Monthly Archive: April 2016

FX Daily: Yen Pares Gains, Dollar-Bloc Firms

The surging yen has been the main feature in the foreign exchange market in recent days, but its advancing streak has been stopped with today's setback. The greenback traded briefly dipped below JPY107.70 in North America yesterday but has not ...

Read More »

Read More »

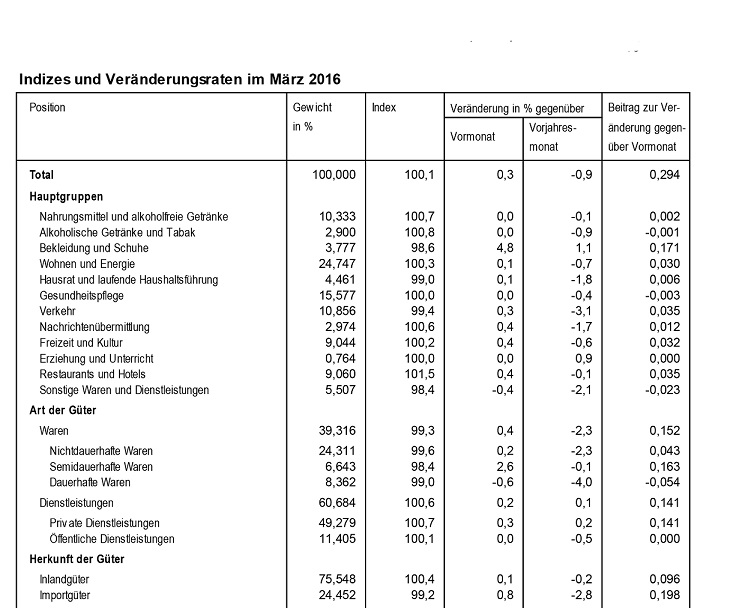

Swiss Consumer Price Index in March 2016: -0.9 percent against 2015, +0.3 percent against last month

08.04.2016 09:15 - FSO, Prices (0353-1603-50) Swiss Consumer Price Index in March 2016 Neuchâtel, 08.04.2016 (FSO) – The Swiss Consumer Price Index increased by 0.3% in March 2016 compared with the previous month, reaching 100.1 points (December 201...

Read More »

Read More »

Great Graphic: WSJ survey of Fed Expectations

This Great Graphic shows the results of the last three Wall Street Journal survey of business and academic economists on the outlook for Fed policy. The key take away is that despite all the talk and ink spilled on the shifting Fed stance and the split within the FOMC, economists views did not change much … Continue...

Read More »

Read More »

Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke.

Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the co...

Read More »

Read More »

FX Daily, April 7: Yen Continues to Climb

The main feature in the foreign exchange market continues to be the surge of the Japanese yen. A convincing explanation of the yen's strength seems elusive. Until last week, which means through the fiscal year-end last month, Japanese fund managers have been buying foreign bonds at a near-record pace. Foreign investors, for their part, have …

Read More »

Read More »

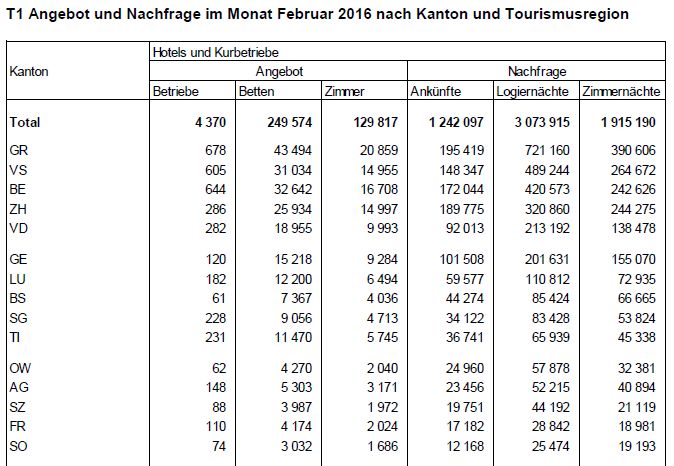

Statistics on tourist accommodation in February 2016: Overnight stays in February fall despite rise in domestic demand

07.04.2016 09:15 - FSO, Tourism (0353-1603-40) Statistics on tourist accommodation in February 2016 Neuchâtel, 07.04.2016 (FSO) – The Swiss hotel industry registered 3.1 million overnight stays in February 2016, which corresponds to a decrease of 1....

