|

Yesterday I explained why Revealing the Real Rate of Inflation Would Crash the System. If asset inflation ceases, the net result would be the same: systemic collapse. Why is this so?

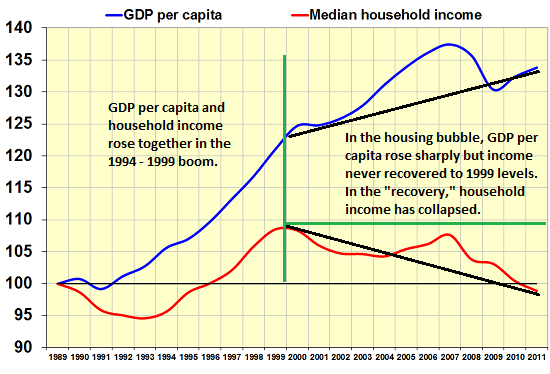

In effect, central banks and states have masked the devastating stagnation of real income by encouraging households to take on debt to augment declining income and by inflating assets via quantitative easing and lowering interest rates and bond yields to near-zero (or more recently, less than zero).

The “wealth” created by asset inflation generates a “wealth effect” in which credulous investors, pension fund managers, the financial media, etc. start believing the flood of new “wealth” is permanent and can be counted on to pay future incomes and claims.

|

GDP - Median Household Income(see more posts on GDP per capita, ) |

|

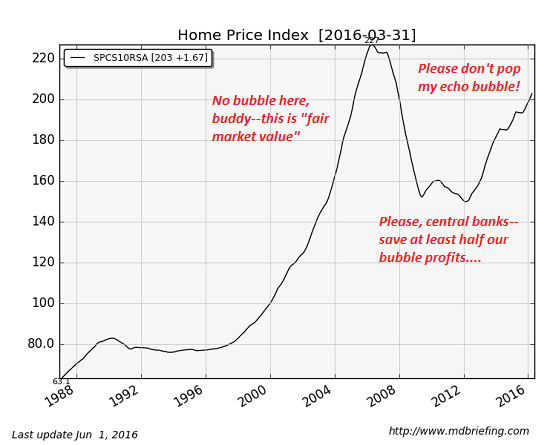

Asset inflation is visible in stocks, bonds and real estate:

|

|

|

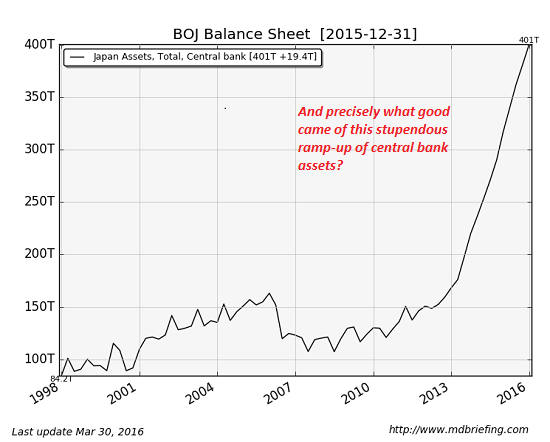

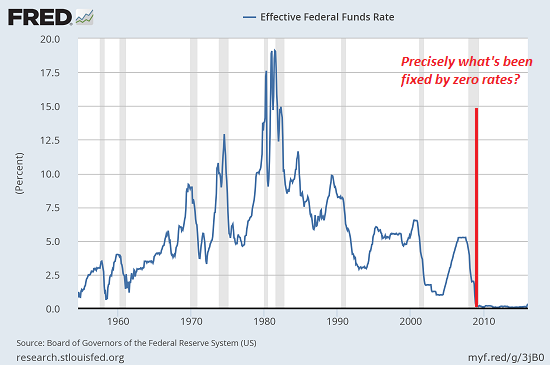

The sources of asset inflation are highly visible: soaring central bank balance sheets, credit expansion that far outpaces GDP growth and ZIRP (zero interest rate policy):

|

Bank of Japan Balance Sheet, December 31 2015(see more posts on Bank of Japan, ) |

|

Destroying the return on cash with ZIRP and NIRP (negative interest rate policy) has forced capital to chase any asset that offers any hope of a positive yield. As asset inflation takes off, the capital gains attract more capital (never mind if yields are low–we’ll make a killing from capital gains as the asset inflates further) which creates a self-reinforcing feedback: the more assets inflate, the more attractive they become to capital seeking any kind of return.

