Monthly Archive: April 2016

Some Thoughts on US Fiscal Policy

The US presidential selection process is well underway, and yet there has been no coherent discussion of fiscal policy. In part, this is because it does not appear particularly urgent. The US deficit peaked in 2009 at 10.1% of GDP. Last year it stood at what for most OECD countries an enviable 2.6%. This year and next … Continue reading...

Read More »

Read More »

FX Daily April 20: Markets Build on Yesterday’s Dramatic Recovery

Global capital markets staged an impressive recovery after the initial reaction to the failure to freeze oil output sent reverberations through the oil markets, commodities, and Asian equities. The sharp reversal begun in Europe and extended in N...

Read More »

Read More »

A Morally Sound Tax Reform Proposal

The Oppressed U.S. Taxpayer This year, Americans’ day of tribute to their federal overlords falls on April 18. As calculated by the Tax Foundation, the average American will work from January 1 to April 24 (Tax Freedom Day) to pay his share of tax...

Read More »

Read More »

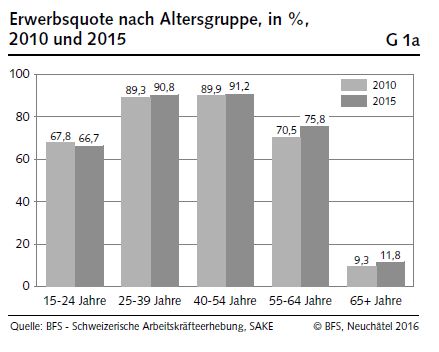

Swiss Labour Force Survey 2015: Large increase in labour market participation of 55 to 64 year-olds

19.04.2016 09:15 - FSO, Labour Force (0353-1603-90) Swiss Labour Force Survey 2015 Neuchâtel, 19.04.2016 (FSO) – In 2015 the average age of the economically active population was 41.6 years (+0.7 years compared with 2010). The ageing of the economic...

Read More »

Read More »

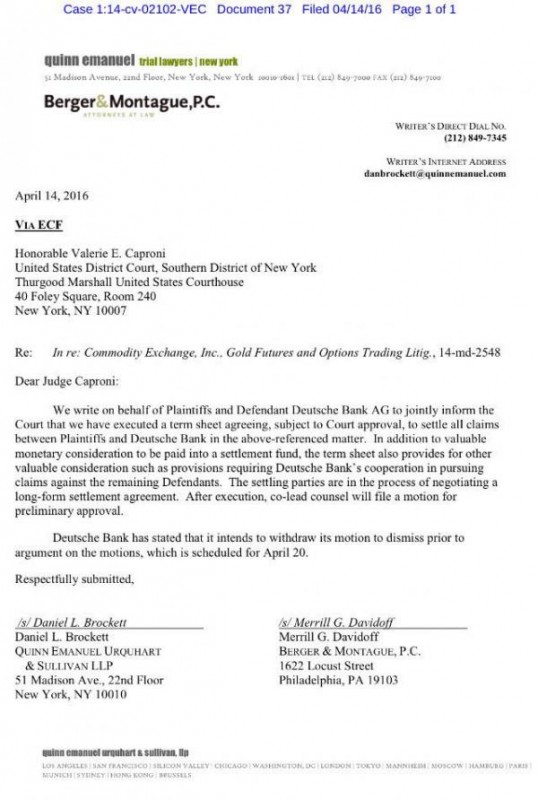

Malaysia CDS Spike After Abu Dhabi Puts Scandal-Ridden 1MDB In Default, Funds hidden in Switzerland

Over the better part of the past year, we’ve documented the curious case of 1MDB, Malaysia’s government investment fund founded in 2009.

It’s a long and exceptionally convoluted story that doesn’t exactly lend itself to a concise summary but suffice...

Read More »

Read More »

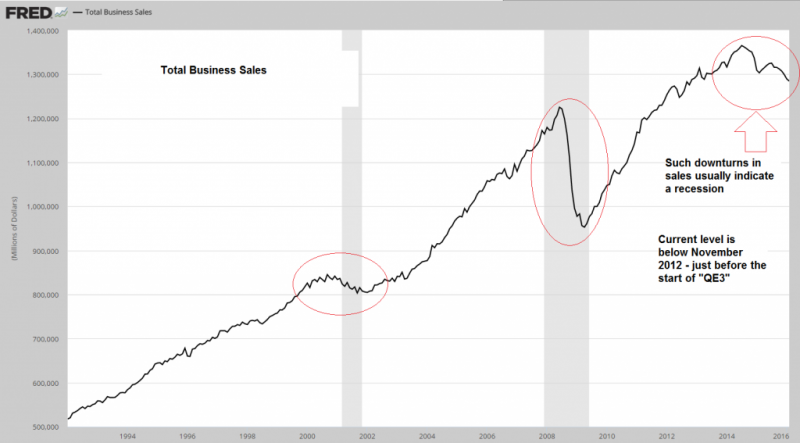

US Economy – Ongoing Distortions

Business under Pressure A recent post by Mish points to the fact that many of the business-related data that have been released in recent months continue to point to growing weakness in many parts of the business sector. We show a few charts illust...

