Swiss FrancThe Non-Farm Payrolls for June were very positive, even if Marc Chandler is not totally convinced. Good job data in the United States are typically positive for both USD and EUR, because the odds of a rate hike are increasing. Consequently the EUR/CHF rose. In the last two days SNB interventions should have been smaller. The Swiss (seasonally adjusted) unemployment rate fell from 3.5% to 3.3%. |

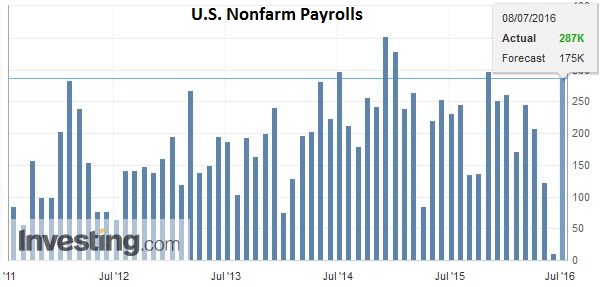

United StatesThe US employment data tends to be among the most important economic reports during the monthly cycle. It often injects volatility into the market. The report itself tends to be volatile and subject to revisions. Economists have little input on which to base their forecasts.

One of the reasons that the US employment data resonates with market participants is that is has policy significance. Full employment is one three Fed goals (alongside price and financial stability). However, this time, there is little policy implication, and to the extent there is, it could be asymmetrical. A disappointing report may have greater impact than a stronger report.

After two disappointing monthly reports, with 123k rise in April and the shocking 38k in May, it may take more than one report to convince Fed officials that robust job growth continues. The Q1 average was 196k, which is nearly impossible to match in Q2. Last year’s average was 229k.

The market expects 170k-185k increase in non-farm payrolls. The service sector ISM showed a jump in the employment index to 52.7 from 49.7. Weekly jobless claims eased over the period. While the ADP estimate is in line with expectations, it reported that small businesses expanded their employment more than large businesses and the BLS series does not pick up small business activity as well (hence the birth/death plug factor). |

Click to enlarge. Source Investing.com |

Unemployment RateIn addition to the headline, with no change expected in the workweek, and some risk that the unemployment rate ticks up to 4.8% from 4.7%, look for the average hourly earnings to draw attention. A 0.2% rise would be sufficient to lift the year-over-year rate to 2.7%, a new cyclical high. The preliminary signs of upward pressure on wages has been recognized by several Fed officials. There is little chance of a Fed hike later this month. The September Fed funds futures contract also shows that participants see little chance of a hike then either. It may require a strong report today and another one in early August, a better sense that risk from Brexit and China are contained, to get investors to put a September hike back into play. |

Click to enlarge. Source Investing.com |

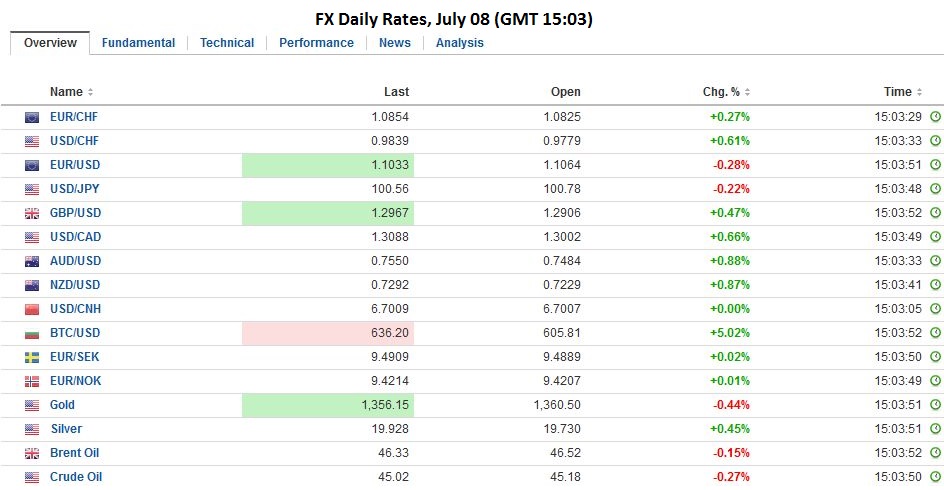

FX RatesThe US dollar is narrowly mixed ahead of the jobs report. The euro is trading inside yesterday’s range, which was inside Wednesday’s range. The narrow range today is $1.1060 to $1.1090. Technically, the range can be extended roughly half a cent in both directions without altering the tone. The greenback has made lower highs against the yen consistently this week. Resistance is now seen near JPY101.00. Many look for a break of JPY100. |

|

SterlingSterling is licking its wounds after having been rejected above $1.30 yesterday. It rebounded off the $1.2880, perhaps helped by news that the trade balance did not deteriorate in May. Despite a decline in exports (4.4%), it looks as if the external sector may be a small net contributor to UK growth in Q2. Meanwhile more real estate funds have closed, but the UK financials are among the strongest sectors today.

|

Euro zone

Canada

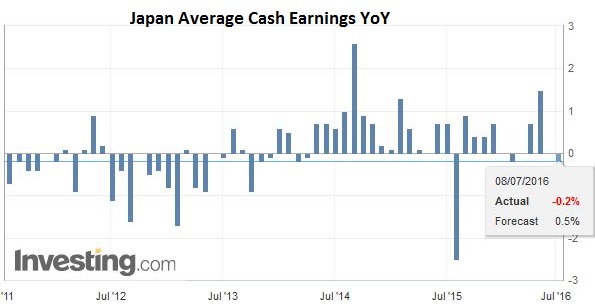

JapanJapan reported a slightly larger than expected current account surplus for May, despite a smaller than expected trade surplus. Bank lending slowed. The most important economic data point, though, was likely the unexpected decline in labor cash earnings. The 0.2% fall compares with expectations of a 0.5% gain after a 0.3% rise in April. Real cash wages rose 0.2%, slowing from the 0.6% gain in April. The importance is that it is part of the accumulation of data that many expect will lead the BOJ into easing policy at the end of the month.

|

Click to enlarge. Source Investing.com |

Japan Elections

Tags: Bank of Canada,David Cameron,Japan Average Cash Earnings,newslettersent,U.S. Average Earnings,U.S. Nonfarm Payrolls,U.S. Unemployment Rate