By Allan Flynn, Guest Post at BullionStar.com

Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things.

Judge Valerie E. Caproni, former white-collar defense attorney, SEC Regional Director and controversial FBI General Counsel, presided over oral arguments for motions-to-dismiss totaling 9 hours on April 18 and 20.

Its “based entirely on statistics with no other,” the judge said, pouring cold water on plaintiff’s claims of bank collusion in gold benchmark rigging. Defense attorney scoffed as much at the silver hearing. “There is not a single fact… that shows an agreement between my client and the other alleged conspirators to fix the fix.”

Seven banks are being sued in separate gold and silver class action lawsuits currently before the US. District Court, Southern District of New York. The plaintiffs: gold and silver bullion traders, and traders of various associated financial instruments, allege banks conspired in secret closed meetings, to rig the London PM Gold Fix, and Silver Fix benchmarks during the period from 2001 to 2013.

If the motions to dismiss are allowed, the complaints will be thrown out. Plaintiffs on the other hand, are hoping to crack open the door to “discovery,” where they get to access confidential bank communications and records. Turning the tables earlier in April Deutsche Bank surprised by promising to provide such evidence ratting out its former fellow defendants. “No. I cannot consider it at all,” the judge said, stonewalling plaintiffs’ arguments mentioning the move. The German mega-bank settled claims a week prior to the hearing but is yet to hand over records.

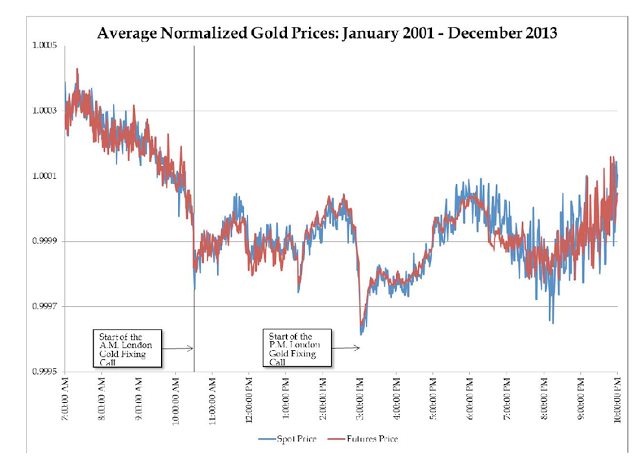

EvidenceAlleged proof of downward price manipulation is revealed by averaged charts showing “Anomalous” price drops from 2001 to 2013 in the London Silver Fix and PM Gold Fix. In sympathy, even as the gold price quadrupled from around $300 to $1200 through the period, something counter-intuitive happened. Plaintiffs’ claim during London hours between the AM and PM fixes, the average price declined for each of the 13 years, bar one being flat in 2013. More pronounced effects were seen in silver. “Those were compelling charts,” the judge responded to a presentation of evidence during the silver hearing. “I mean, seriously, they truly show that something happened.” Defendants argue rather than collusion, the price drops show normal “parallel conduct.” Loads of precious metals producers all needing to sell, and a bunch of savvy bankers hoping to buy low. Plaintiffs say the banks have a near-perfect record betting on the fix outcome. Well of course, they trade on “the best information in the world about supply and demand,” the banks’ attorneys retorted. |

Average Normalized Gold PricesImage courtesy of Commodity Exchange, Inc., Gold Futures and Options Trading Litigation, Dkt No. 14-MD-2548 (VEC) |

FindingsInclusion of a non-fixing bank UBS, in the lawsuit, is described by defendants as “unfair,” and just to “suck in” a Swiss regulator’s findings. If the Court is to be believed, the FINMA report may be all the cases have going for them. Of its 19 pages, the dominating subject is foreign exchange misconduct, with only a few lines about precious metals. Tip-toeing around the topic of collusion, the report describes a process of “cooperation” between UBS and others in precious metals trading. It says the bank shared sensitive client trade information such as “client names”, “stop loss orders,” and “flow information on large or imminent orders” with “third parties.” Sharing of client trade information by banks, including UBS, in currency trading, the UK Financial Conduct Authority (FCA) reported in 2014, was for the purpose of collusion. Such communication enabled different banks to plan trading strategies, and “attempt to manipulate fix rates and trigger client “stop loss” orders (which are designed to limit the losses a client could face if exposed to adverse currency rate movements).” Strong similarities exist between the methods and tools used by currency traders to rig benchmarks, and those used by precious metals traders. Referring to the detailed description of UBS offences including collusion in currency benchmarks, the FINMA report said, “the conduct and techniques inadmissible from a regulatory perspective, were also applied at least in part to PM spot trading.” |

Hanging by a Thread

One “misconduct” the report emphasized in precious metals trading was UBS’ manipulation of the silver benchmark in the banks proprietary trading. “A substantial element of the conspicuous conduct in PM trading was the repeated front running (especially in the back book) of silver fix orders of one client.” According to the FCA, front running is a kind of insider trading.