Read More »

Read More »

Panama Papers Names Revealed: Multiple Connections to Clinton Foundation, Marc Rich

There has been much confusion, at time quite angry, how in the aftermath of the Soros-funded Panama Papers revelations few, if any, prominent U.S. name emerged as a result of the biggest offshore tax leak in history. Now, thanks to McClatchy more U.S...

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

(from my colleague Dr. Win Thin)

EM ended last week on a firm note. Given the absence of any Fed-specific risks or any major US data releases, that firmness could carry over into this week. The failure to reach an agreement in Doha by oil pro...

Read More »

Read More »

Cultural Marxism and the Birth of Modern Thought-Crime

What the Establishment Wants, the Establishment Gets If a person has no philosophical thoughts, certain questions will never cross his mind. As a young man, there were many issues and ideas that never concerned me as they do today. There is one que...

Read More »

Read More »

11 on the Nutty Scale – Banks are Paying Interest to Mortgage Borrowers

Wicked Don Giovanni GUALFIN, Argentina – Tuesday evening, we went to the main opera house in Buenos Aires, the Teatro Colón, to see Mozart’s Don Giovanni. On our way over, our taxi driver told us that Luciano Pavarotti rated it as the second best o...

Read More »

Read More »

FX Daily, April 18: Doha Failure Sets Tone

Oil producers failed to reach an agreement yesterday at the meeting in Doha. That is the main spur to today’s activity. It is not that the outcome was a surprise. One newswire poll found around half of the respondents thought an agreement was elusive. Although not oil experts by any stretch, we too thought political … Continue reading...

Read More »

Read More »

Beware of Particularly Challenging Week Ahead

It is never easy, but the week ahead may be particularly difficult for market participants. It will first have to respond to weekend developments. First, the front page of the NY Times on Saturday was a report that the Saudi Arabia warned the US if a bill making its way through Congress that would allow it (Saudi … Continue reading...

Read More »

Read More »

FX Weekly: The Dollar’s Technical Condition Remains Vulnerable

The US dollar turned in a mixed performance last week, which given the softer than expected inflation, retail sales data, and industrial output figures, coupled with the poor technical backdrop, could be a signal that its decline in recent months has run its course. The dollar-bloc continued its advance, led by the Australian dollar’s nearly …

Read More »

Read More »

Double Whammy Economics

What’s up with U.S. consumers? They seem to have come to their senses at the worst possible time. They can no longer be counted on to push economic growth up and to the right. Specifically, they’re not spending money on stuff.A little public service on etymology: “Double whammy” was reportedly first used in a 1941 Oakland Tribune article related to boxing. It means a devastating blow, setback or catastrophe. In today’s economy, it often means...

Read More »

Read More »

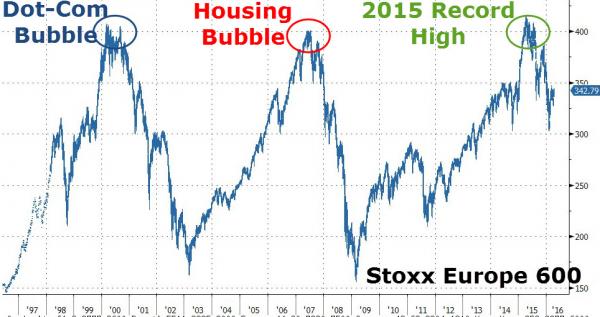

What Happens Next (In Europe)?

A year ago today, European equities hit their highest levels ever. But, as Bloomberg reports, the euphoria about Mario Draghi’s stimulus program didn’t last, and trader skepticism is now rampant. The Stoxx Europe 600 Index has lost 17% sinc...

Read More »

Read More »

SDR Does Not Stand for Secret Dollar Replacement

At the IMF/World Bank meetings this week, Chinese officials are again pushing for greater use of the IMF's unit of account, Special Drawing Rights. It is China's turn as the rotating host of the G20, which gives it greater influence over its ag...

Read More »

Read More »

Weekly Emerging Markets: What has Changed

Bank Indonesia will use the 7-day reverse repo rate as its new benchmark policy rate The ruling party in South Korea unexpectedly lost parliamentary elections The Monetary Authority of Singapore eased monetary policy to recession settings Turkey has nominated its next central bank chief The Brazilian special lower house committee voted 38-27 in favor of …

Read More »

Read More »