Economist John Taylor is on his way to join the world’s central bankers at Jackson Hole for the 35th annual monetary-policy conference in the Grand Teton Mountains. As he explains (via EconomicsOne.com)…

First and 35th Jackson HoleI attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it. Paul Volcker chaired the Fed in 1982. He went to Jackson Hole, but he was not on the program to give the opening address, and no one was speculating on what he might say. No other Fed governors were there, nor governors of any other central bank. In contrast, this year many central bankers will be there, including from emerging markets. Only four reporters came in 1982 — William Eaton (LA Times), Jonathan Fuerbringer (New York Times), Ken Bacon (Wall Street Journal) and John Berry (Washington Post). This year there will be scores. And there were no television people to interview central bankers in 1982 (with the awesome Grand Teton as backdrop). It was clear to everyone in 1982 that Volcker had a policy strategy in place, so he didn’t need to use Jackson Hole to announce new interventions or tools. The strategy was to focus on price stability and thereby get inflation down, which would then restore economic growth and reduce unemployment. Some at the meeting, such as Nobel Laureate James Tobin, didn’t like Volcker’s strategy, but others did. I presented a paper at the 1982 conference which supported the strategy. |

I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it. - Click to enlarge |

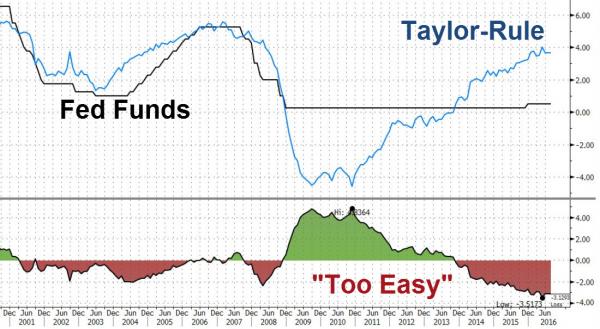

Interest Rates and Taylor Rule TodayThe federal funds rate was over 10.1% in August 1982 down from 19.1% the previous summer. Today the policy rate is .5% in the U.S. and negative in the Eurozone, Japan, Switzerland, Sweden and Denmark. There will be lot of discussion about the impact of these unusual central bank policy rates, as well the unusual large scale purchases of corporate bonds and stock, and of course the possibility of helicopter money and other new tools, some of which greatly expand the scope of central banks. I hope there is also a discussion of less weird policy, and in particular about the normalization of policy and the benefits of normalization. In fact, with so many central bankers from around the world at Jackson Hole, it will be an opportunity to discuss the global benefits of recent proposals to return to a rules-based international monetary system along the lines that Paul Volcker has argued for. |

Central Bank Policy Rates I attended the first monetary-policy conference there in 1982, and I may be the only person to attend both the 1st and the 35th. I know the Tetons will still be there, but virtually everything else will be different. As the Wall Street Journal front page headline screamed out on Monday, central bank Stimulus Efforts Get Weirder. I’m looking forward to it. - Click to enlarge |

He may have a point!!

Full story here Are you the author? Previous post See more for Next postTags: central banks,Eurozone,Helicopter Money,Jackson Hole,Japan,New York Times,newslettersent,Paul Volcker,Switzerland,Unemployment,Wall Street Journal