“transaction for a “person’s own benefit, on the basis of and ahead of an order (including an order relating to a bid) which he is to carry out with or for another (in respect of which information concerning the order is inside information), which takes advantage of the anticipated impact of the order on the market or auction clearing price.”

Commenting on the brevity of plaintiffs’ evidence in silver, and the FINMA findings, Judge Caproni pointed out, “your hanging your hat pretty heavily on one line in that report.”

Attorney for defendants found the report favorably vague:

“Your Honor, I apologize. I must say he has made a misstatement three times. The FINMA settlement, Section 3.2.3 talks about UBS conduct with respect to silver. There’s not a not a word or hint about coordination with any other bank. It is between UBS and one of its customers or maybe more than one but no collusion.”

The judge responded, “We have the FINMA report. I knew that wasn’t exactly what it said.”

Confusion about the Swiss findings wasn’t helped by the events of the day. The conference call in German, reported FINMA boss Mark Branson alluding to perhaps more than the report dare, in, “clear attempts to manipulate precious metals benchmarks.” FINMA declined a request to supply a transcript or recording of the conference call, with a spokesperson responding, “We do not publish a transcript, and besides we have nothing to add to the report.”

A couple of things may help explain the regulators haziness, and thus the challenges for sensitive cases as these. Switzerland is a country long associated with gold and banking. In 1970 Zurich was home to the worlds largest gold market. Most of the worlds’ gold is imported to Switzerland for refining. Consider then this impressive feat: An official inquiry is conducted of Switzerland’s largest bank caught up in a scandal involving “precious metals.” Offenses were identified in its Zurich office. The agency reports “serious misconduct” in precious metals trading including sharing of secret client trade orders with “third parties.” The agency head rallies against manipulation of “precious metals benchmarks.” Action against 11 bank personnel, including industry bans of between one and five years, were brought against two managers and four traders for, “serious breaches of regulation in foreign exchange and precious metals trading.” But yet, the word “gold” is absent from the entire report and announcements.

Secondly, FINMA’s 2015 Annual Report describes the sanctions against four now-former UBS traders. It may concern some, that justice is left to financial market regulators when:

“Four further enhancement actions against UBS foreign exchange traders were discontinued in August 2015. Since there were indications that their behavior had contributed to serious breaches of regulatory provisions, FINMA issued reprimands without taking further action against these individuals.”

The Puzzle

If the cases proceed, US commodity futures markets may also come under scrutiny. The Court spotted a not-so-obvious paradox concerning allegations the banks suppress gold prices. “Why would they drive the price down when they are sitting on I don’t know how much bullion? They are driving down the price of their own asset,” Judge Caproni posed.

Plaintiffs claim the banks hold a majority of short gold and silver futures on the US-based Chicago Mercantile Futures Exchange, paper instruments tied to the value of London silver and gold, which increase in value as the bullion prices fall. The banks argue that it’s impossible to tell from mandatory government filings, which banks prosper during the declines, and to what extent. The judge agrees, and defendants are pleased. “I’m very skeptical they have a well-pleaded factual allegation of what the banks’…COMEX position is,” the judge said.

“Mr Feldberg: Then your Honor has said that much better than I ever could.”

Where direct evidence of collusion isn’t available, antitrust law allows the pleading of additional circumstantial evidence that lends plausibility to allegations. Other circumstantial evidence, or “plus-factors,“ listed by gold plaintiffs, namely problematic antitrust facts arising out of the very clubby arrangement of the fix meetings themselves, failed to impress particularly.

“The Court: But weren’t all of your plus factors just the natural – they are just a function of the fix?..I thought every plus factor you pointed to was just that’s the nature of the fix.”

Last Stand

The unconvinced magistrate was likely close to a decision, before four weeks back when the banks had one last throw at dismissal. The court in the silver case was asked to apply a recent ruling where warehouse aluminum price manipulation was deemed not to have impacted end users of aluminum. Any decision on this in silver will likely impact the gold case also.

The question of standing, or which plaintiff’s are close enough to the alleged activity to have suffered injury, was well discussed back in April. For example the Court put to defense: “I’m not saying the two guys at a swap meet from Ohio would be a particularly compelling class representative, but why wouldn’t they have standing?” Plaintiffs seemed to have convinced that the issue could be decided later, if it gets to that. Judge Caproni just wasn’t sure firstly if all the statistics, and facts complained were plausible enough to infer collusion, reminding frustrated gold plaintiffs where the balance lies.

“Unfortunately for you I’m the one who has to make the decision here.

Mr Brocket: Again, with the greatest respect, I am trying to resurrect this here but, look. Every fact alone doesn’t prove collusion.

The Court: I agree.”

Decisions regarding motions to dismiss in the London gold and silver benchmark-rigging class actions against banks, initially expected around the end of August, could come any day sooner or later according to someone familiar with the cases.

The above article was first published at Allan Flynn’s website here.

Allan Flynn is a specialist researcher in aspects of gold and silver. He is currently investigating for future publication on the same topic and works in property and commercial architecture when he needs to eat. He holds shares in precious metals producers and banks.

Tags: Deutsche Bank,FBI,newslettersent,Precious Metals,Switzerland,Zurich