The CFTC Commitment of Traders reporting week ending February 16 was short due to the US holiday. This may have contributed to the small adjustments to speculative positioning in the currency futures. It also may reflect the lack of conviction that a dollar recovery was at hand.

On a net basis, speculators had switched to a long yen position six weeks ago. In the latest period, speculators swung to a net long Australian dollar position for the first time since last May. The 2.8k contract net long Australian dollar position was a result of speculators covering 5.7k short contracts and adding 2.7k to the gross long position (63.9k and 66.7k contracts respectively.

There were only three significant (10k contracts or more) speculative adjustment to gross positions. The gross short speculative position in the euro was cut by 15.7k contracts, leaving 162.2k. This is down from 227.5k gross short position at the end last year and 198.7k contracts at the end of last month. The gross long position was trimmed by about 600 contracts, leaving 114k. This is up from 67k contracts at the end of 2015 and 71.4k contracts at the end of last month.

The Mexican peso accounts for the other two significant adjustments to speculators' gross currency position. The gross longs were nearly halved to 21.4k contracts, and 10.6k contracts were added to the gross short position, bringing it to 98.8k. The aggressive action by Mexican officials after the reporting period closed likely forced many late shorts to cover.

Before turning our attention to the speculative positioning in light sweet crude oil and the ten-year Treasury futures, we note that the gross short yen position increased from more than three-year lows seen in early February. The increase of 4k contracts lifts the gross short position to 6k. While the bears may be testing the waters, the bulls have not given up. To the contrary, they extended the gross long position by 8.7k contracts to 84.5k contracts.

The speculative net long crude oil position was trimmed by 28.9k contracts to 159k. This was largely a function of long liquidation. The bulls cut 26.9k contracts from the gross long position, leaving 517.9k contracts. The bears added 2k contracts to their gross short position, raising it to 359.0k.

The net short speculative position in the 10-year Treasury futures was cut by a third to 40.3k contracts from 62.3k. However, neither bulls nor bears were sellers. What happen was that the former was more aggressive than the latter. The gross long position increased by 47.4k contracts (to 507.8k) while the gross short position rose 25.4k contracts (to 548.1k).

| 16-Feb | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -48.2 | -63.3 | 114.0 | -0.6 | 162.2 | -15.7 |

