Monthly Archive: March 2016

Are We Becoming a Nation of Silver-Haired Crooks?

A Salutary Effect BALTIMORE – “Ike and Dick Sure to Click” was an exciting election slogan. Their Democratic opponents, Adlai Stevenson and Estes Kefauver, had their snazzy campaign jingle, too: “Adlai and Estes… They’re the Bestes.” Surely, the me...

Read More »

Read More »

The Pitfalls of Currency Manipulation – A History of Interventionist Failure

The G-20 and Policy Coordination Readers may recall that the last G20 pow-wow (see “The Gasbag Gabfest” for details) featured an uncharacteristic lack of grandiose announcements, a fact we welcomed with great relief. The previously announced “900 p...

Read More »

Read More »

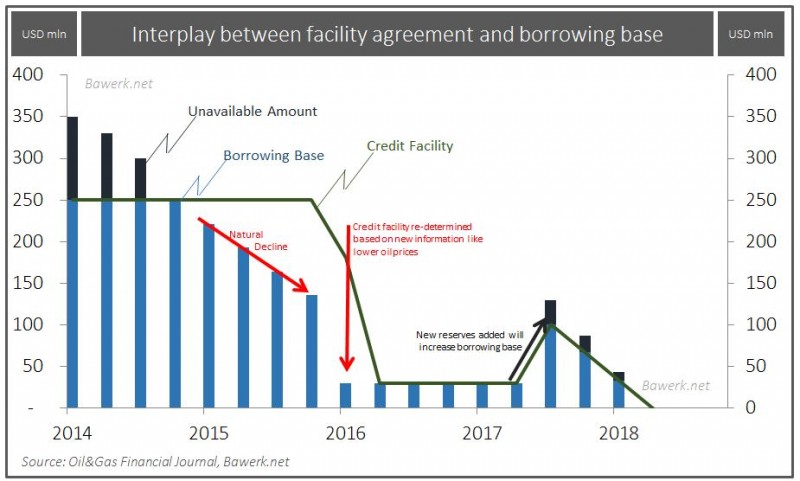

OPEC’s Doha Dilemma: 3mb/d US lock in?

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs.

Read More »

Read More »

Great Graphic: Bottom Building on CRB Commodity Index?

Marc Chandler shows that after the commodity currency Canadian Dollar, also the CRB Commodity index could have found a bottom. See here his Great Graphic on the CAD bottom buildung. See also the CAD resilience despite falling oil prices.

Read More »

Read More »

Swiss and Eurozone Trade Anomalies

Marc Chandler emphasises the discrepancies between overvalued franc and - despite being overvalued - the massive Swiss trade surplus. Will it continue like that?

Read More »

Read More »

Silver Relative Strength Report, 27 Mar, 2016

Gold went down (as the muggles would measure it, in dollars). It dropped almost 40 bucks. Silver fell almost 60 cents. Since silver fell proportionally farther than gold, the gold-silver ratio went up.

Read More »

Read More »

Four Keys to The Week Ahead

There are four events that will shape market psychology in the week ahead. They are Yellen's speech to the NY Economic Club, US jobs data, eurozone March CPI and PMI, and Japan's Tankan Survey. The broad backdrop is characterized by the rebuilding of risk appetites since the middle of February, though the MSCI emerging market … Continue reading...

Read More »

Read More »

Weekly Speculative Position: Yen Longs Near Record Levels

The most extreme speculative positioning, judging from the futures market is the long yen position. The bulls added another 3.4k contracts, lifting the gross long position to 82.8k contracts. The record was set in 2008 at 94.7k contracts. The gross short position was trimmed by 4.5k contracts, leaving 29.5k. It is the smallest gross short position …

Read More »

Read More »

FX Review Week March 21- March 25

The US dollar rose against all the major and most emerging market currencies last week. After selling off following the ECB and FOMC meetings, the dollar found better traction. It was helped by widening interest rate differentials. Regional Fed manufacturing surveys for March suggest the quarter is ending on a firm note. With new orders rising, …

Read More »

Read More »

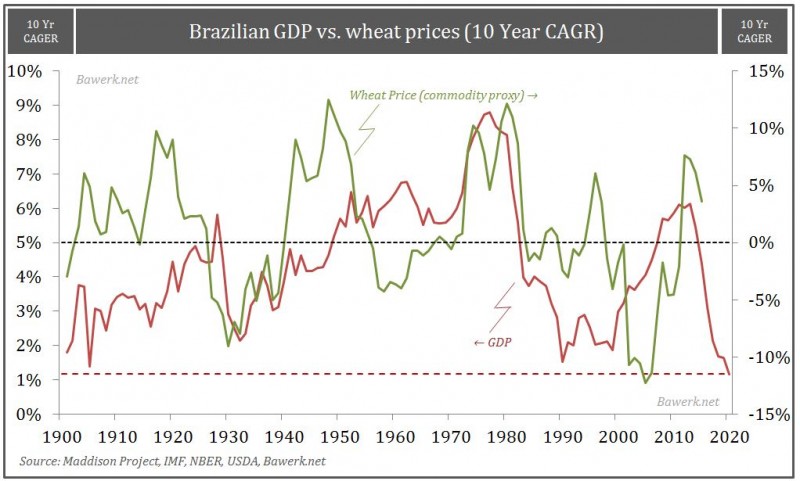

Latin America – Seven Ugly Sisters in Deep Political Trouble

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices.

Read More »

Read More »

Great Graphic: Has the Canadian Dollar Bottomed Out?