Read More »

Read More »

Frisky Yen Upsets Japan’s GOSPLAN

It Wasn’t Supposed to Do That… When you’re a central banker in a pure fiat money system and even your ability to print your own currency into oblivion is questioned by the markets, you really have a problem. This is actually funny on quite a number...

Read More »

Read More »

Going Into Debt to Invest Into Debt…

Bankers Hate It When You Hold Cash In an extraordinary turn of events, last week we were contacted by our local bankers. Since we were turned down for a mortgage in 1982 (our business finances were thought to be “too shaky”), we have had little tru...

Read More »

Read More »

Great Graphic: Head and Shoulders in Dollar-Yen

The old head and shoulders pattern in the dollar against the yen is back in vogue. We first pointed it out in the first week of January here.

Recall the details. The neckline is drawn around JPY116.30 and measuring objective is near JPY107.00....

Read More »

Read More »

Dutch Referendum: Devil is not in the Details

In what is possibly one of the under-appreciated political events of the year, the Netherlands holds a plebiscite today on an associational agreement with Ukraine that has already been approved by the Dutch parliament, the European Parliament and all other 27 EU members. When stated so baldly, it is difficult to see what is at …

Read More »

Read More »

FX Daily, April 6: Greenback Finds A Little Traction

The US dollar is better bid today but remains largely in the ranges seen in recent days. There a few developments to note, which together are lifting European equities after Asian equities softened. First, the API oil inventory estimate showed an unexpected fall of 4.3 mln barrels. An increase of half the magnitude was expected. The …

Read More »

Read More »

Rotten to the Core

Poison Money BALTIMORE – We live in a world of sin and sorrow, infected by a fraudulent democracy, Facebook, and a corrupt money system. Wheezing, weak, and weary from the exertion of trying to appear “normal,” the economy staggers on. Staggering...

Read More »

Read More »

Talk of Secret Shanghai Agreement is a Distraction

(I have been sick with pneumonia but am just about back. I expect to resume my commentary tomorrow. Here is my overdue monthly column for a Chinese paper. Thanks to everyone for their support.)

Conspiracy theories have run amok. After sev...

Read More »

Read More »

A Tribute to the Jackass Money System

A Witless Tool of the Deep State? Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can ge...

Read More »

Read More »

March 2016: Highest SNB Interventions since January 2015

Speculative position: Strong shift to CHF long: +4967x 125K contracts after the Fed reduced their expectations of rate hikes for this year. …………Sight Deposits: SNB intervenes for 6.1 bln. CHF during the month of March. This is the higest level since January 2016. ……….FX: EUR/CHF steady slightly over 1.09. As I expected last week, the EUR/CHF …

Read More »

Read More »

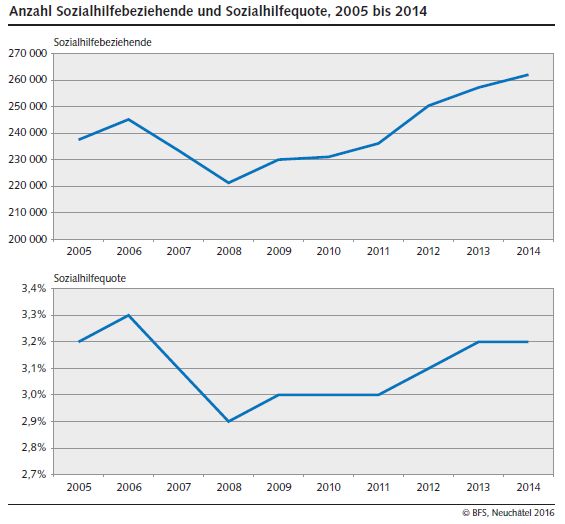

10 years of Swiss Social Assistance Statistics: Social assistance rate the same as 10 years ago

04.04.2016 11:00 - FSO, Social Assistance (0353-1603-30) 10 years of Swiss Social Assistance Statistics Neuchâtel, 04.04.2016 (BFS) – The Swiss Social Assistance Statistics cover ten years of observation with the latest data from 2014. The social as...