| Yen | 47.9 | 43.2 | 84.5 | 8.7 | 36.6 | 4.0 |

| Sterling | -36.3 | -36.3 | 36.5 | 5.5 | 72.8 | 5.4 |

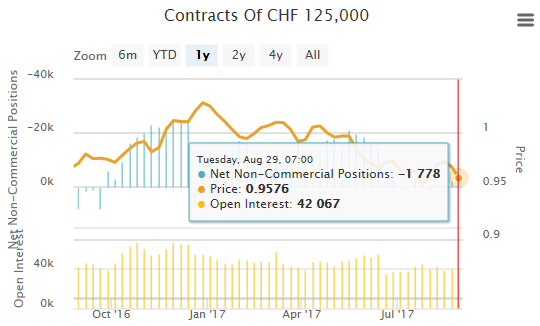

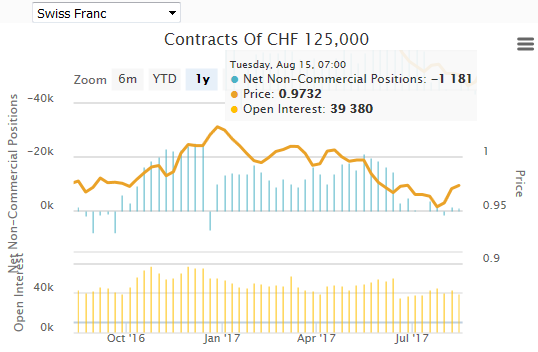

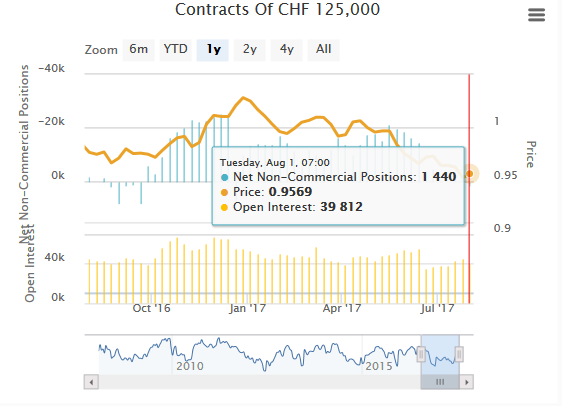

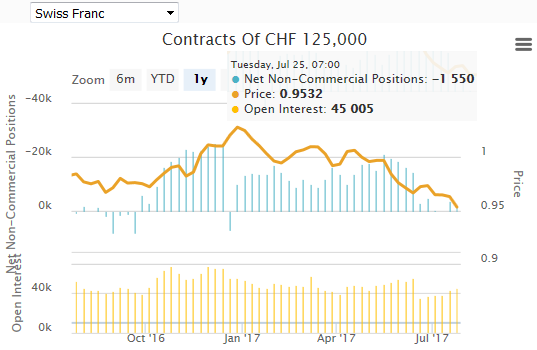

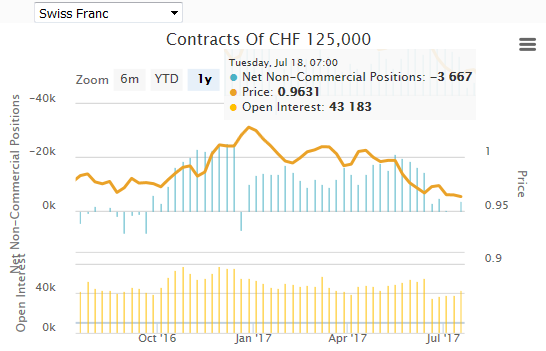

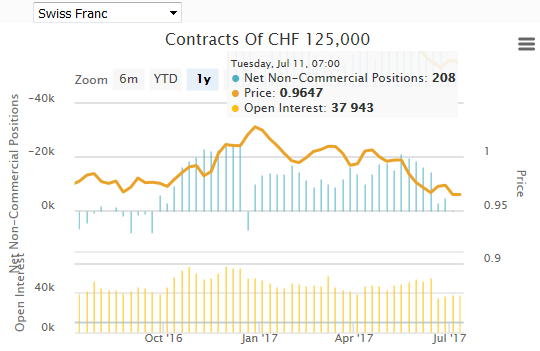

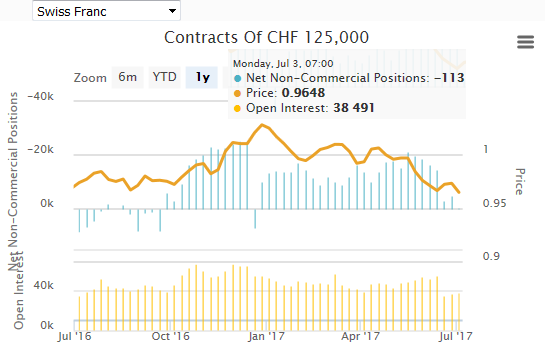

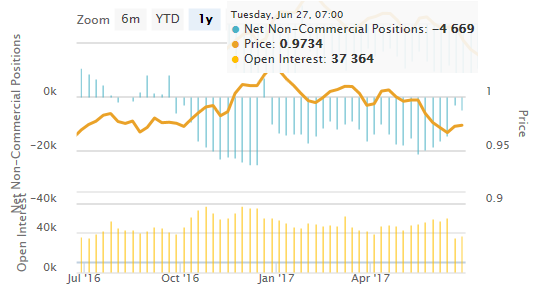

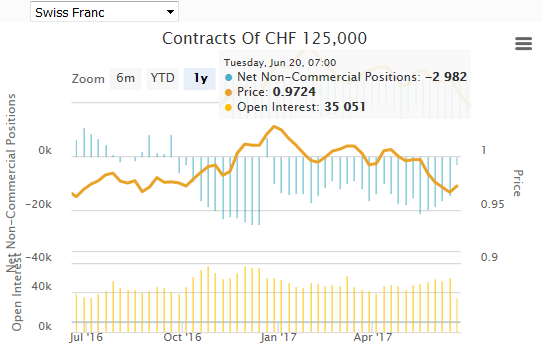

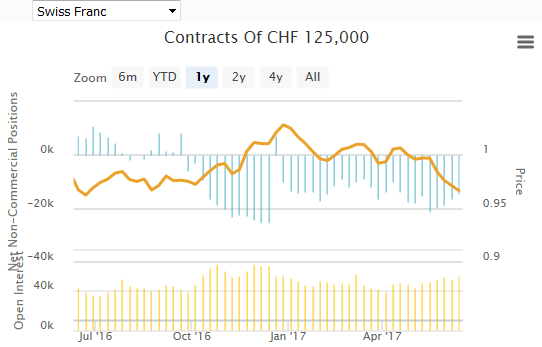

