At least that is the impression one gets when reading a recent piece by the Swiss Tagesanzeiger, which notes that the SNB stock price has soared from 1,100 francs in July to 1750 francs last night, a 60% gain. In fact, as the chart below shows, the stock of the Swiss National Bank is now at its all time high. |  |

The surge has taken place at a time when the broader Swiss stock index remained virtually unchanged. “And nobody is talking about it” the Swiss publication adds stunned, which had prompted the bizarre question: “Is someone trying to buy the Swiss National Bank.”

How is this possible?

The answer is that unlike other central banks which are owned by their respective governments (although in the case of the Fed that is not true), the ownership structure of the Swiss National Bank is unusual. It is owned by Swiss cantons (States), cantonal banks, private individuals and companies: it is a public company. The Swiss cantons together own 45%, 15% is owned by cantonal banks and the remaining 40% by private individuals or companies. The Swiss Federal Government owns no shares.

What’s more, the shares of the SNB are listed on the Swiss stock exchange (Ticker: SNBN:SW) and their price moves up and down like every other share traded in the market. Every year, with rare exceptions like last year, shareholders receive a dividend, which according to the central bank amounts to CHF15 per year (and is not to exceed 6% of the share capital).

So what is prompting the surge. As Tagesanzeiger writes it can not be a scramble for the dividend, whose yield has tumbled to the lowest ever, well below 1% as of today.

It is also unlikely that any of the bank’s traditional shareholders are gobbling up its shares: It is unlikely that a canton or a cantonal bank would buy the shares en masse, because as the Swiss publications notes, “on the side of the shareholders – alongside the SNB’s national owners – the situation has been carved in stone for years.”

The alternative is that a private investor is quietly buying up all the stock available. Foreign companies and individuals own 15% of the total issued registered shares. The single largest private shareholder is a German national called Theo Siegert, a German business leader and professor at Munich University. He owns around 7% of the Bank, more than any Swiss canton except Bern. Still, if the buyer was Siegert, he would have to file a new report as a large shareholder once he crosses a 10% threshold. So far it is missing.

It is also unclear what the mass buyer of SNB stock intends to do with it. After all, it can not be “bought” leading to the speculation that the SNB, which is now a huge hedge fund, is no longer viewed as a classical bank, but as a rising star in the world of asset management. And, as such, it has invited other hedge funds to gobble up its stock.

Which leads Tagesanzeiger to state “the question about the explosive rise in the SNB share remain unanswered.”

The amazement does not end there and as the Swiss exclaim, “like the world’s largest foreign asset manager, the SNB is investing more and more in equities. As documented here previously, the equity share of the “bank’s” CHF700 billion portfolio has grown to 20%. In fact, as observed recently, the SNB’s investment in Facebook is greater than that of its founder Mark Zuckerberg, while its holdings of ??Apple stock gigantic.”

Which leads to the following absurd, if 100% correct, conclusion: “The SNB is pushing global stock prices up, in the process creating the next bubble. And now private traders are jumping on the bandwagon, and gobbling up shares of the central bank itself.”

A perfect visual to explain the new paranormal.

Full story here Are you the author? Previous post See more for Next postTags: Apple,central banks,newslettersent,SNB Holdings,Swiss National Bank,Switzerland