Read More »

Read More »

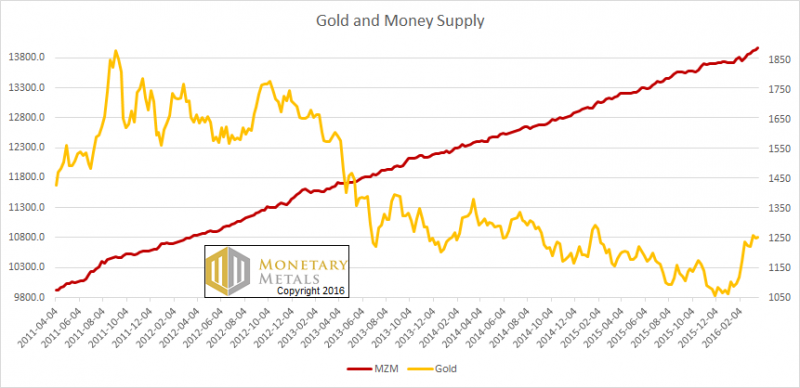

The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on...

Read More »

Read More »

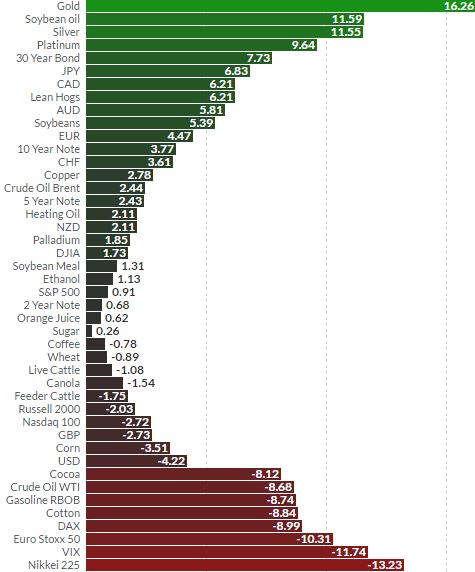

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

Gold Prices Rise 16% In Q1 – Best Quarter In 30 Years

– Gold prices gained 16% in Q1 – best quarterly performance since 1986– Gains due to increasing global financial, macroeconomic and monetary risk– Stocks come under pressure – Flat in U.S.; Falls ...

Read More »

Read More »

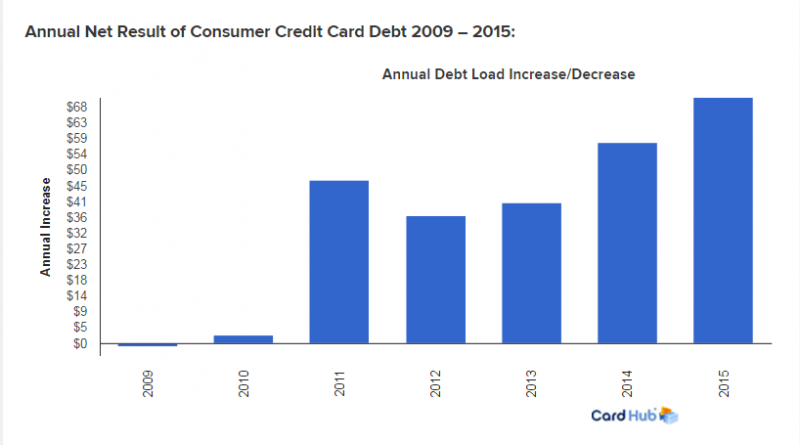

The Other Problem with Debt No One is Talking About

Faux Growth Recovery Nearly 7 years have elapsed since the official end of the Great Recession. By now it’s painfully obvious the rising tide of economic recovery has failed to lift all boats. In fact, many boats bottomed out on the rocks in earl...

Read More »

Read More »