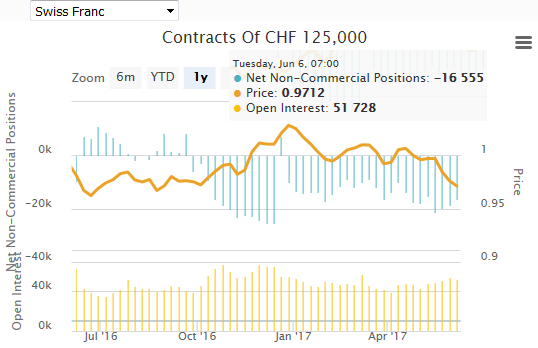

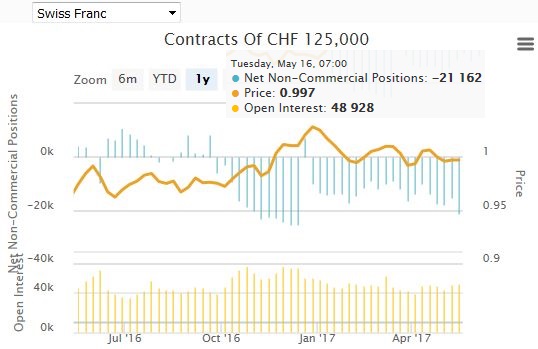

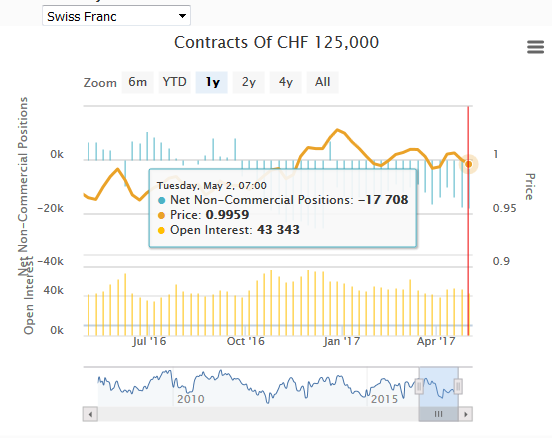

| Swiss Franc | -4.4 | -7.3 | 20.1 | -0.2 | 24.5 | -3.1 |

| C$ | -45.1 | -51.9 | 29.1 | 1.8 | 74.2 | -5.1 |

| A$ | 2.8 | -5.6 | 66.7 | 2.7 | 63.9 | -5.7 |

| NZ$ | -8.3 | -9.1 | 14.5 | 0.8 | 22.8 | 0.0 |

| Mexican Peso | -77.4 | -46.5 | 21.4 | -20.3 | 98.8 | 10.6 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts | ||||||

Tags: Commitments of Traders,Speculative Positions