In effect, gambling on additional future asset inflation is the only game in town.Institutional money managers are buying bonds that yield less than zero not because they’re pleased to lose money, but because they anticipate rates dropping further.

As bond yields decline, the value of existing bonds paying higher interest rises. As crazy as it sounds, buying a bond paying -0.01% will be a highly profitable trade if the yield on future bonds drops to -0.1%.

With the cost of borrowing less than zero once the loss of purchasing power (i.e. consumer price inflation) is factored in, it makes sense to borrow money to increase speculative asset purchases to leverage up any gains from future asset inflation.

|

Federal Funds Rate(see more posts on Federal Funds Rate, ) |

|

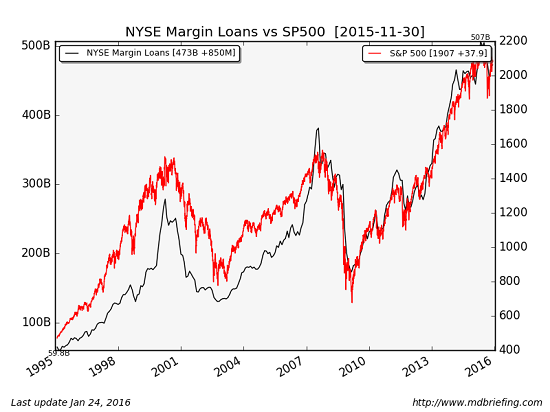

Look at how margin borrowing and stock prices move in lockstep:

|

NYSE Margin Loans vs SP500, November 11 2015(see more posts on S&P 500, ) |

|

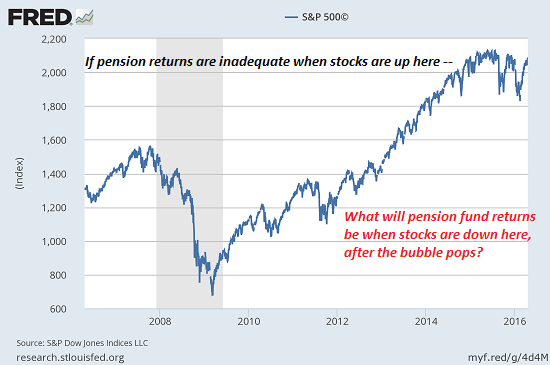

The question that few ask is: what happens to pension funds that need 7.5% annual returns to remain quasi-solvent when asset inflation turns into asset deflation, i.e. assets decline in value? Take a look at the S&P 500’s rise to the stratosphere and ponder the monumental losses that would accrue to any institution that thought asset inflation was a permanent feature of modern life:

|

S&P 500(see more posts on S&P 500, ) |

|

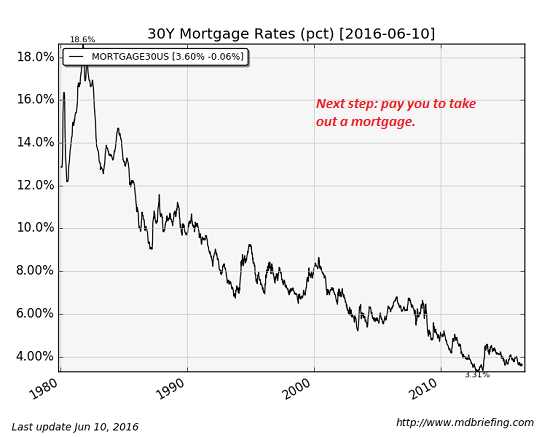

There are only two ways to keep asset inflation alive: one is for central banks and states to buy up major chunks of all asset classes, i.e. hitting every higher bid regardless of the risks of such a strategy, and the second is to pay households to borrow money to chase future asset inflation, for example, paying households to buy a house with a mortgage:

|

Mortgage Rates, 1980 - 2016 June 10(see more posts on Margin Debt, ) |

The insanity of these two strategies is no hindrance to their implementation.The collapse of asset inflation will implode all the fiscal and financial promises based on ever-inflating assets and reveal the unsustainability of the status quo’s strategy of substituting debt and asset bubbles for stagnating real income.

Tags: Bank of Japan,Federal Funds Rate,GDP per capita,Margin Debt,newslettersent,S&P 500