Monday July 4: Five things the markets are talking about

Happy 4th of July!

Stateside, this is a holiday shortened trading week, one that will be dominated by two fundamental events – Wednesday’s FOMC minutes and Friday’s non-farm payroll (NFP) report for June. With no surprises expected in the minutes, both dealers and investors have very much priced out any possibility of a U.S rate hike occurring within the next 18-months. In respect to the jobs report, is it possible that the U.S can print two disappointing numbers back to back?

Fundamental’s aside, trading will continue to be dominated by the U.K’s Brexit vote outcome. With the market remaining in a state of confusion over the future of the U.K’s relationship with the E.U, the initial reaction being one of shock and panic selling, the market seems a tad confused how to proceed with the lack of political clarity, both domestically in the U.K and amongst its fellow European partners. Expect this to be the new norm for the foreseeable future.

|

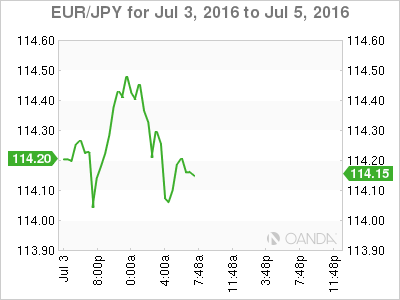

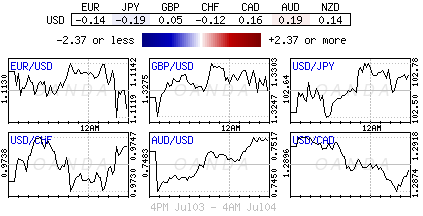

1. Pound falls, but other risky currencies gain Sterling continues to trade under pressure this morning after data shows a drop in U.K. construction sector activity in June (construction PMI 46 vs. 50.6 – first contraction in 40-months). The pound is down -0.2% at £1.3254. It’s closest ally for now, the euro is also trading a tad heavy, easing -0.3% to €1.1105. Outside of these currency pairs, investors for the time being seem less concerned about the global fallout from the U.K. vote to leave the EU. This has a percentage of the market slightly positive on risk, but they do seem contained to within tight ranges. The commodity-linked currencies, such as the loonie (C$1.2877) and the Aussie (A$0.7518) are gaining, while the safe haven yen retreats (¥102.77). Markets are expected to be quiet today due to a holiday in the U.S. |

|

|

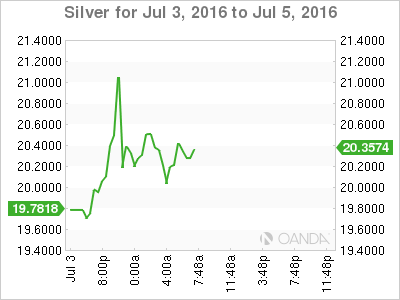

2. Silver tops $20 an ounce as nickel rises to eight-month high Mining stocks are on the rise as commodities advance and the yen weakens amid optimism that Tier I central banks will need to step up and loosen monetary policy further (BoE, ECB and BoJ). The raw-material advance has pushed the MSCI Asia Pacific Index to recoup all of its losses that followed the U.K.’s vote to leave the E.U. In Europe, equity bourses are currently trading mixed across the board as markets consolidate ahead of the U.S Independence Day bank holiday. Earlier this morning, silver exceeded $20 an ounce for the first time in two-years, while nickel climbed to an eight-month high. Indices: Stoxx50 -0.2% at 2,875, FTSE -0.1% at 6,569, DAX -0.4% at 9,742, CAC-40 -0.4% at 4,256, IBEX-35 +0.1% at 8,274, FTSE MIB -1.1% at 16,113, SMI -0.1% at 8,081, S&P 500 Futures +0.1% |

|

|

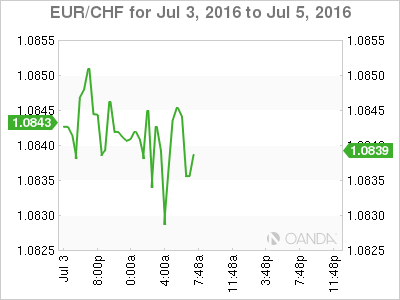

3. Swiss National Bank (SNB) data suggest currency intervention It’s no really much of a surprise to see the latest Swiss National Bank intervention by the central bank last week. The average sight deposits of domestic Swiss banks for the week ended July 1 were +$430.3 billion, up from +$423.5 billion in the previous week (June 24) and +$416.5 billion the week before that. Note, the sight deposits are not a direct proxy, due to the valuation effects, but dealers do suggest that a sizable change is a strong signal of central bank intervention. The SNB announced on June 24, a day after the shocking Brexit vote outcome that the bank had intervened in the currency market to cap the CHF’s rise – an unfamiliar act by the SNB, but a necessary shot across the bow for this historical risk aversion currency of choice ($0.9755). |

|

|

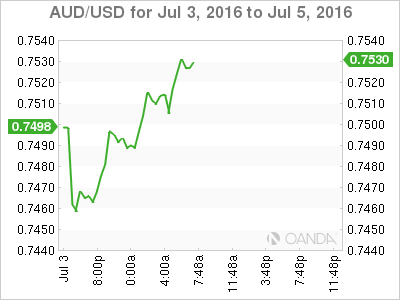

4. Australia national elections results remain indecisive Down-under, the Labor party has mounted a surprisingly strong challenge to the Conservative coalition over the weekend in the Aussie general election. Currently, the results are deemed to be inconclusive until the absentee ballots are counted later this week. The ruling coalition are said to be on track to win at least 74 seats in 150-seat Parliament – 76 seats are needed to form a government. While the Labor party is on track to take at least 66 seats. Rating agencies have been to the fore in recent weeks when it comes to politics, and this election is no different. S&P suggests that it could cut the ‘AAA’ sovereign rating if Aussie parliamentary gridlock on the budget continues. For Moody’s, the primary risk to the country’s Aaa’ sovereign rating would come if the sworn-in party showed a lack of interest in returning the country’s budget to a surplus over the medium-term. According to Fitch, the agency has voiced their concerns of an ongoing political deadlock. |

|

|

5. Bank of England’s (BoE) Carney not that optimistic Given the Brexit vote, Bank of England (BoE) Governor Mark Carney was not very optimistic about where the U.K’s economy is headed this summer. Late last week, the governor suggested that more rate cuts would be needed as the U.K economy slows. The Bank meets later this month and U.K policy makers are to present a ‘partial’ report assessing the initial impact of economic damage at that meeting and a fuller report next month. Carney also stressed the BoE had other options rather than just rate cuts – likely a reference to more QE. Carney is not a fan of NIRP. Further out, he said the U.K. does have the capacity to successfully adapt to a future outside the EU, but stressed that it was the responsibility of political leaders to shape that future. |

Are you the author? Previous post See more for Next post

Tags: newslettersent,Valuation Effect