We have seen several explanations for the financial crisis and its lingering effects depressing our global economy in its aftermath. Some are plain stupid, such as greed for some reason suddenly overwhelmed people working within finance, as if people in finance were not greedy before 2007. Others try to explain it through “liberalisation” which is almost just as nonsensical as government regulators never liberalised anything, but rather allowed fraud, in polite company called fractional reserve banking, to grow unrestrained. Some point to excess savings in exporting countries as the culprit behind our misery. Excess saving forces less frugal countries reluctantly to run deficits, or so the argument goes.

While some theories are pure folly, others are partial right, but none seem to grasp the fundamental factor that pulled and keep pulling the world into such unsustainable constellations witnessed in global finance, trade and capital allocation.

Whenever we try to explain the reasons behind the crisis, such as the build-up in non-productive and counterproductive debt (see here, here and here for more details) people ask us why did this happened now, and not earlier? It is a fair question that we have thought about and believe have one simple answer. Bottom line, the world economy is running on a system with no natural correcting mechanisms. As we are never tired of pointing out, the Soviet Union only had one recession, the one in 1989. The system was stable, until it was not.

Bailing out unproductive business

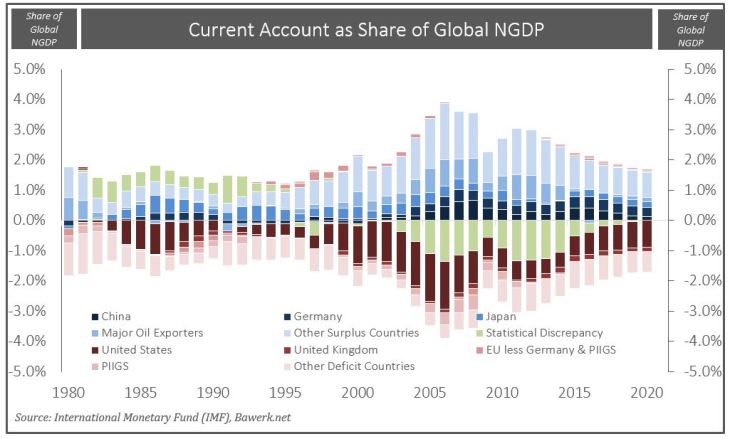

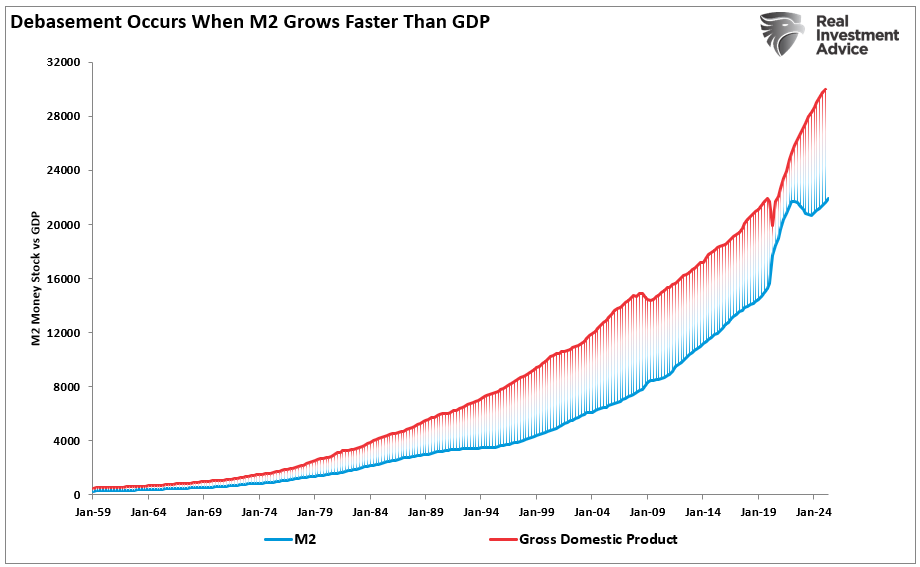

But therein lies the rub; by constantly bailing out unproductive business ventures the global system kept on toward the economic cliff. Financial imbalances, as shown clearly in the chart below, never corrected itself. Surplus countries kept on with surpluses while deficit countries maintained their deficits. Year after year.

A free market system would correct these imbalances long before they became a danger to the system. A fully flexible dollar standard, concocted on Keynesian principles, whereby demand does actually create its own supply (dollar reserve demand will always be met with additional supply, worldwide, as anything else leads to crisis) on the other hand will not perform this most fundamental task.

With the Federal Reserve suppressing any natural correction mechanism, the global economic system has been moulded into a perversion. A perversion that simply cannot be allowed its natural course because its legacy of capital misallocation would be too much to bear.

Greatest Keynesian monetary experiment

Of course, if it is not sustainable it will not continue ad infinitum. Our money masters are just postponing the inevitable bust that will eventually correct these imbalances through worldwide capital re-allocation. This earthquake of an economic downturn has been building tensions for so long that the consequences will be mass unemployment and financial losses like never seen before. Political upheaval and social unrest undoubtedly follows.