We have been looking for a bottom in the US dollar against the Canadian dollar. It is been difficult, but now it appears that the technicals are turning. This Great Graphic, from Bloomberg, shows that the US dollar is moving above a trend line...

Read More »

Read More »

Is that Buzzing Sound Helicopter Money?

Helicopter money is the rage. Central banks are talking about it. Economists are debating it. The media is rife with coverage. While it sounds important, it is not precisely clear what helicopter money means. It appears to have originated with Milton Friedman. In 1969, he wrote: "Let us suppose now that one day a helicopter … Continue reading »

Read More »

Read More »

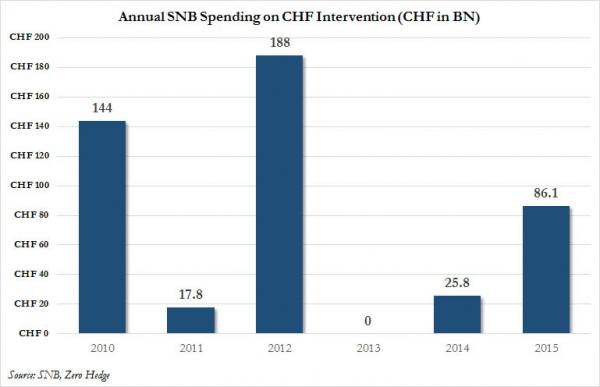

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woef...

Read More »

Read More »

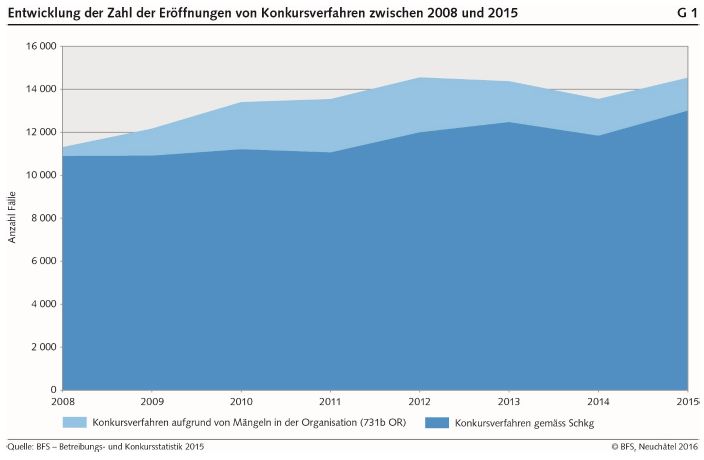

Bankruptcy Statistics 2015: Increase in the number of bankruptcies

24.03.2016 09:15 - FSO, Economic structure and analyses (0353-1602-90) Bankruptcy Statistics 2015 Neuchâtel, 24.03.2016 (FSO) – The number of bankruptcy proceedings opened in 2015 rose to 13,016 cases, a 9.9% increase compared with 2014. The Lake Ge...

Read More »

Read More »

ECB, Corporate Bonds, and Credibility

The euro's rallied shortly after the ECB announced numerous monetary measures that in their totality were more than expected. Many saw this as proof that monetary policy had lost its effectiveness, and central banks have lost credibility.

R...

Read More »

Read More »

Great Graphic: Brexit Fears Boost Sterling Put Buying

The UK referendum is three months away. Three-month options are a common benchmark for various market segments; from speculators, to fund managers to corporations. Events over the past week have raised the risks that the UK votes to leave the EU. The market has responded forcefully today, and even if you only follow the spot …

Read More »

Read More »

Brexit Risks Rising

Many banks suggested that Swiss Franc long is the trade to hedge against the Brexit risk.Therefore this text by Marc Chandler is quite important for Switzerland. An ill-conceived strategy undermined by mismanagement and bad fortune is increasing the risks that the UK votes to leave the EU in June. Nearly everything that could, has …

Read More »

Read More »

Great Graphic: 10-Year Break-Evens and Oil

Until last September, the Federal Reserve seems to play down the market-based measures of inflation expectations, preferring the surveys that showed views were anchored. At the September 2015 FOMC meeting where the Fed had been expected to tighten until the August turmoil, officials cited among other considerations, the decline in market-based measures of inflation expectations. …

Read More »

Read More »

FX Daily, March 22: Terrorist Strike in Brussels Causes Market Angst

A series of attacks at Brussels airport and metro casts a pall over the market. The attacks come as Europe prepares what for many will be a long holiday weekend. Gold, the dollar and yen seem to have been the beneficiaries. Bonds are generally firmer and equities lower. However, in late morning activity in London, …

Read More »

Read More »

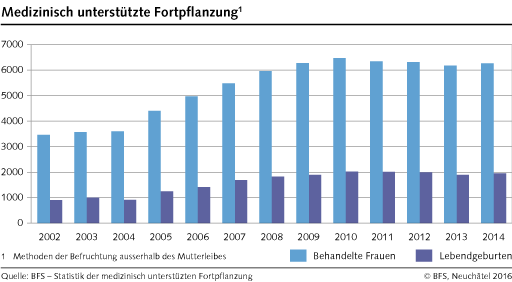

Assisted reproductive technology in 2014: definitive data: Uptake of in-vitro fertilisation on the rise again

22.03.2016 09:15 - FSO, Health (0353-1603-60) Assisted reproductive technology in 2014: definitive data Neuchâtel, 22.03.2016 (FSO) – In 2014, 6269 couples wishing to have children turned to in-vitro fertilisation. This resulted in the birth of 1955...

Read More »

Read More »