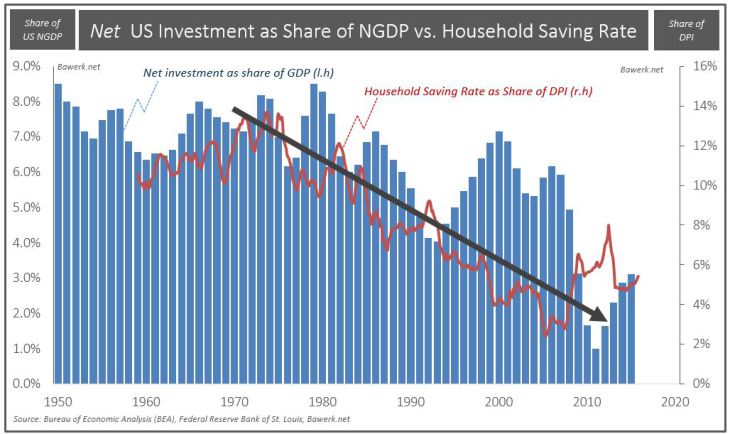

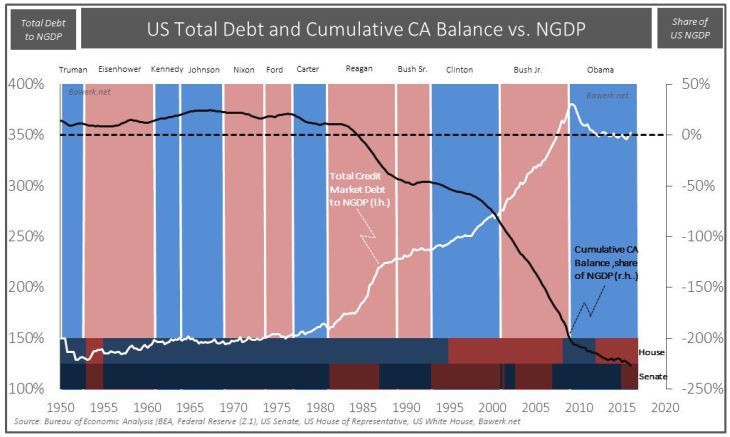

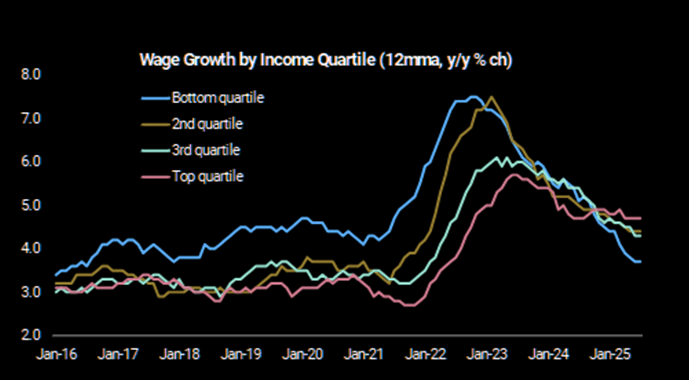

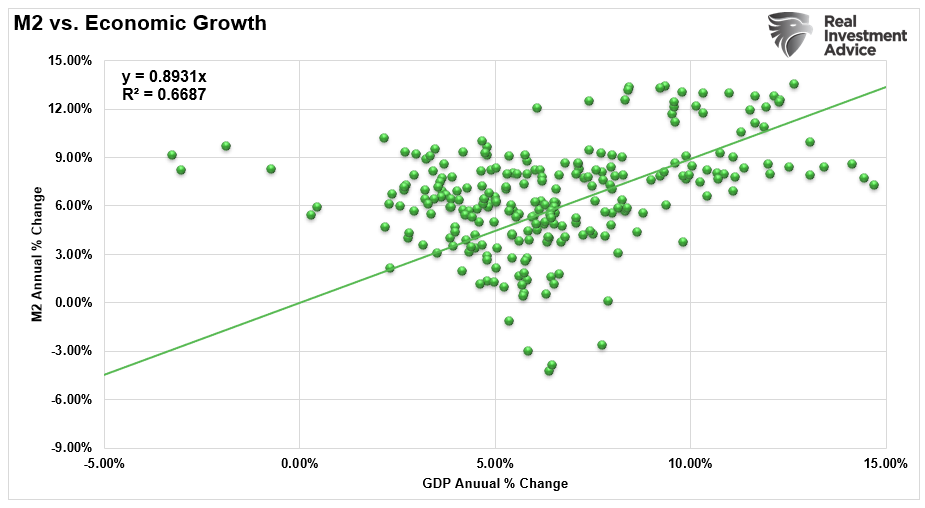

Federal Reserve parlour tricks that used to work when saving rates where high(er) and financial wealth more uniformly distributed will, to the amazement of today’s pundits, stop working. Moving capital and wealth from the poor to the rich, through inflationary depressing wages and boosting asset values, is a tax policy with rapid diminishing marginal returns, as witnessed by ever-larger amount of debt it takes to create GDP growth.

We are actually living through the end-game of the greatest Keynesian monetary experiment as we type. It was one hell of a party while it lasted, but the hangover is now over us.

Tags: Austrian economics,central-banks,Economics,Geopolitics,newslettersent,Price Inflation,Regulation